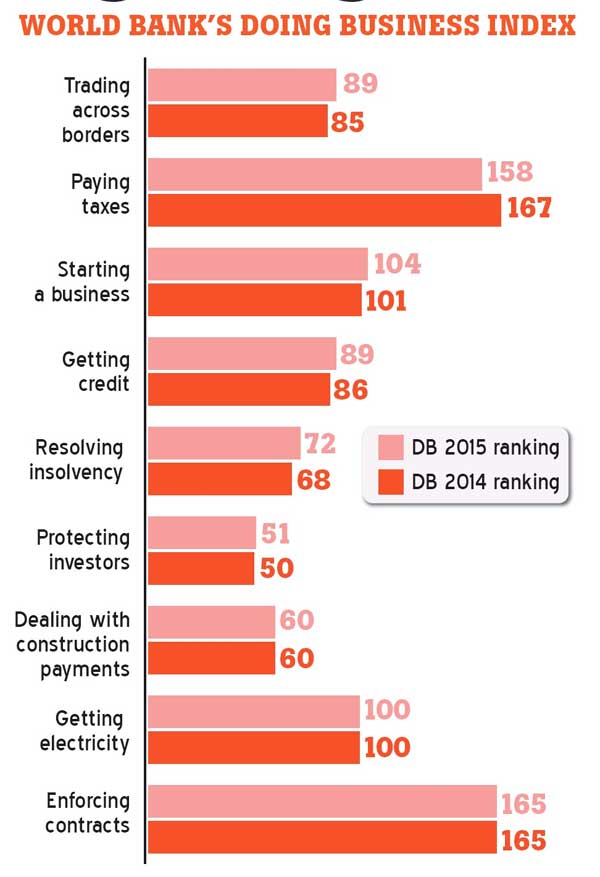

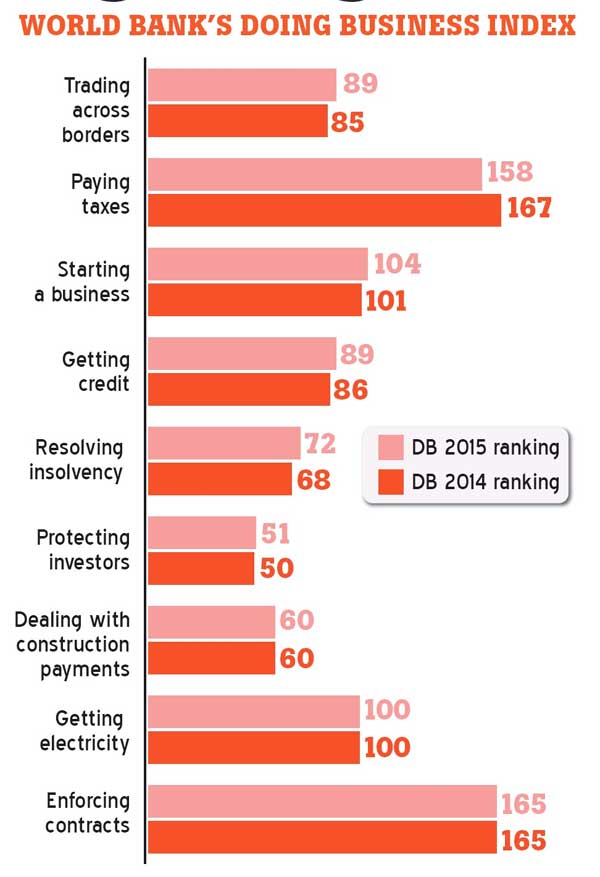

Sri Lanka’s ranking in the World Bank’s Doing Business Index (DBI) 2015 has improved to 99 (out of 189 countries) from 105 last year.While this seems a positive development, there are certainly no grounds for complacency. The country’s ranking has been oscillating in recent years. In addition, the improvement attained in the latest ranking is based on better performance on only two of the ten indicators contained in the DBI.The Pathfinder Foundation (PF) has consistently emphasized that investment performance has been the most disappointing aspect of the postconflict economic narrative.

The new coalition government is attaching high priority to governance reform. While this is laudable, equal attention must be paid t o sound economic management. Without a growing economy which meets the rising aspirations of the population, it becomes increasingly difficult to sustain good governance and political stability.

Time to improve investment climate

In this connection, promoting a well-functioning competitive private sector should be a matter of the highest priority.The previous regime was constrained by ideological pre-dispositions which meant that creating a propitious climate for private investment, domestic and foreign, was not high on its agenda. The present economic team is well placed to advance a reform program which places the economy on a higher growth trajectory, rather than continuing to consign it to a repeating stop-go cycle of unsustainable booms followed by painful contraction.

While recognizing the time-pressures associated with the 100-day program and the political compulsions of the short-term political calendar, the PF emphasizes that it is also necessary to embark upon a medium-term reform agenda.

The country requires a package of medium/long-term comprehensive reforms targeting macroeconomic stability; investment in education, health and infrastructure; and strengthening technological and entrepreneurial capacity. This needs to be supported by a political system which promotes the public interest and protects individual rights while managing scarce resources in a transparent and accountable way.

Reducing the complexity and cost of regulatory processes and strengthening legal institutions are an integral part of the package of reforms needed to place the economy on a path of higher growth and development.

The medium-term economic agenda

The economic agenda of the government should embrace the following key components:

Maintaining macroeconomic stability in a context where the Interim Budget has infused considerable aggregate demand into the economy, using all available tools (interest and exchange rates; increasing taxes; reducing recurrent expenditure; and rephasing capital expenditure). There are already some trends which need to be monitored very carefully. The trade balance deteriorated in 4Q 2014, with an increase in consumer imports (particularly motor vehicles), and the Central Bank has been using some of its reserves to defend the Rupee. In addition, the credit cycle seems to have turned, with private sector credit beginning to pick-up. Early and decisive action reduces the pain associated with stabilization (contractionary) policies. It is useful to recall the old adage that the punch bowl should be taken away just as the party gets going, given the lags involved in policy transmission. Structural reforms to improve the efficiency/competitiveness of the economy (see Economic Alert 27 at www.pathfinderfoundation.org).

Specific measures to improve the investment climate. In this connection, it should be emphasized that consistency and predictability of policies are of paramount importance (retrospective and entity based taxes, for instance, can transmit negative signals). The DBI provides a useful framework to develop a concerted program to strengthen the investment climate. Countries, like Sri Lanka, that do not have a large domestic market or an extensive natural resource base need to work even harder at improving the business environment. It is feasible to make rapid progress on this front. For instance, Georgia was able to advance about 75 places to 30th in the overall ranking in the space of 5 years. This is the kind of benchmark that Sri Lanka needs to set for itself.

Learning from past experience

Under the previous government, attempts were made by both the BOI and the Central Bank to position Sri Lanka in the top 30 countries in the world. However, unfortunately this exercise, which was launched with a big-bang was not sustained and did not achieve the desired results. The present administration needs to analyse the previous mistakes to formulate a better mechanism and approach to bring Sri Lanka to a higher ranking in the DBI ranking.

Using DBI to benchmark performance

It is important to recognize that the ranking on the DBI does not have a one-to-one matching with the amounts of FDI attracted by a country, for some of the reasons, such as the size of the domestic economy and natural resource endowment, given above.

However, in the Sri Lankan context, considerable value can be gained by using all the indicators within the index as benchmarks to assess our progress. In this connection, it is noteworthy that the World Bank (WB) is broadening the scope of each of the indicators by including: more features on the strength of legal rights and depth of credit information; more features on minority shareholders’ rights; a measure of the strength of the legal framework for insolvency; measures of the quality of building regulations/the reliability of electricity supply/the quality of the land administration system/the post-filing process in paying taxes/the quality of the judicial system and a ranking based on the distance to the frontier score.

Private investment-led path to prosperity

Countries have been successful in pursuing development using growth models characterized by different mixes of state/private sector involvement. However, Sri Lanka’s sovereign debt dynamics limit the room for maneuver for this country.

Going forward, it is private investment which will have to be the l ocomotive for growth and development. The headroom for acquiring i ncremental sovereign debt (as opposed to rollovers) is constrained. The path to prosperity requires transforming the growth model from debt-led public investment in infrastructure to private investment, particularly FDI, driven export expansion. Strengthening the investment climate is, therefore, of paramount importance.

Meeting the challengeA proposal

The PF proposes that under the current set-up the Ministry of Policy Planning and Economic Affairs, together with the Ministry of Investment Promotion, lead a coordinated and ti me-bound inter-Ministerial effort, with clear milestones, to propel Sri Lanka to a top-30 ranking in the DBI.