Sri Lanka will reach US $ 4000 per capita GDP only in 2026

.jpg)

On April 13, 2013, the Central Bank launched its Annual Report for 2012. The governor’s speech exploded in the news over the attention he drew to avoiding the ‘middle income trap’. The concern may have been a little premature – the phenomenon concerns countries that are beyond the US $ 4,000 per capita mark and on current trends, Sri Lanka will not get there till 2026 (projecting optimistically on, annually: 7.5 percent growth, 4 percent slide of the rupee against the dollar and population growth of just under 1 percent) – but there is nothing wrong with looking ahead.

Looking ahead: SL not on ‘Singapore Sling’

Singapore is a classic example of an Asian country that avoided the middle income trap and it has often been sighted as a model for Sri Lanka. Singapore has a unique mix of governance: it’s coercive (democratically weak) but also competent (technocratically strong). A previous Verité Insight mentioned that neither a theoretical nor empirical cause-effect relationship links the two. The present insight substantiates this point and evaluates Sri Lanka’s trajectory in relation to Singapore.

In order to set a sustainable course for long-term economic growth, the analysis indicates that Sri Lanka needs to do much better in precisely some areas where it is faring worse. Specifically, the data says, while better regulating and developing it functioning markets, Sri Lanka is in particular need of ensuring the rule of law, building societal consensus and improving international cooperation. How do we come to this conclusion?

Slouching away from democratic governance

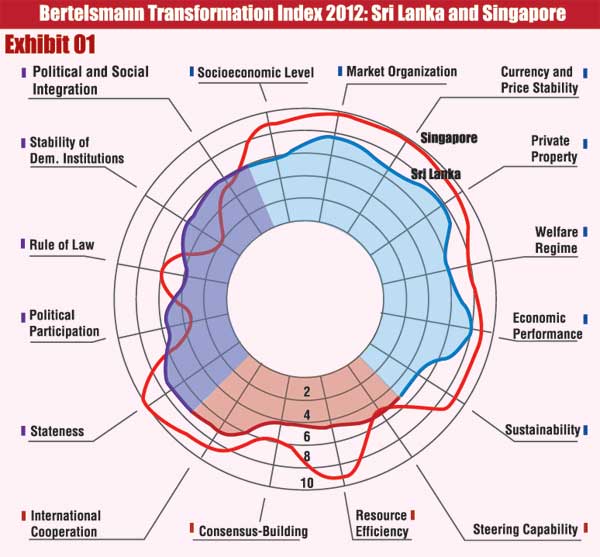

The Bertelsmann Transformation Index, compiled by the independent Bertelsmann Stiftung (Germany’s largest private foundation), analyses and evaluates whether and how developing countries are steering social change toward democracy and a market economy.

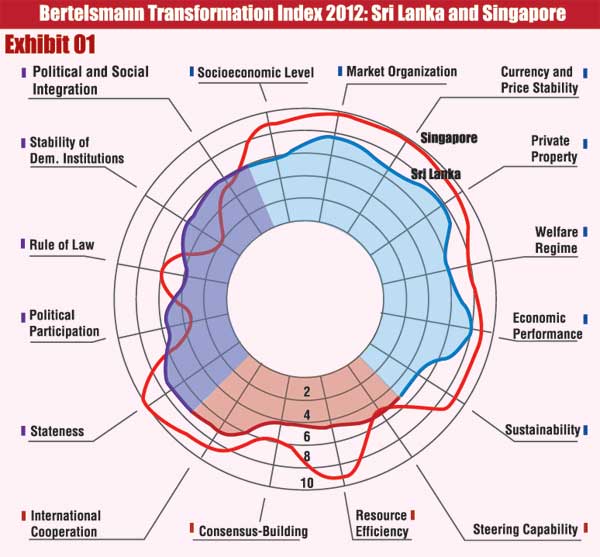

Previous Verité Insights have shown the connection between institutions like the rule of law and economic growth. So, let’s see how Sri Lanka is doing, using Singapore as a benchmark. Exhibit 1 uses the index to compare Sri Lanka’s and Singapore’s economic, institutional and political performance in 2012. Sri Lanka does much worse than Singapore on every technocratic competence-based economic indicator – from market organisation to exchange rate stability. That is not the surprise (after all, competence is Singapore’s strong point). But Sri Lanka also does considerably worse on some of the democratic and governance indicators, such as rule of law, Stateness, international cooperation and consensus building.

SL vs Singapore: Catching up or falling back?

SL vs Singapore: Catching up or falling back?

Sri Lanka is clearly lagging Singapore in many important areas. But perhaps the more critical question should be whether Sri Lanka is improving or falling back over the years? Here the evidence is mixed, but unfortunately, weighted towards the pessimistic.

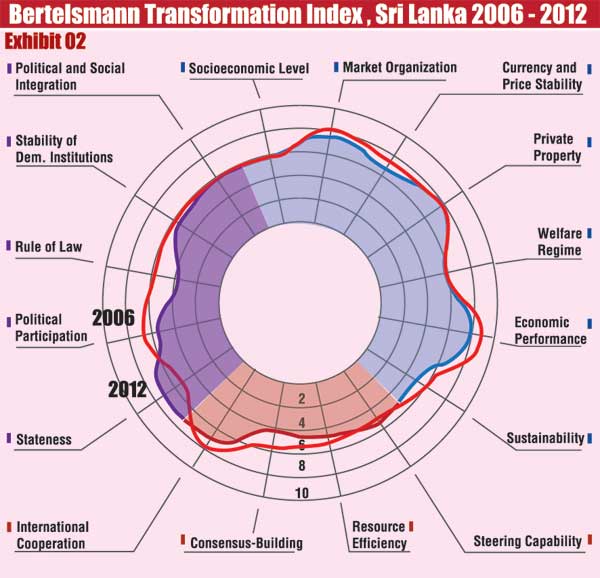

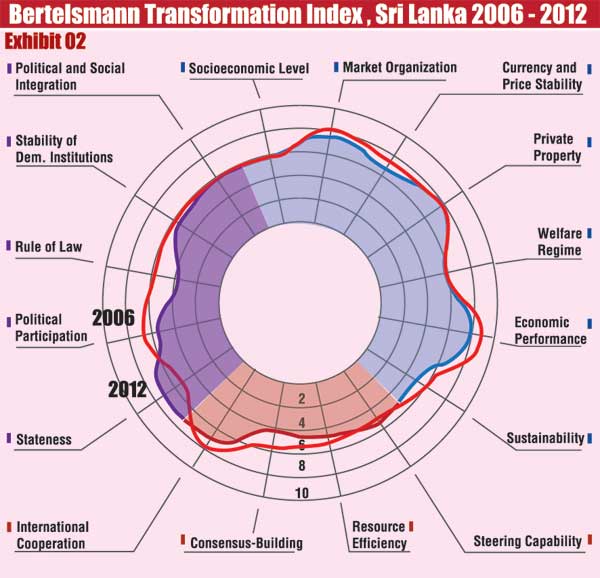

Exhibit 2 compares Sri Lanka in 2006 with Sri Lanka in 2012. The only area in which Sri Lanka has decisively improved between these years is in the ‘Stateness’ indicator. This indicator looks at the state having a monopoly on the use of force, state identity, non-interference of religious dogmas and basic administration. Unsurprisingly, the largest leap forward is in the first (monopoly on the use of force), resulting from the end of the war.

Improvement in the Stateness indicator is important – it is one of the areas in which Sri Lanka was significantly behind Singapore. But in several other democratic and governance indicators where Sri Lanka is significantly behind it has in fact fallen back. These are rule of law, international cooperation, and consensus building. In short, today, Sri Lanka may in sum be further away from the institutional conditions needed for emulating Singapore’s growth than it was in 2006.

Emulating Singapore isn’t enough

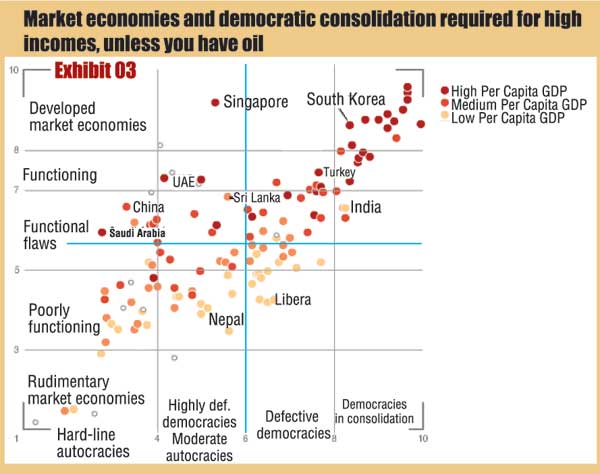

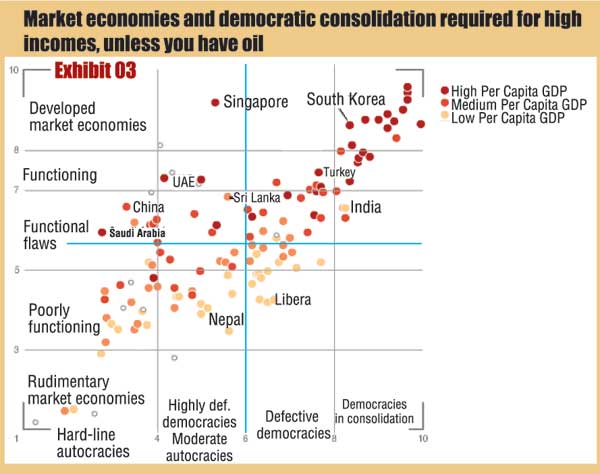

Exhibit 3 shows that the Singaporean model of high per capita GDP in the context of faltering commitment to democratic institutions is very much an outlier (not a generalisable phenomenon).

The vertical axis plots the extent to which a country has developed a sophisticated market economy. The horizontal axis assesses the strength of democratic institutions. Therefore, economies in the top-right quadrant have both developed market economies and robust democracies. Those in the bottom-left represent the reverse. Economies are plotted on this graph and are coloured on the basis of the per capita GDP - the higher the per capita GDP, the darker the colour. For example, Sri Lanka’s economy has ‘functional flaws’, its democracy is ‘highly deficient’ and it enjoys a medium per capita GDP.

Of the 29 countries with high per capita growth, 23 (that is 80 percent) are in the top right quadrant. They are countries that do well in terms of ‘both’ democratic consolidation ‘and’ developed market economy conditions. Of the six high income countries that are not in the top right quadrant, three owe their success to resources exploitation (oil or gas). Virtually, all economies with per capita GDPs as high as Singapore, have significantly stronger democratic institutions.

Sri Lanka has only recently risen above the low income status. Getting up to even GDP US $ 4,000 dollars per capita is a good 12 to 15 years away. There may be shortcuts to spur growth in the near term and previous Verité Insights have discussed some of them and evaluated their sustainability. The governor, however, by speaking of the middle-income trap has alerted the country to look ahead and take the long view.

It’s the democracy, stupid

It’s the democracy, stupid

Taking the long view, Sri Lanka’s political participation and democratic traditions put it on a hopeful wicket – Sri Lanka is not yet that far from getting into the top right quadrant. But there may also be a problem. The voices that generally push democratic consolidation tend to be from political traditions that also push for dislodging rather than developing market economy conditions.

The present data and analysis provide some clear guidance for those who take the long view: the Singapore story of growing the economy without expanding democracy is a uniquely rare phenomenon – that means those who try to replicate it are highly unlikely to succeed. Ensuring the rule of law, building societal consensus and improving international cooperation are three key areas in which Sri Lanka has been falling behind even Singapore and would do well to improve.

Developing rather than hobbling its functioning market economic conditions will be important for Sri Lanka but in the long term that may not be the key constraining factor. The implication in a nutshell is this: The long term promise for Sri Lanka’s economy, unless it hits upon free oil and gas, is significantly tied to consolidating its democratic institutions.

(Verité Research provides strategic analysis and advice for governments and the private sector in Asia)

(Verité Research provides strategic analysis and advice for governments and the private sector in Asia)

.jpg) On April 13, 2013, the Central Bank launched its Annual Report for 2012. The governor’s speech exploded in the news over the attention he drew to avoiding the ‘middle income trap’. The concern may have been a little premature – the phenomenon concerns countries that are beyond the US $ 4,000 per capita mark and on current trends, Sri Lanka will not get there till 2026 (projecting optimistically on, annually: 7.5 percent growth, 4 percent slide of the rupee against the dollar and population growth of just under 1 percent) – but there is nothing wrong with looking ahead.

On April 13, 2013, the Central Bank launched its Annual Report for 2012. The governor’s speech exploded in the news over the attention he drew to avoiding the ‘middle income trap’. The concern may have been a little premature – the phenomenon concerns countries that are beyond the US $ 4,000 per capita mark and on current trends, Sri Lanka will not get there till 2026 (projecting optimistically on, annually: 7.5 percent growth, 4 percent slide of the rupee against the dollar and population growth of just under 1 percent) – but there is nothing wrong with looking ahead.