Reply To:

Name - Reply Comment

.jpg)

.jpg)

The 2015 Index of Global Economic Freedom by the Heritage Foundation ranks Sri Lanka at 101 of 178 countries assessed with a score of 58.6. Sri Lanka’s rankings declined steadily from 66 in 2001 to 119 in 2010. This was followed by an improvement, reaching a post-war high of 81 in 2013. However, these gains have been short-lived.

As highlighted in our previous Verité Insight, ‘Economic freedom in Sri Lanka: Changes and consequences’ published on May 7, 2014, the significance of the index lies in its positive correlation with other important outcomes. It demonstrated two insights from the 2014 indices. First, while Sri Lanka improved in rank post-2010 to 2014, areas that improved were not all the same as the areas that had declined pre-2010. Second, there is a positive correlation between improved economic freedom and human development.

.jpg)

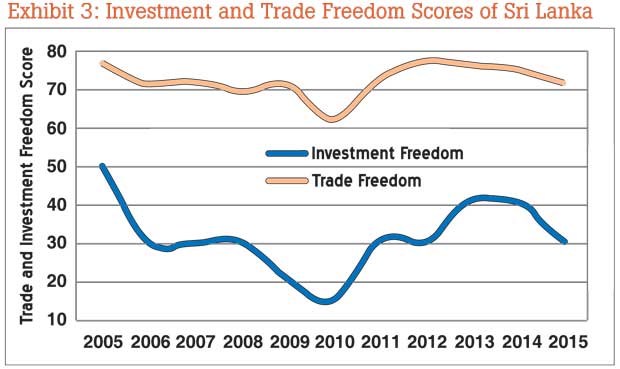

This article shows two worrying trends in the Trade and Investment Freedoms of Sri Lanka. First is that although the country’s Investment and Trade Freedom have picked up post-war, the improvements have been short-lived. Second is that the country performance in Trade Freedom was better than the world average in 2005 and on par with the average in Investment Freedom. By 2015, the country is faring worse than it did in 2005 (the Investment Freedom score in 2005 was 49.9 compared to 30 in 2015 and the Trade Freedom score was 76.6 in 2005 compared to 71.6 in 2015) and its performance is below the world average.

What is Economic Freedom and why it matters

Launched in 1995, the index evaluates countries in four broad policy areas that affect Economic Freedom: rule of law, limited government, regulatory efficiency and open markets. These indicators are important because they are strongly correlated with improvements in other economic outcomes. For example, in addition to the positive correlation with human development, it displays that the intensity of multidimensional poverty is lower on average in countries with higher levels of economic freedom. Multidimensional poverty, a measure used by the UN, assesses the nature and intensity of deprivation at the individual level in education, health outcomes and standard of living.

Economic Freedom is measured based on 10 quantitative and qualitative factors, grouped into four broad categories, or pillars, of economic freedom (refer Exhibit 1). The 2015 index is based mostly on data from the last two quarters of 2013 and the first two quarters of 2014.

Post-war gains short-lived

Sri Lanka’s rank on the index improved post-war and the country was momentarily categorised as ‘moderately free’ in 2013. Notable gains were made in the areas of Fiscal Freedom with the government’s efforts to curtail budget deficit and government spending. With low inflation, Monetary Freedom has also improved. However, the post-war improvements were short-lived.

The scores of the last two years (in 2013 and 2014) indicate that Sri Lanka is sliding back into the ‘mostly unfree’ category. Since 2013, Investment Freedom, Trade Freedom, Business Freedom and Property Rights have all declined significantly (Exhibit 2). Although Freedom from Corruption has improved, it is important to note that Sri Lanka still fares very poorly in this category, with a score of 37 out of 100. The score of each of the 10 factors in 2015 is given in brackets in Exhibit 2.

Trade and Investment Freedoms shave taken a plunge since 2005

Trade and Investment Freedoms in Sri Lanka as measured under the index have declined steadily from 2005 to 2010. Although there is post-war improvement, initial gains have eroded in the last two years (Exhibit 3).

‘Trade Freedom’ under the index is a composite measure of tariff and non-tariff barriers that affect exports and imports of goods and services. ‘Investment Freedom’ measures constraints on the flow of investment capital such as regulatory barriers, foreign equity restrictions, foreign exchange restrictions, labour laws, bureaucratic red tape and corruption.

In 2015, Investment Freedom in the world averages a score of 54.8 while Trade Freedom is much higher with a world average score of 75.4. In 2015, the level of Trade and Investment Freedoms in Sri Lanka is below what it was in 2005. Sri Lanka fared better than the world average Trade Freedom in 2005 and was on par with the world average

Investment Freedom.

Although Sri Lanka aspires to become an upper middle income country by 2016, it fares poorly in terms of Trade and Investment Freedoms when compared to upper middle income economies in the Asia-Pacific Region. For example, out of 42 countries in the Asia-Pacific, in terms of Trade Freedom, Malaysia is ranked 12, Vietnam (a lower middle income economy) is ranked 16, the Philippines 20 and Thailand 21 compared to Sri Lanka, which is ranked 31. In terms of Investment Freedom, Philippines is ranked 11, Malaysia 15 and Thailand 21 compared to Sri Lanka ranked at 29.During the last two years, losing ground gained in Trade and Investment Freedoms post-war to a level that is below the world average and below the level of freedom displayed in 2005 is a concern. Contrary to expectations, Sri Lanka has fared poorly both in attracting foreign direct investment (FDI) and increasing its export revenues. FDIs were at 1.3 percent of gross domestic product (GDP) and exports were at 15 percent of GDP in 2014. The Trade and Investment Freedoms in the country are reflective of the decline in its export competitiveness and its struggle to attract FDI in the post-war period. Paying attention to what is causing this and taking steps to rectify it will help revitalise Sri Lanka’s exports and FDI.

(Verité Research is an independent think-tank based in Colombo that provides strategic analysis to high level decision-makers in economics, law, politics and media. Comments are welcome. Email [email protected])