Reply To:

Name - Reply Comment

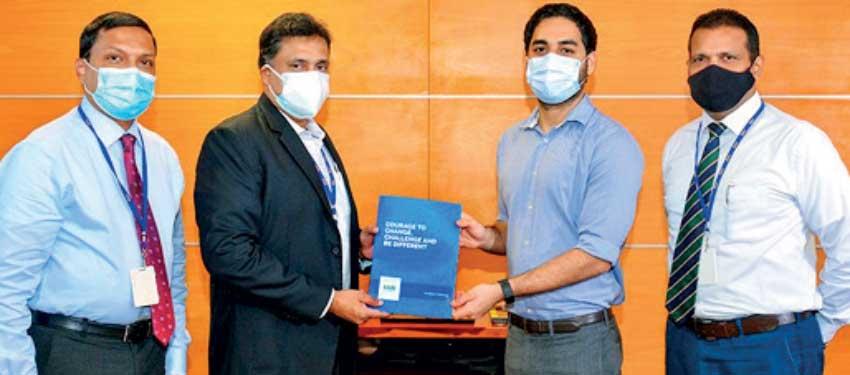

From left: HNB Head of SME Indravasan Kailaivasan, HNB Deputy General Manager- Retail and SME Banking, Sanjay Wijemanne welcoming Director of Delmon Holdings and BOWL’D restaurant Rahal Balasuriya as first HNB Business Banking customer with HNB Manager, Business Banking, Jude Pillai

HNB PLC recently unveiled an all-new ‘one-stop-shop solution for SME entrepreneurs.

Leveraging the bank’s sophisticated technological and digital banking capabilities, ‘HNB Business Banking’ will offer a complete suite of personalised banking products and services on par with solutions used by large corporate organisations but scaled to meet the needs of a wave of dynamic and growing businesses.

This will include total automation of payments, access to trade services, lending and a wide range of powerful e-commerce and cashless payments tools, all designed to optimise costs and operating efficiencies.

“HNB has seen an increase in demand for banking services of similar sophistication from established corporate organisations, especially from fast-growing enterprises which have found success in particular niches and regions.

While such businesses may have tech and digitally-savvy owners, they often have certain common challenges hindering their expansion. HNB’s Business Banking product has been carefully designed to address these constraints and propel them to a higher growth trajectory,” HNB Deputy General Manager- Retail and SME Banking, Sanjay Wijemanne said.

To be eligible for HNB Business Banking, customers need to maintain an average balance in their savings or current accounts.

HNB, in turn, will offer several personalised services, including access to a dedicated Account Relationship Manager, doorstep banking – and privileges such as a pre-approved, globally-accepted business credit card with two complimentary Airport lounge access per annum to over 1000 airports around the world

Account holders will also be provided fuel cards and branded cheque books free of charge while enjoying preferential rates for cash-backed facilities.

The bank will provide a 25 percent discount on real-time gross settlement (RTGS) services/Letter of Credit (LC) issuance for imports/Letters of Guarantee, payment and cash management services, custodian services, margin trading facility locker facility bundled with advisory services on insurance solutions for business including their staff from HNB Assurance PLC, company secretarial/ payroll processing and tax consultancy services by reputed companies.

The bank will also offer attractive interest rates on business/project/start-up loans with refinancing scheme options to support new businesses, emphasising women entrepreneurs who will also be identified as potential Business Banking customers.

“While we were performing well before the pandemic, COVID-19 created many challenges. Throughout adapting and eventually overcoming these issues, HNB has been an outstanding partner to SMEs,” HNB customer, Director of Delmon Holdings and BOWL’D restaurant owner Rahal Balasuriya said.

HNB will encourage its SME customers to use its extensive digital services, from offering improved cashless payment options through its mobile POS terminals HNB MOMO, especially for cash on delivery services, to onboarding merchants to the banks’ digital wallet HNB SOLO to provide contactless QR-based payment facilities.