Reply To:

Name - Reply Comment

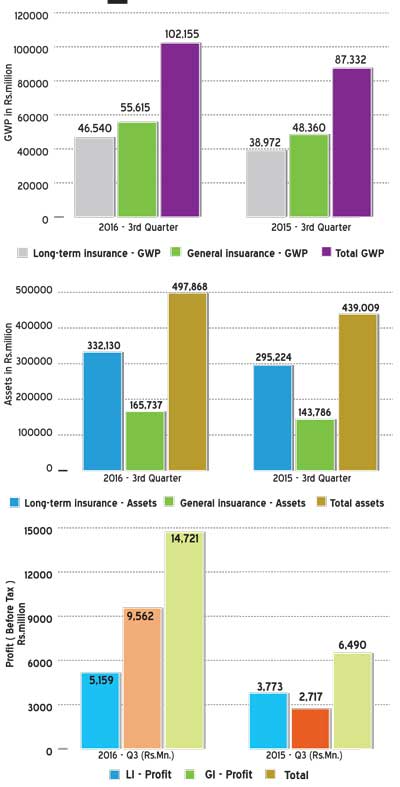

The insurance industry was able to achieve a growth of 16.97 percent in terms of overall gross written premium (GWP), at the end of the third quarter of 2016, recording an increase of Rs.14,823 million when compared to the same period in the year 2015.

The GWP for long-term insurance and general insurance businesses for the third quarter ending September 30, 2016 was Rs.102,155 million compared to the third quarter of 2015 amounting to Rs.87,332 million. The GWP of long-term insurance business amounted to Rs.46,540 million (3Q, 2015: Rs.38,972 million) while the GWP of general insurance business amounted to Rs.55,615 million (3Q, 2015: Rs.48,360 million). Thus, the long-term insurance business and general insurance business witnessed a GWP growth of 19.42 percent and 15.0 percent, respectively, when compared to the corresponding period of the year 2015.

Total assets

The value of total assets of insurance companies has increased to Rs.497,868 million as at September 30, 2016, when compared to Rs.439,009 million recorded as at September 30, 2015, reflecting a growth of 13.41 percent.

The assets of the long-term insurance business amounted to Rs.332,130 million (3Q, 2015: Rs.295,224 million) indicating a growth rate of 12.50 percent year-on-year (YoY). The assets of the general insurance business amounted to Rs.165,737 million (3Q, 2015: Rs.143,786 million) depicting a growth rate of 15.27 percent.

Investment in government securities

At the end of the third quarter of 2016, investment in government securities amounted to Rs.162,052 million representing 48.79 percent (3Q, 2015: Rs.128,232; 43.44 percent) of the total assets of long-term insurance business, while such investment of the total assets of the general insurance business amounted to Rs.33,535 million representing 20.23 percent (3Q, 2015: Rs.29,024; 20.19 percent).

Accordingly, the total investment of both long-term insurance business and general insurance business in government securities amounted to Rs.195,587 million (3Q, 2015: Rs.157,256 million) as at September 30, 2016. Thus, the investment in government securities for both long-term insurance business and general insurance business has increased by 26.37 percent and 15.54 percent, respectively.

Profit (before tax) of insurance companies

The profit (before tax) of insurance companies in both long-term insurance business and general insurance business has increased to Rs.14,721 million (3Q, 2015: Rs.6,490 million) showing a growth in profits by 126.83 percent. The profit (before tax) of long-term insurance business amounted to Rs.5,159 million (3Q, 2015: Rs.3,773 million) while the profit (before tax) of general insurance business amounted to Rs.9,562 million (3Q, 2015: Rs.2,717 million) at the end of third quarter of 2016.

Thus, profit (before tax) of long-term insurance business and general insurance business witnessed a growth of 36.76 percent and 251.87 percent, respectively, when compared to the corresponding period of the year 2015. Such growth in profit (before tax) is due to the increase in other income segment of an insurance company.

Insurers

Out of 28 insurance companies (insurers) in operation as at September 30, 2016, 12 are engaged in long-term (life) insurance business, 13 companies are carrying out only general insurance business and three are composite companies (dealing in both long-term and general insurance businesses).

Insurance brokers

Fifty six insurance brokering companies, registered with the Board as at September 30, 2016, mainly concentrate in general insurance business. Total assets of insurance brokering companies have increased to Rs.3,961 million as at the end of third quarter of 2016 when compared to Rs.3,695 million recorded as at September 30, 2015, reflecting a growth of 7.22 percent YoY.