Reply To:

Name - Reply Comment

Many retail investors believe that market performance is shaped by the actions/omission of the stock exchange, regulator, investors and listed companies. Nevertheless, there are many other stakeholders who play a decisive role in shaping the stock market and the capital market in general. Are you aware of the functions of these stakeholders? Today’s article will enable you to clarify your doubts.

Many retail investors believe that market performance is shaped by the actions/omission of the stock exchange, regulator, investors and listed companies. Nevertheless, there are many other stakeholders who play a decisive role in shaping the stock market and the capital market in general. Are you aware of the functions of these stakeholders? Today’s article will enable you to clarify your doubts.

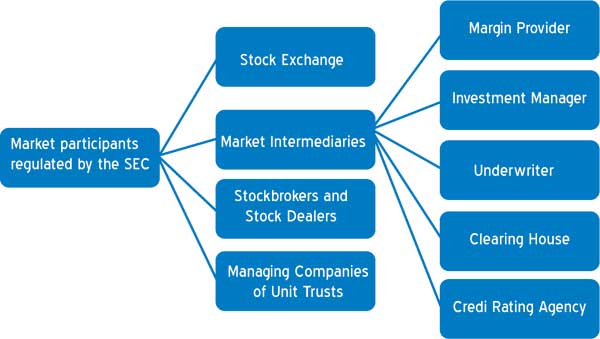

Most of these stakeholders are regulated by the Securities and Exchange Commission of Sri Lanka (SEC). The chart will give you a better understanding on market stakeholders.

Stockbrokers and stock dealers

Who is a stockbroker?

A corporate engaged in the business of buying or selling securities on behalf of investors.

Do you need a stockbroker to invest in the stock market?

Yes. You have to open an account at Central Depositary System (CDS) through a stockbroker.

Why do investors need a stockbroker firm?

A stockbroker firm will assist you in your journey of investing. They are expected to inform you about the suitable investment opportunities and provide the necessary advice.

How can investors contact a stockbroker firm?

A list of licensed stockbroker firms can be obtained from the Colombo Stock Exchange (CSE) website. Further on, you might be able to directly contact representatives of various stockbroker firms if you visit the trading floor of the CSE. Most of these stockbroking firms are stationed in Colombo and also have an islandwide network.

How does a stockbroker firm earn an income?

They receive a commission for every transaction. This commission will be charged even if you trade online.

What other services can you expect from a stockbroker firm?

Stockbrokers provide research facilities. If you are a strategic investor, they will assist you in takeovers and mergers.

Is there a difference between a stockbroker firm and investment advisor?

Yes. However, many use these two words as synonyms. The public refers to an investment advisor as a stockbroker. Stockbroking firms provide investment advice to their clients through licensed investment advisors.

What should you look for in an investment advisor?

You should work only with licensed investment advisors. The SEC issues the licence to act as an investment advisor.

Can stockbroker firms buy/sell stocks for the client?

The stockbroker firm can buy/sell shares only when the client gives instructions to do so. However, the investment advisor can act on his own accord if the client has signed a discretionary account and thereby allows the advisor to trade on his behalf.

Are there trading practices stockbroker firms are expected to refrain from?

When acting on behalf of clients, a stockbroker firm and employees of such a firm who deal with clients should observe the highest standards of professional conduct and integrity. Given below are a few forms of trading they are not expected to engage in.

Is there a difference in the role of a stockbroker firm and an agent?

Yes. As stated above, a stockbroker firm can buy/sell securities on behalf of investors while the primary role of an agent is to introduce ‘new clients’ to the stockbroker firm.

What can you do in case of a dispute?

Give a written complaint to the compliance officer of the stockbroker firm. If an investor is not satisfied with the response, he/she may contact the CSE to resolve the dispute.

Who is a stock dealer?

Stock dealer is an individual or body corporate engaged in the business of buying or selling of securities or in the dealing or jobbing or trading of securities or the underwriting or retailing of securities but will not include an underwriter who is a registered market intermediary.

What is the difference between a stockbroking firm and stock dealer?

Stockbrokers are given the licence to trade on behalf their clients while a stock dealer trades for his own company.

Managing companies of unit trusts

What is the role of a unit trust managing company?

A unit trust managing company collects funds from a number of investors who share a common financial goal. Funds collected from the investors are invested in various financial assets such as shares, treasury bills, treasury bonds, debentures and other securities.

How do you earn from a unit trust?

The income earned from these investments and the capital appreciation are shared by the unit holders in proportion to the number of units owned by them.

What are the types of unit trusts?

Open-ended funds

Open-ended funds are funds where investors can enter the fund at any time and existing investors can exit out of the fund at any time. There is no restriction on the number of units to be issued by the fund and the fund has no maturity.

Close-ended funds

Close-ended funds are funds that carry a maturity date. The fund management company will open these funds to the prospective investors for subscription for a specific period of time. At the end of subscription period, the fund management company will close the fund for any new subscription.

Can a fund be listed in an exchange?

Yes. Currently two funds are listed.

How does the investor monitor the investment?

After making your investment in the fund, you can monitor the value of your investment based on the unit prices that are published daily. You may refer the local newspapers, the fund management company’s website to check the unit prices of the fund in which you have made the investment.

Market intermediaries

What is a clearing house?

A clearing house acts as a go between for buyers and sellers by settling the buyers/seller trading accounts. Clearing house makes an equity market stable and efficient. Central Depository Systems (Pvt.) Limited is registered as a clearing house in Sri Lanka. This is a wholly-owned subsidiary of the CSE. The depository can be compared to a bank. It holds securities (shares, debentures, bonds, government securities, units, etc.) of investors in electronic form. Besides holding securities, the depository also provides services related to transactions in securities.

What are the other functions of the CDS?

Dematerialization of listed securities: converting physical certificates to electronic form

Rematerialization: conversion of securities in demat form into physical certificates

Clearing and settlement of trades in the CSE

Is it compulsory to open an account with CDS?

Yes. Investors are expected to open an account at CDS through a stockbroking firm prior to investing in the market.

Is there a charge involved when opening an account?

No. The account opening is done free of charge. However, a small commission will be charged when transactions are executed.

Can investors deal with more than one stockbroker firm?

An investor is permitted to open and maintain more than one account through different stockbroking firms. The CDS will assign a unique account number for such person with the participant code of the stockbroker firm.

What are the documents you receive from CDS?

What is a credit rating agency?

Credit rating agency is an agency engaged in the business of assessing and evaluating the creditworthiness of any issue of listed securities or securities to be listed with particular regard to the issuers’ ability to perform any obligations imposed on the issuer thereon.

How many credit rating agencies are registered with the SEC?

Two

Do credit ratings encapsulate a substantial view on risk?

Credit ratings focus mainly on credit risk. It does not comment on the adequacy of market price or market liquidity for rated instruments.

Can a credit rating be considered as a stock/debt recommendation?

No. Credit rating should be taken into consideration when making an investment decision. It should be analysed together with other vital factors.

Is it possible for two rating agencies to give different ratings to the same company?

Yes. There can be a slight difference in the ratings due to the variation in the methodology used by rating agencies. However, investors should be vigilant if there is a sharp variation in the rating. If you are familiar with financial jargon it is best to refer to the methodology adopted.

Why should investors pay attention to conflict of interest?

The problem arises when a person in the rating panel is affiliated to the company that is given a rating. In such a situation it is rational to question the credibility of the rating.

Who is a margin provider?

Margin Provider is a person who is in the business of providing credit to investors to purchase securities of a listed public company.

What does the margin provider keep as collateral?

The stocks you purchase from the money that is given to you will be kept as collateral.

When is a margin call made?

A margin call is required to be made when the value of the share/portfolio of shares falls below the maintenance margin requirement. The investor would be required to provide cash or securities to satisfy the maintenance margin requirement. In the event the investor fails to meet the shortfall within three market days, the margin provider will ensure that the securities pledged are sold with due notice to the relevant parties on the next market day and notice will be given to the client at the end of the market day, the sale is concluded.

Who is an investment manager?

Investment manager is a person who for a fee or commission engages in the business of managing a portfolio of listed securities on behalf of an investor or advises any person on the merits of investing, purchasing or selling listed securities.

Is there a difference between an investment manager and a unit trust managing company?

Yes. A unit trust managing company collects money from individuals and invests in funds while the latter managers the investor’s portfolio.

Who is an under writer?

Underwriter is any person who in connection with a public issue of securities of a listed public company or a company which has applied for a listing guarantees to purchase unsubscribed securities of such company for a fee or commission or who negotiates with such company to purchase such securities in the event of the offer being not fully subscribed and includes any person who purchases such issue from the company specifically with a view to offering such securities to the public.

What is the most important factor to consider when working with an underwriter?

It is important to look into the financial strength of the company.

Aforesaid information reveals that all participants play a pivotal role in the market. It is the positive contribution of all these stakeholders that enable us to maintain efficient markets. At times there might be situations where these stakeholders would deviate from the accepted norm/rule. Thus, it is advisable to always react wisely and in a timely manner.