Reply To:

Name - Reply Comment

Very often, when discussing tourism and its performance, the focus is on occupancy and room rates. Certainly, these two indices are the most important aspects to monitor the tourism and hospitality sector, which give a good indication of how the industry is performing. However, over and above this, there are several other interesting statistics that one can explore, to give a broader perspective of the tourism industry in Sri Lanka.

Very often, when discussing tourism and its performance, the focus is on occupancy and room rates. Certainly, these two indices are the most important aspects to monitor the tourism and hospitality sector, which give a good indication of how the industry is performing. However, over and above this, there are several other interesting statistics that one can explore, to give a broader perspective of the tourism industry in Sri Lanka.

A few such statistics are analysed from the 2012 Annual Statistical report of the Sri Lanka Tourism and Development Authority (SLTDA). (The 2013 Statistical report is still unavailable)

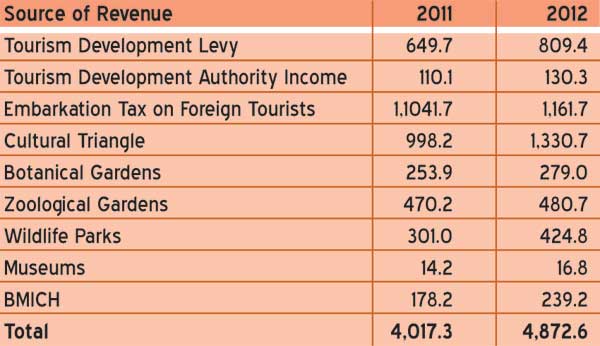

Public sector revenue from tourism

This gives an indication of the overall revenue that is derived from tourism in various ways by the public sector. However, the sources of revenue collection given in the SLTDA statistics are by no means exhaustive, as there are many other areas where tourists spend money, which do not get properly recorded. Therefore, this figure is almost certainly under estimated.

In 2012, this revenue to the public sector amounted to Rs.4.9 billion, compared to Rs.4 million in 2011, which indicates an annual increase of 21.3 percent.

The largest component of revenue is from the Cultural Triangle earnings (entry tickets), followed by Embarkation tax from foreign tourists and the 1 percent Tourism Development Levy that all establishments pay to the SLTDA.

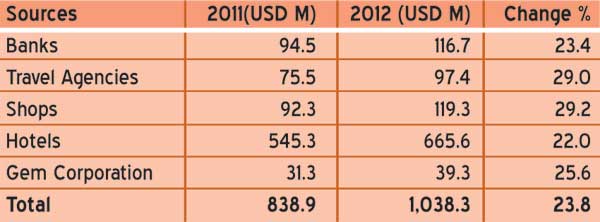

Forex earnings from tourism

Foreign exchange (forex) earnings from tourism are captured from five sources, which include banks, travel agencies, shops (licensed forex accepting establishments) and the Gem Corporation. Obviously, the forex revenue recorded by hotels is the highest component of earnings at 64 percent of the total.

It is interesting to note that the earnings from the hotel sector increased by 22 percent year-on-year (YoY) in 2012, and 42.1 percent in 2011 YoY. This indicates that hotel prices have been increasing quite rapidly.

Here again, there will be considerable ‘leakage’ where tourists would be changing foreign currency in places which do not get properly recorded.

It is interesting to note that tourism today has become the third largest forex earning industry to the country, preceded by worker remittances and the apparel industry.

However, it is a common knowledge that the value-added component in the tourism industry is high and in the order of about 75 percent to 80 percent, while that of the apparel industry can be much lower (50 percent). Hence, if one were to discount for this factor, tourism could well then be rated as the second largest forex earning industry of the country.

However, it is a common knowledge that the value-added component in the tourism industry is high and in the order of about 75 percent to 80 percent, while that of the apparel industry can be much lower (50 percent). Hence, if one were to discount for this factor, tourism could well then be rated as the second largest forex earning industry of the country.

Average stay per tourist

It is interesting to note that Sri Lanka has always maintained around an average 10 days stay per guest, from as far back as in the 1970s. Hence, it is very clear that Sri Lanka has always been accepted as a long-stay destination for tourists, which is to be expected, given the wide range of attractions and diversity that the country can offer.

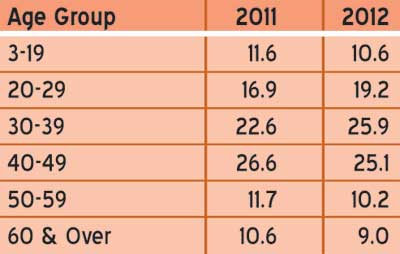

Age and sex of tourists

The male to female ratio of visitors to Sri Lanka is fairly well balanced, with males (55.4 percent) out numbering females (44.6 percent) slightly.

The largest component of about 51 percent is in the age group of 30 to 49 years. Hence, obviously, the appeal of Sri Lanka for more ‘senior citizens’ (50 years and over) is relatively less.

The largest component of about 51 percent is in the age group of 30 to 49 years. Hence, obviously, the appeal of Sri Lanka for more ‘senior citizens’ (50 years and over) is relatively less.

This is borne out from the fact that only 8 percent of visitors are from the ‘retired’ category, with about 13 percent been recorded as unemployed. A large proportion is professionally employed persons.

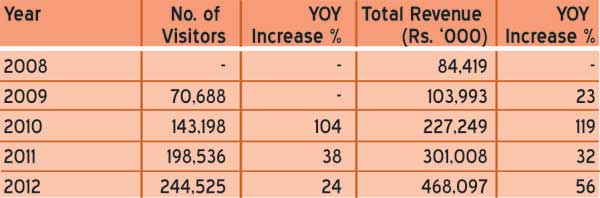

Visitation to wildlife parks

One of the important and popular revenue streams are earnings from visitation to the wildlife parks. These revenue streams have been showing very strong YoY growth in the post-war scenario, indicating that wildlife tourism is fast becoming an important facet of Sri Lanka tourism offerings.

It is interesting to note that of these 244,525 foreign visitors to the national parks, almost 50 percent are visitors to the Yala national park. Therefore, it is quite obvious that Yala is the most well-known and popular national park in Sri Lanka. It is this popularity that is causing the current over visitation problem at Yala.

The total visitors of 244,525 to wildlife parks in 2012 amounts to about 20 percent of the overall total arrivals for the year (little over one million), which leaves room for further improvement by promoting other wildlife national parks, which will then ease the pressure on Yala.

Charter operations

It is very interesting to note that tourist arrivals from charter flights to the country have dropped to a mere 0.6 percent in 2012. This is a remarkable reduction from about 60 percent in the early 1990s.

.jpg) The dramatic increase in inter-regional flights, fuelled by the Middle East carriers offering good connections to Europe has been a major factor for this drop in charter airlines operation to Sri Lanka.

The dramatic increase in inter-regional flights, fuelled by the Middle East carriers offering good connections to Europe has been a major factor for this drop in charter airlines operation to Sri Lanka.

Also, the improved security and ground condition in Sri Lanka has had an effect as well. During the period of instability, tourists preferred to use more packaged group tours, operated through charter flights for security reasons. However, today, tourists are able to access all parts of the country, without any hindrance. Therefore, more and more tourists are utilizing inter-regional flights, which will give them more flexible and independent travel options.

From the foregoing therefore, it is obvious that there are more interesting trends and statistics that tourism operators and professionals should start looking into seriously, now that Sri Lanka tourism is growing rapidly, with the country now fast developing into a mature tourism destination.

(Srilal Miththapala, a past President of the Tourist Hotels Association of Sri Lanka, is a well-known tourism industry personality in the country)