Reply To:

Name - Reply Comment

By Srilal Miththapala

By Srilal Miththapala

The Sri Lanka Tourism Development Authority (SLTDA) undertook an Airport survey of Departing Foreign Tourists from Sri Lanka from January to June 2011 and the results were published last week. A descriptive sample cross section of tourists was used in the study and information was gathered by direct interviews by trained personnel. The total sample size was 4,500, covering 11 market groups.

This article attempts to analyze some of the more important findings of this survey, comparing them to a similar study carried out by the SLTDA in 2008/09 to identify major changes in trends and variations.

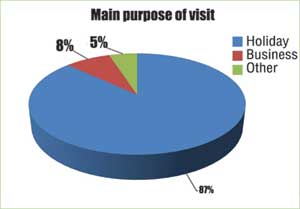

Purpose of visit

A very high percentage (87%) of sampled foreign tourists chose Sri Lanka for holiday purpose, which does not show too much variance against a similar percentage (81%) in 2008/09. However, the choice of Sri Lanka for ‘sun and beach’ has dropped from 59% in 2008/09 to 49% in 2011. This is quite possibly due to some of the other attractions of Sri Lanka, such as culture and excursion trips to the hill country becoming marginally more popular over the last few years. However, still, close to 50% of travellers identify Sri Lanka with ‘sun and beach’ which further reinforces theory that the primary brand attribute to Sri Lanka tourism is our beaches.

Apart from the holidays, 8% choose Sri Lanka for business and 5% for ‘other’ purposes. Further analysis of the ‘other’ category indicates that the 5% is almost totally comprised of the visiting friends and relatives (VFR) category.

Analysis by the author in previous studies has indicated that this ‘non-tourist’ VFR segment is significant in Sri Lanka tourist arrival statistics. This therefore, shows that this segment could be 5% or more of all arrivals recorded nationally. It is no surprise that the highest component of these VFRs is from the UK (50%), where there is a large number of Sri Lankan emigrants, holding UK passports.

Length of stay

The average length of stay per tourist was 10 nights, with Indian tourists staying an average of four nights, while tourists from the UK and Germany average a stay of 14-21 nights. This goes to emphasize the fact that Western European tourists effectively bring in more revenue and reinforces the industry ‘rule–of thumb’ that one UK tourist is ‘equivalent’ to three to four Indian tourists.

Popular places of visit

Colombo city, from being the most popular place to visit (65% in 2008/09) has marginally dropped to 61%, with Kandy overtaking it to be the most popular destination within Sri Lanka. Close upon 63% of the respondents confirmed visiting Kandy in 2011. The south west coastal beach has shown an increase of interest of 55% in 2011 up from 48% in 2008/2009. Sigiriya and the hill country are the next most popular regions with about 38% of visitors. This falls in line with the overall branding proposition that while the beach predominates, the other diverse attractions help reinforce the destination attributes.

Decision to visit Sri Lanka

The main source of information, which influence tourists to visit Sri Lanka was the Internet (22%) followed by recommendations of friends and relations (20%). The main sources of Internet information gathering was from Google (30%) followed by the Sri Lanka Tourism website (19%) and Trip Advisor (12%).

Hence, it is quite obvious that the trend in Sri Lanka, similar to other international destinations is that information dissemination through the Internet is becoming a strong and popular channel. It is very important therefore, that individual hotels, travel agents and other tourism related service providers have a strong presence on the web.

Travel arrangements

Most interestingly, the quantum of tourists visiting Sri Lanka, who use tour operators or travel agents in their own country, has reduced from 59% in 2008/09 to 46% in 2011. This clearly indicates that the general trend seems to be that visitors are moving away from using travel agents and tour operators. This could be attributed to the fact that the Sri Lanka tourism market is now vibrant and maturing after the difficult times during the war, where tourists who visited the country then, may have preferred the security of an organised package tour.

Repeat visitors

The trend that prevailed for quite some time, where Sri Lanka is a popular repeat destination still continues as is reflected from almost 30% of the respondents being second time/or more visitors. Indian tourists account for the highest repeat visitors, but this needs to be discounted, because a large proportion of these repeaters would be ‘traders’, who use the tourist visa to enter the country. The UK (28%) and Germany (37%) account for the larger number of ‘real’ repeat visitors.

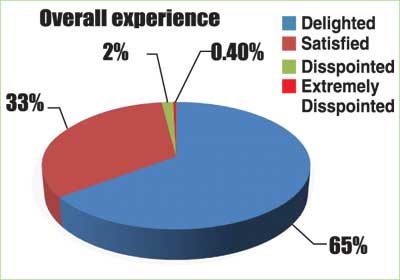

Perception and satisfaction levels

The proportion of visitors who say they were ‘delighted by their visit’ remains virtually unchanged at 65% as does the ‘satisfied’ component at around 33%. A high number (close to 73%) says that they will return, while the comparable figure for 2008/09 was 78%. Hence, this very important ‘planning to return’ percentage still seems to be strong, in spite of some prevailing controversies that higher room rates, inadequate products to match the high room rates and poor service levels, may somewhat deter tourists from returning for a second visit.

Gender and age

Male visitors outnumber females by 57% to 42%. It is interesting to note that the male/female ratio variance is minimal for France and Germany, where the ratio was almost 50:50. More importantly, there seems to be a radical change in the predominant age group of visitors to Sri Lanka, which has moved from the 40 to 50-year range in 2008/09, to 60 years and over in 2011. In fact, the 50 years and over segment and 60 years and over segments both together account for 46% of all travellers.

This indicates that the product offering of Sri Lanka possibly satisfies the more mature relaxed travelers, who want peace, quiet and tranquility, as against high intense excitement and entertainment, which would possibly cater to a younger clientele. Hence, perhaps hoteliers should take note of this trend.

Accompanying children

Surprisingly, 70% of all respondents said that they have been travelling with children of the age group of two to 15 years. This indicates a very interesting fact that Sri Lanka seems to be attracting families and hence, hotels should broad base their product offering to cater to children’s needs.

Surprisingly, 70% of all respondents said that they have been travelling with children of the age group of two to 15 years. This indicates a very interesting fact that Sri Lanka seems to be attracting families and hence, hotels should broad base their product offering to cater to children’s needs.

However, there does seem to be a paradox in this index, when compared to the earlier aspect where there is an increasingly large segment of over 50 years visiting Sri Lanka. Not too many over 50-year-olds would be having young children! Hence, if some reconciliation between these two findings is to be established, one can only conclude that it appears that a larger proportion of these elderly tourists is bringing along their grandchildren!

Accommodation facilities

There is a drop of visitors using conventional hotel establishments for accommodation from 83% in 2008/09 to 73% in 2011. At the same time, those utilizing rest houses and similar lower category facilities have increased from 7% to 16%. This therefore, further confirms the fact that Sri Lanka is attracting tourists with a lower spending capacity who patronize more lower end establishments (refer ‘Where have all the tourists gone’ – article written by the author published in Daily Mirror of July 19, 2012.

Harassment on tourists

The overall harassment percentage has not changed appreciably. The survey tracks harassment from beach boys, beach vendors, street vendors, three-wheeler drivers and touts.

However, as most hoteliers and tourism professionals will agree, harassment by touts and unruly behaviour of jeep drivers in national parks have become a serious issue in Sri Lanka. Repeated efforts to bring this under control by various stakeholders have been unsuccessful and it is imperative that the government and the SLTDA take some urgent and decisive steps to bring this immediately under control.

Wildlife

As expected, only about 25% of tourists showed interest in visiting the wildlife parks, which is borne out separately by the actual foreign visitors’ statistics at wildlife parks, where only 23% of all visitors to the country visited the wildlife parks in 2011. As highlighted in this publication, Sri Lanka certainly has room to develop this aspect of tourism tremendously, given the varied and unique natural fauna and flora available in abundance in the country.

The elephant topped the list as Sri Lanka’s star wildlife attraction with over 65% of respondents being interested in elephants. The leopard scores a meager 7.5%, possibly because Sri Lanka’s potential for sighting leopards is still not as famous as it is for elephants.

(The writer is a senior tourism professional, who is the Immediate Past President of the Tourist Hotels Association of Sri Lanka (THASL). He is now attached to the Ceylon Chamber of Commerce as Project Director of the Greening Hotels SWITCH ASIA project. He is a keen environmentalist and wildlife enthusiast)