Reply To:

Name - Reply Comment

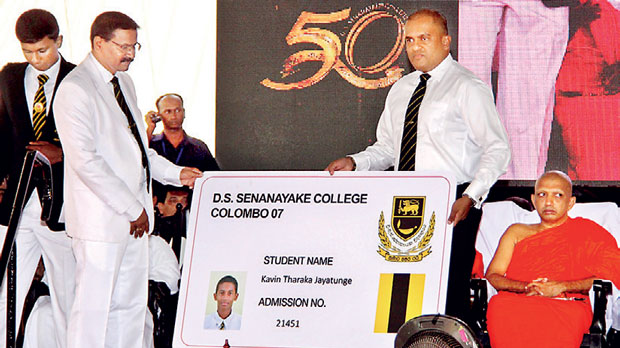

HNB Senior Card Centre Senior Manager Roshantha Jayatunge presents a ceremonial copy of the first HNB Smart Pay card to D.S. Senanayake College Principal R.M.M. Ratnayake

HNB Senior Card Centre Senior Manager Roshantha Jayatunge presents a ceremonial copy of the first HNB Smart Pay card to D.S. Senanayake College Principal R.M.M. Ratnayake

Sri Lanka’s most technologically innovative bank, Hatton National Bank (HNB) partnered with D.S. Senanayake College to launch Smart Pay – a revolutionary new proprietary card that will completely redesign payments and attendance recording in schools.

The official launch of HNB Smart Pay was timed to coincide with the 50th anniversary celebrations of D.S. Senanayake College. Utilizing near-field communication (NFC) technology, HNB Smart Pay will enable students to simply tap their cards on specially designed devices placed strategically around the school in order to record their attendance each morning as they enter the school.

The 50th anniversary celebrations and Smart Pay launch event were graced by the presence President Maithripala Sirisena and several other distinguished dignitaries.

The Smart Pay prepaid card, which is being made available to all students regardless of whether they own an HNB bank account, will also enable students to make digital payments within the school premises – from canteen purchases to buying textbooks and stationary supplies from the school bookshop and even covering payment of school fees.

“HNB has long been a pioneer in the introduction of cutting-edge technology into the Sri Lankan banking industry. In that regard, the launch of HNB Smart Pay for schools is another bold step forward in our digital journey that we believe will empower school children by teaching them how to save and spend responsibly within a cashless payment ecosystem. We invite all of Sri Lanka’s educational institutions to join hands with us on similar initiatives to make this technology-led vision a reality,” HNB Chief Digital Officer Sidath Wijeratne explained.

Designed in accordance with the most comprehensive international security standards and protocols, HNB Smart Pay card can be topped up at any HNB branch, through the bank’s Internet and mobile banking platforms, at HNB ATMs or at any of the HNB point-of-sales (POS) devices placed at strategic locations inside the school premises.

The topping up process for HNB Smart Pay was also designed with convenience in mind. Parents will receive automated notifications whenever the card runs low on funds and a further notification every time the card is topped up, thereby ensuring that parents have full visibility into their children’s spending habits.

Notably, the Smart Pay card is also capable of linking with HNB Singithi savings accounts for children, enabling students to transfer any pocket money that they have saved up to their account, helping them to save more and win valuable prizes.

“In developing HNB Smart Pay our goal above all else was to create a holistic solution capable of meeting the specific needs of a school environment on multiple levels and in that regard we are very proud of the results that we have achieved.

“Through HNB Smart Pay, we have been able to offer a product that can help the school to track attendance and very soon, even monitor library book borrowing while at the same time, helping students to make payments quickly, easily and accurately, enabling them to make the most of their interval by wasting less time in the canteen.

Since payments through the student card can only be made within the school premises, this also gives parents an added sense of security. We are confident that this card will be the first step in bridging the digital divide in our schools and we therefore warmly invite all other schools to come on board with HNB Smart Pay,” HNB Senior Manager Card Centre Roshantha Jayatunge said.