Reply To:

Name - Reply Comment

.jpg)

By Chandeepa Wettasinghe

Sri Lankan businesses are likely to face enormous challenges in the coming year both in the local and export markets due to political and macroeconomic issues, leading economists in the country pointed out in conversation with Mirror Business.

Policy Uncertainty

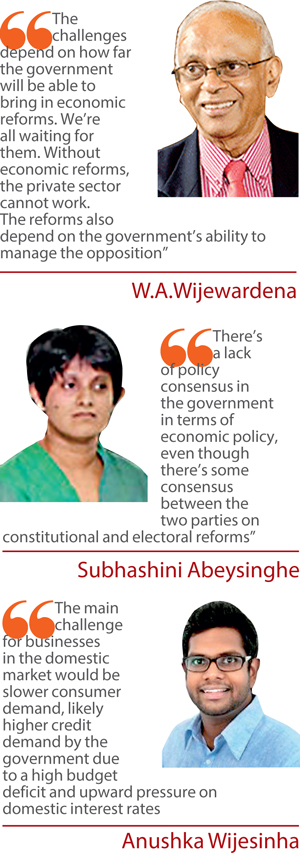

“The challenges depend on how far the government will be able to bring in economic reforms. We’re all waiting for them. Without economic reforms, the private sector cannot work. The reforms also depend on the government’s ability to manage the opposition,” Former Central Bank Deputy Governor and leading independent economist W. A. Wijewardena said.

One of the major slogans of the new regime during both the Presidential and Parliamentary elections was that the Rajapaksa regime had grossly mishandled the economy. They promised that once in power it would be put on the right track.

The recent Budget which had at face value seemed extremely progressive in terms of reforms was later criticized by most quarters of the business community. They comprehensively pointed out that the Budget 2016 did not follow measures in the progressive mid-term economic statement issued by Prime Minister Ranil Wickremesinghe a couple of weeks before the Budget.

Colombo-based think tank Verite Research’s Economic Research Head Subhashini Abeysinghe noted that the contradictions may be a result of the ideological differences between the major parties of the unity government-the United National Party and the Sri Lanka Freedom Party-which are working together for the first time in history.

“Policy uncertainty will be the biggest challenge. The Budget was rather messy and didn’t provide clarity. The economic statement made some clarity but the Budget didn’t show how to go ahead with those policies. This is because we have a unity government with the UNP and SLFP, which have different policy ideologies. If it was just a UNP government, people will know the direction of policies. If it was an SLFP government, people will know their direction too,” she said.

Following the Interim Budget of 2015 which was brought in after January 8, when a minority UNP government was set up with an SLFP President and some SLFP crossovers, the Sri Lanka Economic Association too pointed out that the Interim Budget was weak in policy direction due to such ideological differences of the government.

This is despite President Maithripala Sirisena saying that policy stability should be more important than political stability. Business leaders in Sri Lanka have gone on to say that in the political economic matrix, while successful countries sacrifice politics for economic development, Sri Lanka has consistently managed to sacrifice economic development for political gain.

“There’s a lack of policy consensus in the government in terms of economic policy, even though there’s some consensus between the two parties on constitutional and electoral reforms,” Abeysinghe said.

Economists have placed the blame on the people as well, who are ill-educated on economic matters, and are easily swayed by election goodies which are handed out, instead of allowing the state to cover foreign loan payments and develop the human capital of the country, thereby adding to balance of payment crises and long-term economic stagnation.

Abeysinghe said that 2016 would be less challenging than 2015, as businesses were aware of two closely held elections, of which a clear winner could not be predicted easily, which businesses had accounted for in their plans for this year.

She said that since clarity in economic policy was not seen this year, if the government can provide consensus and clarity between the two parties in the next six months, businesses may be able to wait patiently, and take decisions from a stronger policy base during the second half of 2016.

“People feel lost. Who is calling the shots? Is it the UNP or the SLFP? The unity government has also lost some credibility, because of the appointment of some ministers who didn’t have good track records. The Budget was a bit of a disappointment. So there’s credibility lost in both political and economic fronts. So the next six months are crucial. Since it’s a unique, unity government, we still have to wait and see for more clarity. Clarity is needed for investments and business,” she said.

However, according to Wijewardena, a political upheaval, which would bring further uncertainty to the country’s economy, is likely to take place if the government does not radically change its means of communicating economic situations to the public.

“What matters is that the government will have to realistically assess the current economic situation, communicate it to the people, and show what will happen if they continue the current trends. But the Central Bank’s annual report, and the Treasury’s mid-year report published the same past figures, justifying all actions of the previous government,” he said.

He added that since Prime Minister Ranil Wickremesinghe and the current Cabinet did not communicate the past regime’s economic mishandling to the people effectively, when people are faced with tough realities next year, the political front will deteriorate.

“Since Ranil Wickremesinghe didn’t communicate the faults to the people, when it goes bad, all will blame Ranil Wickremesinghe. We’re sitting on a volcano that might erupt at any time,” Wijewardena said.

Interest Rates

Interest rates in commercial banks have been on the rise, despite the government insisting on maintaining a low-interest regime. The new regime cut down the policy interest rates in a bid to increase consumption and fuel economic activity during an uncertain year. The price cuts in the Interim Budget had also helped nudge the economy into a deflationary stance in the short-term, helping to justify the lower rates.

“The main challenge for businesses in the domestic market would be slower consumer demand, likely higher credit demand by the government due to a high budget deficit and upward pressure on domestic interest rates,” Ceylon Chamber of Commerce Chief Economist Anushka Wijesinha said.

The rising rates are likely to push consumers to save instead of spend, a trend that is already worrying the consumer goods heavyweights in the country.

The local interest rates rose as a precursor to the rate hike expected of the US Federal Reserve which finally came about in December after significant delay. The rates are likely to continue to rise, which the Premier Wickremesinghe said was a political play by US President Barak Obama to gain the confidence of his nation.

“While much of the first Fed rate hike has been priced in by markets, the speed of the tightening cycle could cause volatility. Emerging markets-which had been a strong source of global growth and stability-are seeing troubles for the first time. Some of this is due to the Chinese growth moderation and the impact on value chains in Asia,” Wijesinha added.

However, with the bursting of the Chinese equity and credit bubbles, Premier Wickremesinghe hopes that China will look to invest in markets such as Sri Lanka to drive its economy forward, which will be helped by higher interest rates here.

“We cannot keep on having low interest rates. Our inflation rate is rising. The US rates are rising, so the money foreigners had invested here will go back unless we raise our rates. We also need to have exchange rate management because of balance of payments pressure,” Wijewardena’s comments echoed similarity.

The recent lower interest rates also meant that local businesses borrowed heavily, and placed profitable assets as collateral, due to lower risks of defaulting.

“That’s the price that they have to pay. When you borrow and invest you’re supposed to make an analysis. You can’t sacrifice the wider economic interests of the country-interest rates and exchange rates-for the benefit of a few businesses. Then the Central Bank will have to take monetary policy measures,” Wijewardena added.

For businesses which have already leveraged their assets without making such analysis, Wijewardena suggested that they learn from their mistakes.

Exports

Wijesinha said that the rupee is likely to further depreciate, which would help exporters, and yet the uncertain global economic environment would pose challenges to them.

Commodities still account for a large section of the country’s exports, which are under pressure due to a global commodity crash. Meanwhile, there are political, social and economic instabilities in most of Sri Lanka’s major markets, barring the USA.

“Our external sector has to focus on the long-term. Problems in tea and apparel can’t be solved overnight. In tea, for the labour issue, the government, the companies and the labour unions don’t seem to want to work together, even though they can only benefit from co-operating. In apparel, there’s a genuine problem, because the European Union accounts for 60 percent of the market. The economic recovery in the EU is slow, though the US is picking up,” Abeysinghe said.

She also expressed caution towards the messages coming out of the EU regarding Sri Lanka’s challenges in regaining the GSP Plus facility.

“The current external environment is not conducive for growth, and our internal problems cannot be solved within one year. But we can start. Improved legal and political institutions, and streamlining of procedures are being proposed for investments and trade. This is good because they both go hand in hand,” Abeysinghe opined.

Meanwhile, Wijewardena said that Sri Lankan businesses are fast losing their competitiveness in global markets due to the lack of innovation in the export portfolio.

“We’ve been exporting simple products which other countries can copy and become competitors.

Already, Myanmar, Cambodia and Vietnam have copied our apparels and become competitors. Exports are going to fall by 6 percent year-on-year at the end of the year. So we need to convert from simple technological products, to complex technological products,” he said.

The private sector has been complaining that the government is not investing in education and research, while the government is asking the private sector to team-up in public-private partnerships. The recent Budget allocated a paltry amount of funds towards research and development after constant lobbying, against the billions of dollars spent on such activities by other countries.

However, existing research is not being used for competitiveness, as Wijewardena noted that the state-owned Industrial Technological Institute (ITI) has made significant innovative breakthroughs for Sri Lankan industries, which are being ignored by both the government and the private sector.

“The ITI has been able to bring in new technologies and innovations which can be utilized to compete in the world market, but the government or the private sector hasn’t used them. The private sector has to link up with such research institutes, and the institutes shouldn’t give it for free. The private sector has to buy the research from them,” Wijewardena said.

Opportunities

Despite a gloomy year, which may not be worse than 2015, Abeysinghe noted that businesses do have opportunities in engaging with the government to bring about more business-friendly policies.

“The government is more open for dialogue than before. It feels more approachable than before, and there’s a lot more space for criticizing policy and to get involved in policy. People feel more open to be critical. This is a positive development. Overall, the space for critical engagement is high. But there are also certain interest groups who can turn policies around, like in the Budget,” she said.

However, both major political parties in government are notorious for listening to just a limited number of patrons and beneficiaries.

“The amendments were a failure of the government to consider the repercussions of the policies in the Budget. For example, in the banking sector, it was disastrous. They were proposed without consultation of wider parties, so the Prime Minister had to withdraw them,” Wijewardena said.

Many of the businesses in Sri Lanka are likely to face a tough year going forward, with the country’s economic growth reducing to around 6-6.5 percent according to international ratings agencies.

However, International Fund Manager Mark Mobius recently gave thumbs up for Sri Lanka’s tourism sector, which was given extensive incentives for investments in both leisure and MICE travel in the Budget as well.

International hotel chains are finishing up construction of their local establishments, and the government has set up crash courses to address the acute human resource shortages, which also represents an opportunity for education service providers.

However, the Budget also took away the industry’s marketing fund, placing one of the country’s redeeming industries of 2016 under uncertainty.