Reply To:

Name - Reply Comment

.jpg)

(1).jpg) Sri Lanka’s problem of flagging export growth has generated much discussion. The answer that many are converging on is a single word: DIVERSIFICATION.

Sri Lanka’s problem of flagging export growth has generated much discussion. The answer that many are converging on is a single word: DIVERSIFICATION.

But ‘diversification’ is a double-edged concept in exports. You can either diversify in terms of products, or in terms of markets. So, what should it be for Sri Lanka? That is the export-dollar question. A bit of economic analysis and lessons in paying attention to causation help to answer that question. But first some background.

Export problem and strategic solution

Sri Lanka’s exports are flagging in two ways: first, the exports to GDP ratio is on the decline; second, Sri Lanka’s share in world exports is on the decline as well. The second is important in understanding the problem: it tells us that the difficulties cannot simply be blamed on a general reduction in global trade.

‘Diversification’ has become the buzz word in terms in discussing a strategic solution – and it is based on some simple arithmetic: in terms of products, apparel and tea account for over 50 percent of Sri Lankan exports by value. In terms of markets, over 50 percent of Sri Lanka’s exports go to the EU and USA. Clearly, Sri Lanka’s exports are highly concentrated among a very few products and a very few markets.

Picking wrong horn of dilemma

The problem analysis invites a strategic prioritisation, both for industries and the country. Should it be towards diversifying markets or diversifying products? It’s difficult to focus on both at the same time, which is what creates the dilemma.

In practice, a choice seems to have been made. Sri Lanka seems to be focusing more on diversifying markets than diversifying products. In fact, sending more exports to ‘rising Asia’ has emerged high on the agenda. That has resulted in intensified initiatives for free trade deals with selected Asian countries such as Japan, South Korea and China.

The present analysis shows that this attempt to diversify markets is in fact the wrong approach. It will do little to increase exports because Sri Lanka lacks products to export to those markets and new markets would not be needed if Sri Lanka had more export products: the existing markets would have plenty of untapped scope.

Lesson 1 for export strategy: causation matters

Since both product and market concentration are starkly visible, it’s easy to think that increasing either one can help. If these two are not causally related to each other, then that is a fair conclusion. But, what if one is the cause of the other? If it is product concentration that is causing the market concentration, then trying to expand markets will not really help!

What has eluded many analysts in the ‘diversification’ discussion is precisely this causation question. Prioritising the diversification of markets assumes either that there is no causal link between the markets and products, or that market concentration is the cause of product concentration. A little bit of analysis shows both these assumptions to be incorrect.

In fact, product concentration seems to be very much the cause of market concentration, which means, that is the problem that requires the most attention.

Analysing through apparel sector

Fact 1: Sri Lankan export products are highly concentrated in the apparel sector. Nearly 40 percent of total exports from Sri Lanka are in apparel.

Fact 2: Exports from Sri Lanka are heavily dependent on the US and EU markets. Exhibit 1 confirms this reality. Out of total exports from Sri Lanka to the UK and Italy, over 80 percent is apparel. In the USA, the share of apparel exports is over 70 percent and in France over 50 percent.

So, here is the export-dollar question: does Sri Lanka export apparel because that is what these markets demand, or are these the markets because apparel is what Sri Lanka has to export?

Market concentration is not what is limiting products

The countries listed in Exhibit 1 – where Sri Lanka exports mainly apparel – are leading importers in the world. They account for nearly 30 percent of total world imports. .jpg) In value terms, this means these six countries imported goods to the value of nearly US $ 6 trillion in 2012.

In value terms, this means these six countries imported goods to the value of nearly US $ 6 trillion in 2012.

While 40 to 80 percent of Sri Lanka’s exports to the USA, UK, France and Germany are apparel, apparel imports account for less than 3 percent of total imports by these countries! While 85 percent of Sri Lanka’s exports to Russia are tea, tea accounts for a mere 0.2 percent of total imports of Russia!

In short, there are many more products these countries (Sri Lanka’s existing markets) import from the world but Sri Lanka for many decades has succeeded mainly in exporting only apparel and tea to these markets. In other words, the problem is not what is demanded by those markets, to which Sri Lanka has access, but what Sri Lanka is able to supply.

But product concentration is limiting markets

If you have only a few products that you can export, it is natural that you export it to the markets that are the largest consumers of those products. That, in fact, is what Sri Lanka is doing.

Sri Lanka exports tea and Russia is the largest tea importer in the world. So, it is strategically sensible to select Russia as a target market. And, as Exhibit 1 shows, tea is the only product that Sri Lanka seems to have really pushed in Russia. 85 percent of Sri Lanka’s exports to Russia are tea!

Sri Lanka exports apparel and the EU and USA are the leading importers of apparel in the world. The EU accounts for 34 percent and the USA for 20 percent. The three leading export destinations of Sri Lanka in the EU – the UK, Italy and France – just by themselves account for 14 percent of total apparel imports in the world.

Strategically speaking, Sri Lanka has chosen the right markets for its apparel. And, as Exhibit 1 shows, apparel is the main product that Sri Lanka has attempted to push in these markets.

The insight is as simple as it is important: it is product concentration (not having a diversity of products that it can sell), not market concentration, which is at the root of the problem. The solution lies in a strategic focus to expand products and not on expanding markets.

Market diversification is doomed without product diversification

The current push for new markets is being driven substantially by the hope that it can help apparel exports. But prospects are bleak.

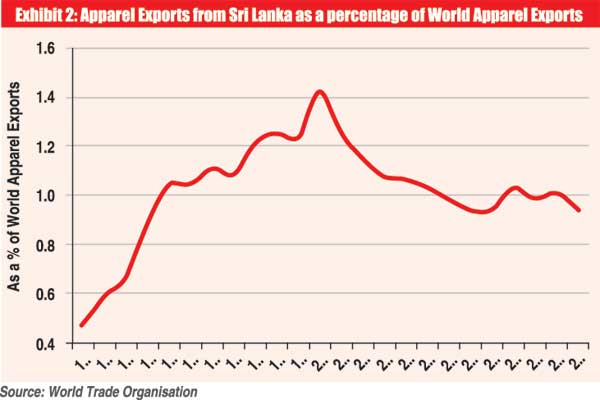

The competition apparel faces in the existing markets has intensified by the loss quotas (known as the MFA or the Multi Fibre Agreement) between 2000 and 2005 and the loss of preferential access (GSP Plus) to the EU in 2010. As a result, apparel exports from Sri Lanka have been in long slow decline in the world market as shown in Exhibit 2.

Other low-cost manufacturers like China, Bangladesh and Vietnam are filling in the gap. During the 2000 to 2012 period, where Sri Lanka had been losing its market share (Exhibit 2), Bangladesh had seen its world market share increase from 2 percent to 5 percent, Vietnam from 1 percent to 3 percent and China’s share had increased from 18 percent to 38 percent.

Sri Lanka’s free trade agreement (FTA) discussions therefore have largely been about seeking market access for apparel. For example, the FTA with India is pushing to get quota on apparel removed and in the China FTA, the push is to get improved market access for apparel.

But this is a weak strategy because these countries/markets, which Sri Lanka is seeking to enter, are not major importers of apparel. China for example accounts for only 1 percent of total apparel imports. Same is true for South Korea, which accounts for just 1 percent of apparel imports in the world.

Answering the question

Export dollars will not grow without diversification. To focus on diversifying products, or markets? That was the question.

This Insight answers that question. The problem for Sri Lankan exports is with the products, not the markets. The market concentration is a result of product concentration and not the other way about.

Therefore, international engagements aimed at helping the handful of existing exportable products to diversify into more markets is not a strategy for success. What required are grass roots domestic strategies that enable Sri Lankan producers to succeed in export product diversification.

(Verité Research is an independent think tank providing strategic analysis and advice to governments and the private sector in Asia. Comments welcome: [email protected])