As investors turn to the Sri Lankan equity market to secure their futures, the presence of a regulator is more compelling t han ever. Accordingly, it is inevitable for the Securities and Exchange Commission of Sri Lanka (SEC) to continue to safeguard the interests of the investors. The success of the initiatives undertaken by the SEC to attain the aforementioned greatly depends on the support rendered by the market stakeholders. Education initiatives undertaken by the SEC are geared at increasing financial literacy in society with the objective of enabling investors to play a pivotal role in the joint efforts of creating an efficient market.The ‘Market Guide’ article series published in collaboration with Mirror Business during the last few years was also structured to achieve the aforesaid objective.

Markets move in cycles

The world of investing is fascinating, complex and it can be very fruitful. The local equity market is no exception. The Colombo Stock Exchange (CSE) experienced a relatively greater degree of volatility during the last two months. The announcement of a presidential election in 2015 followed by political transition and fiscal policy could be attributed to market volatility.

The aforementioned phenomenon underlines the intrinsic nature of an equity market. Stock markets behave in cycles. This is a universal theory that cannot be questioned. The market that was volatile in January 2015 has picked up in February 2015 (Table 1).Hence, what is most important is for investors to embrace volatility with optimism while making wise investment decisions (preferably fundamentally strong stocks) while focusing on a long-term time horizon.

Journey of investing

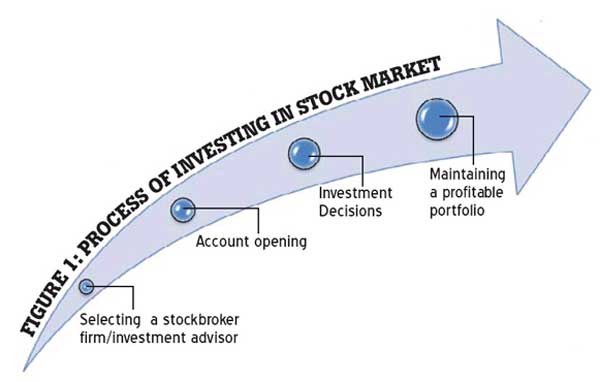

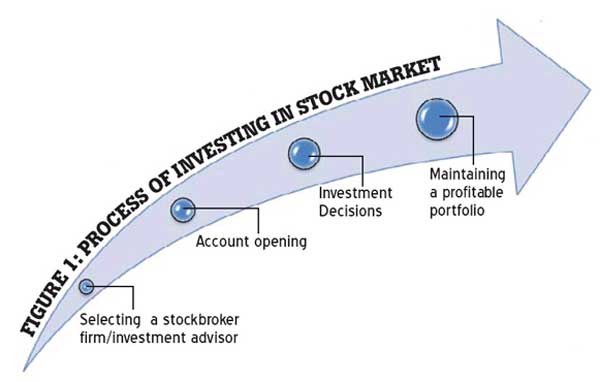

There is a misconception among the public that investing in the market is a tedious task. Investing in the stock market is simple as investing in the banking system. It only requires a certain degree of vigilance. The process of investing can be discussed under the main categories given in Figure 1. Selecting your stockbroker firm/investment advisor Selecting a suitable stock broker firm/investment advisor is the cornerstone of a successful investment journey. An investment advisor with the correct profile can make all the difference in your wealth creation efforts. Most financial experts care about their clients and provide valuable advice. Every financial advisor has a different specialty and the investor must find the one that will work in his best interest at the risk level that is within his tolerance level. The mismatch between your needs and the advisor’s contribution could affect adversely on your portfolio. The process given below will assist you in selecting the suitable investor.

Selecting a suitable investment advisor

Selecting a suitable investment advisor

Think through your financial objectives. Talk with potential investment advisors. If possible, meet them face to face at their offices. Ask each sales representative about his or her investment experience, professional background and education. Ask them their financial plan for you. Think: Talk:

Find out: Find out about the disciplinary history of the investment advisor. Make sure that you deal with a licensed investment advisor.Determine: Determine the level of service you need. Some stockbroking firms provide recommendations, investment advice, online trading systems and research support, while some might not provide research support and online trading systems. Select based on your needs.

Patience: Do not rush. Do the necessary background investigation on both the firm and t he sales representative. Resist salespeople who urge you to immediately open an account with them.

Be alert

- Be sceptical about representations of spectacular profit, such as “Your money will double in six months.” Remember, if it sounds too good to be true, it probably is!

- Don’t fall prey for ‘guarantees’ that you will not lose money on a particular securities transaction or agreements by an advisor to share in any losses in your account. Even though an equity market is expected to generate higher returns than other financial instruments you can’t guarantee returns as returns are based on demand/supply for stocks.

Account opening

There are a set of documents we sign at the point of opening an account with a stockbroker firm.Client agreement: A legal document that governs the basic relationship between the stockbroker firm and the client. It is mandatory to sign this document.

Discretionary account: It is an account that allows an investment advisor to buy and sell securities without your consent. You must give discretionary powers to the advisor in writing.

Credit agreement: A legal contract in which a stockbroker firm gives a loan for a certain period for you to purchase shares. This is not

mandatory. The credit agreement outlines all the rules and regulations associated with the contract.There are a few areas investors should reflect on prior to signing these documents. Failure to do so might tense up your relationship with the investment advisor and effect adversely on your returns.

-Are you honest with your advisor?

The sales representative will ask for information about your investment objectives and personal financial situation including your income, net worth and investment experience. Be honest as investment advisors will use this information in making investment recommendations to you.

-Who will control decision-making in your account?

You will control the investment decisions made in your account unless you decide to give discretionary authority to your investment advisor. Discretionary authority allows your investment advisor to make investment decisions based on what he/she believes to be best – without consulting you about the price, the type of security, the amount and when to buy or sell. Do not give discretionary authority without seriously considering whether this arrangement is appropriate for you.

-

How will you pay for your investment?

Most investors maintain a cash account that requires payment in full for each security purchased. An alternative type of account is a margin account. Buying securities through a margin account means that you can borrow money from the brokerage firm to buy securities and requires that you pay interest on that loan. You will be required to sign a margin agreement disclosing interest terms. If you purchase securities on margin (by borrowing money from the brokerage firm), the firm has authority to sell any security in your account, without notice to you, to cover any shortfall resulting from a decline in the value of your securities. Hence, it is vital for you to be vigilant when signing the agreement especially in volatile markets as prices are subjected to drastic fluctuations. It is widely accepted that margin trading is more suitable for seasoned investors.

Be alert

-Vigilantly review the information contained in these documents because it may affect your legal rights regarding your account.

-Never sign the agreements/forms unless you thoroughly understand it and agree with the terms and conditions it imposes on you.

-Refrain from signing blank forms/ agreements.

-Don’t rely on verbal representations from a sales representative that are not contained in this agreement.

Investment decision

Nobody invests to lose money. However, investments always entail some degree of risk. Be aware that higher the risk, higher the expected return. Nevertheless, the need of centralizing one’s portfolio around fundamentally strong stocks cannot be undermined. The price might dip at in a bear market but will adjust in the long run and bring about attractive returns. With some investments, such as penny stocks, your risk exposure will be greater. Investments in securities issued by a company with little or no operating history or published information may also involve risk.

Further on, certain stocks can trade above its intrinsic value. Be cautious when entering such stocks. Many are in the habit of investing based on past performances. Yet, remember that past success of a particular investment is no guarantee of future performance.Another factor investors should look sharp on is exposure to margin trading as it could increase your risk exposure.

Last but not least, never invest in a stock if you don’t fully understand. In this article series we have at all times stressed on the dire need of investors educating themselves prior to investing in the market. Consult information sources such as business and financial publications on information regarding the fundamentals of investing and basic financial terminology prior to investing. If you have questions, talk with your sales representative before investing and clarify your doubts.

Be alert

-Never send money to purchase an investment based simply on a telephone sales pitch.

-Never make a cheque out to a sales representative personally.

-Never send cheques to an address different from the business address of the brokerage firm or a designated address listed in the prospectus.

-A high pressure sales pitch can mean trouble. Be suspicious of anyone who tells you, “Invest quickly or you will miss out on a once in a lifetime opportunity.”

- Watch out for recommendations on ‘inside’ or ‘confidential information’, an ‘upcoming favourable research report’, ‘a prospective merger or acquisition’or the

your own research.

Be alert

Conclusion

announcement of a ‘dynamic new product’.Maintaining your portfolioIf you are to earn profits you have to be vigilant with your investment. Vigilance when maintaining your portfolio is two folded.

- Monitoring statements nInvestor-investment advisor relationship

On a broader perspective, reading and understanding the statements you receive will enable you to build a constructive relationship with your advisor/stockbroker firm, minimize financial losses incurred as a result of negligence, curtail cost pertaining to dispute resolution and thereby maximize profits. When you receive them you should verify the information in these statements. Keep good records of all information you receive, copies of forms you sign and conversations you have with your advisor.

Continue to maintain a good rapport with your investment advisor. As time goes by, it is normal for both parties to trust each other. However, trustworthy he may be, it is best to confirm his advice by doing

- Never allow your bought/sold notes and account statements to be delivered or mailed to your sales representative as a substitute for receiving them yourself. Make sure they dispatch it on the same day the transaction is executed. These documents are your official record of the date, time, amount and price of each security purchased or sold.

-Securities you own may be subject to tender offers, mergers, reorganizations or third party actions that can affect the value of your ownership interest. Pay careful attention to public announcements and information sent to you about such transactions. They involve complex investment decisions. Be sure you fully understand the terms of any offer to exchange or sell your shares before you act.

-Be vigilant on excessive number of transactions in your account. Such activity generates additional commissions for your sales representative but may provide no better investment opportunities for you.

-Be cautious on recommendations from your sales representative that you make a dramatic change in your investment strategy, such as moving from low risk investments to speculative securities or concentrating your investments exclusively in a single product.

*Pressure to trade the account in a manner that is inconsistent with your investment goals and the risk you want or can afford to take is alarming.

- Assurances from your sales representative that an error in your account is due solely to computer or clerical error. Insist that the officer promptly send you a written explanation. Verify that the problem has been corrected on your next account statement.

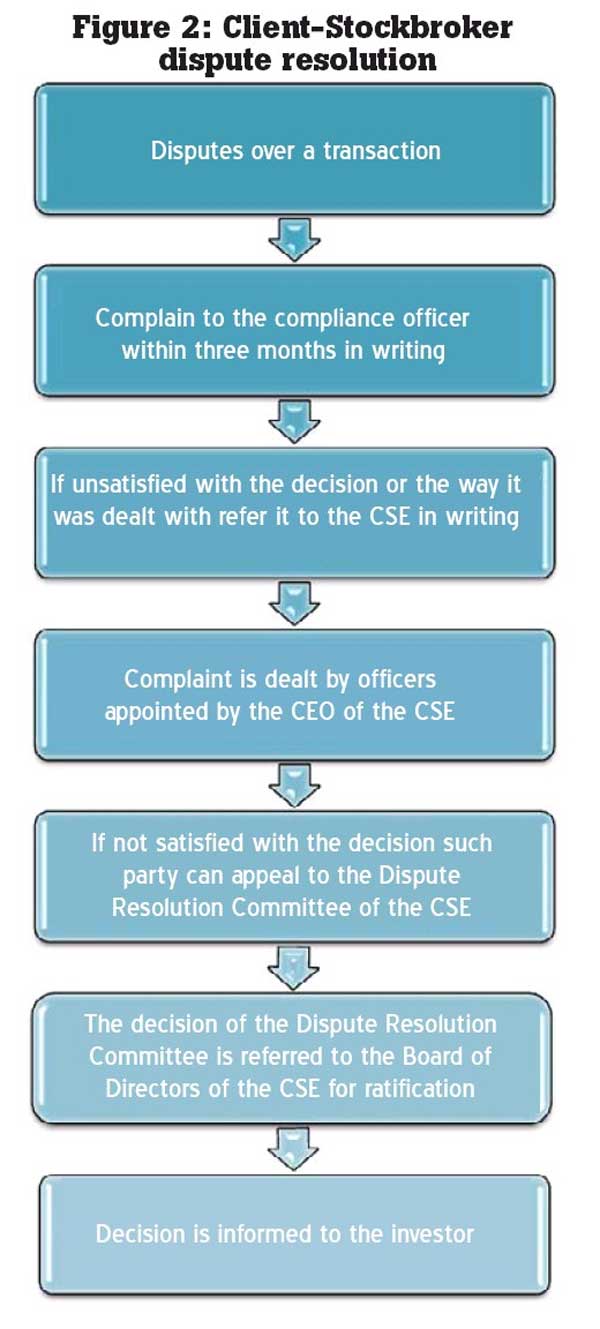

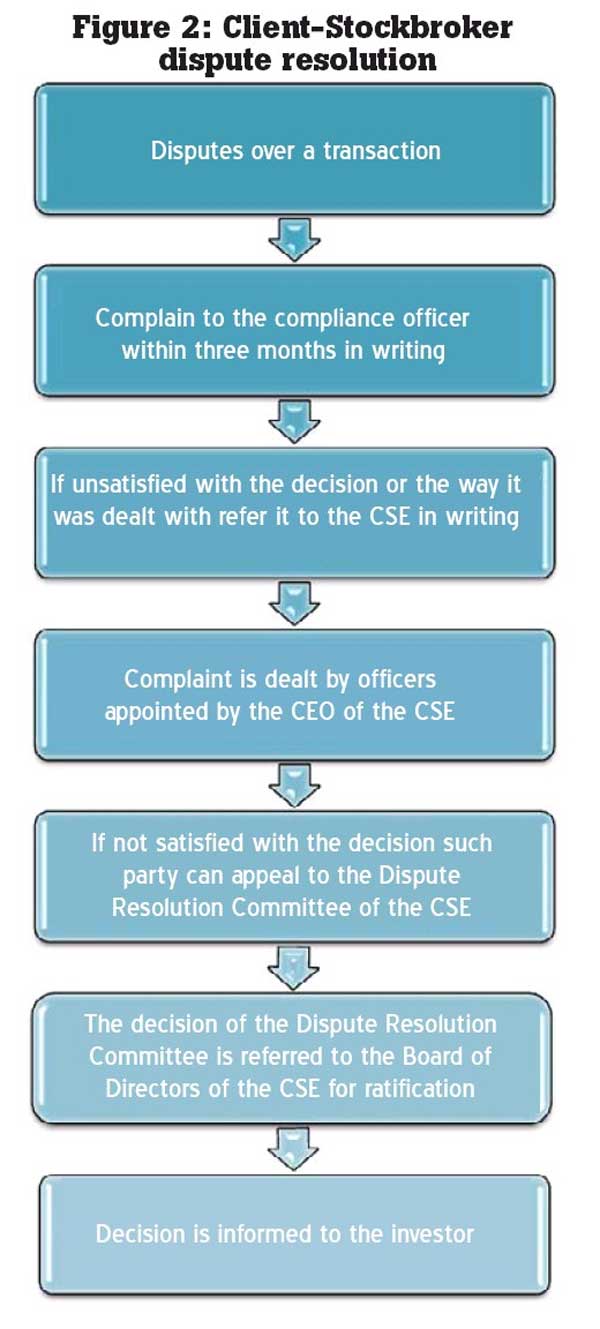

We all know prevention is better than cure. However, failure to be diligent about your investment could result in disputes between the client and the advisor/stockbroker firm. Most of the reported cases could have been avoided if the investors were more responsible from their end. Nevertheless, the flow chart given (Figure 2) will spell out the procedure that should be followed in such situations.On that note, it could be concluded that there is a dire need for investors to be optimistic at times of volatility and focus on value investing within a framework of patience, vigilance and caution.

.jpg)

.jpg)