Reply To:

Name - Reply Comment

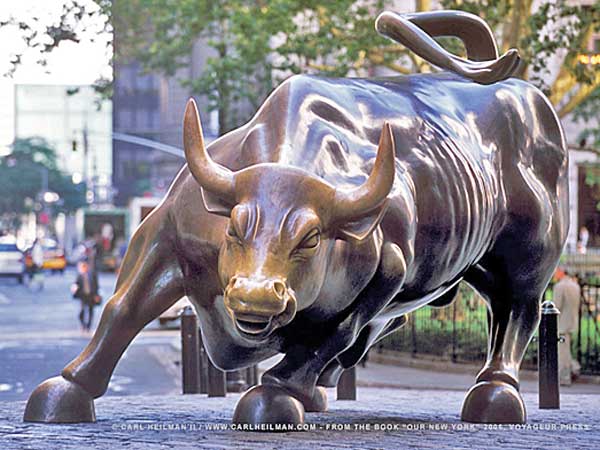

(1)(1)(1)(1)(1).jpg) The year 2014 is a promising year for the Colombo Stock Exchange (CSE). The CSE has recorded a year-on-year (YoY) growth of 14 percent in the broad market index while the S&P SL 20 Index has experienced a growth of 15 percent in the current year. The average daily turnover has already reached Rs.1,090 million while last year’s average daily turnover was only Rs.828 million.

The year 2014 is a promising year for the Colombo Stock Exchange (CSE). The CSE has recorded a year-on-year (YoY) growth of 14 percent in the broad market index while the S&P SL 20 Index has experienced a growth of 15 percent in the current year. The average daily turnover has already reached Rs.1,090 million while last year’s average daily turnover was only Rs.828 million.

Market capitalization, the total value of the market that was Rs.2,459 billion in the year 2013 has increased to Rs.2,817 billion within seven months in 2014.

The growth momentum we are experiencing is a cyclic movement of a market that was growing since mid-2012. It has recorded a growth of around 35 percent during the aforesaid period. The return to investment during this period is very attractive when compared to other forms of risk-free financial instruments.

What contributed towards the performance of the market?

Currently we are experiencing a bull market and there can be several reasons that fuelled this run. Given below are some of them.

“An investment in knowledge pays the best interest.”

Benjamin Franklin

Learn the rules before you play the game. However lucrative a market may be, an investor should do his homework before he invests. Study market trends. Read up on the performance of the company you wish to invest. One should draw up a clear investment plan and diversify his/her portfolio. You will be able to maximize the opportunities in a stable and growing market only if wise decisions are made when investing. Investment advisors in the stock brokering firm will assist the investor and advise him in selecting suitable stocks. Such investors will be able to minimize the risk while maximizing opportunities.

There is another segment of investors who enter the market without sufficient knowledge and suffer financial losses due to incorrect investment decisions. They blame the market for their wrong acts. This creates a misconception among the public about the market. Remember that the market is poised for growth and the return to investment will depend on the choices you make.

Smart investors would see opportunities in both. Such a mind frame will continue to foster a stable and growing market. Failing to understand the cyclic nature of the market, a few investors make rash decisions. This is unhealthy for a growing and stable market.

Refrain from excessive trading on credit. Moving on, don’t invest all the money you have earned however lucrative the market may be. Invest a certain portion of your savings in a diversified portfolio.

The market is currently well poised for stable growth and is fuelled by fundamentally strong stocks. Growth will be sustainable only if investors invest with the correct mentality. The stock market is not a place to earn money overnight as it is a form of investment. Hence, investors should refrain from trading with the expectation of quick returns. It was this unhealthy mentality that created a bubble during the post-war era and later the bursting of it.

“Education is when you read the fine print; experience is what you get when you don’t.”

Pete Seeger

Earning money from the market does not end when you research and invest on a good stock. It is a continuous process. Follow the economic, social and political changes and be an informed investor. Monitor the contract notes (Bought Notes, Sold Notes, etc.) sent by the stockbroker firm and the CDS statement.

Further on, attention should be given towards the documents you sign at the point of opening a CDS account. Certain investors might prefer to allow their advisors to trade on behalf of them by signing a discretionary account. Yet, it is best if investment decisions are made by the investor after consulting the investment advisor.

Investors should be optimistic about the market and watch out for attractive valuations that are in line with their investment goals. However, it is vital for them to act with utmost responsibility if we are to maintain this healthy trend.

.jpg)