Reply To:

Name - Reply Comment

The performance of the Colombo bourse is a debated topic in society. Each of us would perceive the market differently. There is no fixed physical reality or a single perception about the market. These numerous interpretations could be dictated by one’s experiences and knowledge. Yet, some may hold an over exaggerated view based on their personal or political objectives. They would be eloquent in presenting data to deduce the required objectives instead of obtaining a holistic and realistic view. Needless to say, certain news that appeared last week carried a bias interpretation on the market. It indicated that the market is suffering from a major setback.

Bias interpretations of this nature could tarnish investor confidence. Thus, it is imperative to unfold a balanced and realistic approach towards the market.

Markets move in cycles

The local stock market has decreased by 5 percent for the current year. The All Share Price Index (ASPI), which stood at 6,894 points at the beginning of the year, has declined slightly (at present the ASPI stands at 6,547 points). Volatility is an intrinsic characteristic of stock markets. Stock prices are subjected to an unending roller coaster ride. No market would continue to maintain an upward or downward trajectory. It is market volatility that enables investors to maximize returns, especially in the short and medium term. By March 2016, the market had decreased by 15 percent and the ASPI stood at 5,862. Subsequently, the market picked up and has grown by 11 percent since then. An intelligent investor would maximize opportunities in volatile markets instead of focusing on the market drop.

What factors drive stock prices?

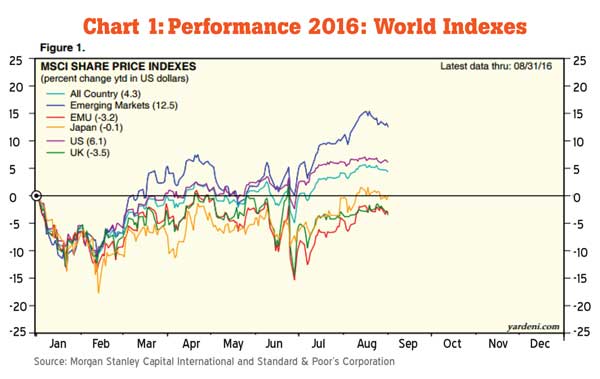

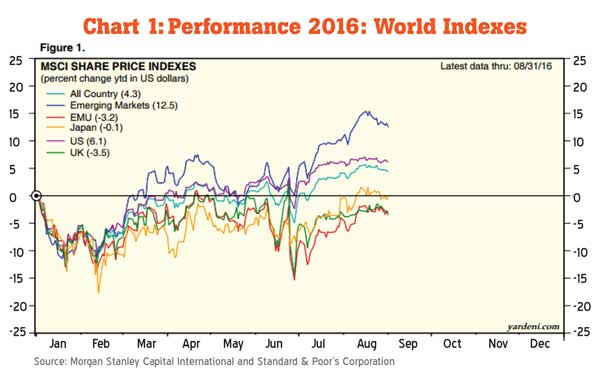

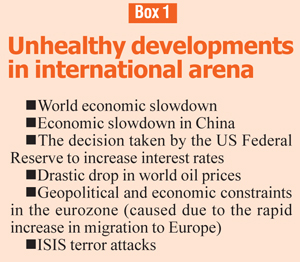

A rational investor would investigate into the low momentum (market drop) as well as the upward trajectory of 11 percent recorded in the market. Stock prices encapsulate a myriad of factors. Both local and international factors play a decisive role in stock markets. The consequences of global turmoil were so grave that it affected global markets adversely. Sri Lanka was no exception. Box 1 spells out the external factors that influenced our market. We can’t address the performance of the market without evaluating the impact of these

external factors.

Further on, analysts believe that the devaluation of the local currency and the marginal increase in interest rates would have accelerated the downward trend in the market.

Market experienced a growth of 11 percent

As stated above, the market has grown by 11 percent since March 2016. It is also interesting to note that the net foreign purchases experienced an upward trend during the last two months. Records indicate that the net foreign inflows exceeded Rs.2.1 billion (since July 2016).

A similar revival is witnessed in global equity markets. Many equity markets that dropped drastically amidst global turmoil during the first few months of 2016 have gradually picked up. The appetite for equity is steadily increasing and the Colombo Stock Exchange (CSE) is currently moving in line with the global equity markets.

It is a matter of interpretation and intention

The individuals, who are persistent in projecting the downward trajectory, fail to acknowledge the 11 percent growth due the deliberate effort made by them to project a market setback. They are determined to tamper investor confidence. A rational investor would question the need for such unhealthy propaganda. It is reasonable to question if these bias views are nurtured by petty political reasons and whims and fancies of a selected group of people. Such individuals will work only with facts that support their underlining cause and ignore the rest that are at times pivotal when analysing the market performance. As a result, they limit their analysis to the market drop experienced during the last 12 months and conveniently avoid evaluating the global equity market trends and the 11 percent growth in the local equity market (since March).

On the other hand, limiting the market analysis to the last six months will definitely over state the status quo. It is imperative that a balanced approach is adopted and that we assess the performance of the market within a longer time horizon. Accordingly, an intelligent investor will thirst to obtain the bigger picture and dig deep into the drop witnessed during the last two years.

Impressive figures matter

A net foreign outflow for the year 2016 is Rs.3.9 billion. In simple, foreign investors have sold more than what they have invested in the market. Yet, the trend slightly reversed during the last two months as the net foreign inflow reached Rs.2.1 billion. Anyone who adopts a pessimistic and bias view can elaborate on the net foreign outflow of Rs.3.9 billion and ignore the net foreign inflow of Rs.2.1 billion.

Further on, the market capitalization that stood at Rs.2.93 trillion at the beginning of the current year, decreased to Rs.2.6 trillion by the beginning of March 2016. However, a shift in the trend was observed as the market capitalization increased to Rs.2.78 trillion by August 2016.

Brighter prospects are ahead of us

The revival in the market indicated optimism in the market. These sentiments are expected to boost market activity amidst constructive policy decisions taken by the government and other relevant market stakeholders.

The government has announced its policy decision of divesting a proportion of its stake in certain institutions to the public through the stock market. These institutions will be listed in the near future. This initiative will undoubtedly revitalize the market by increasing both liquidity and market capitalization, i.e., the value of the market. Above all, it will strengthen investor confidence. Moving on, the decision to sell its stake through the market is commendable. It will increase transparency and promote good governance within the political system and in turn strengthen investor confidence. Economies and stock markets usually thrive on

investor confidence.

The monetary policy stance is expected to be conducive for market growth. The Central Bank mentioned last week that interest rates will be maintained at current levels. Economic theory suggests an inverse relationship between interest rates and stock prices – when the interest rates increase, the return on bank deposits increase. Thus, the investors are expected to exit the market and shift funds to bank deposits. The opposite will occur when the interest rates decrease.

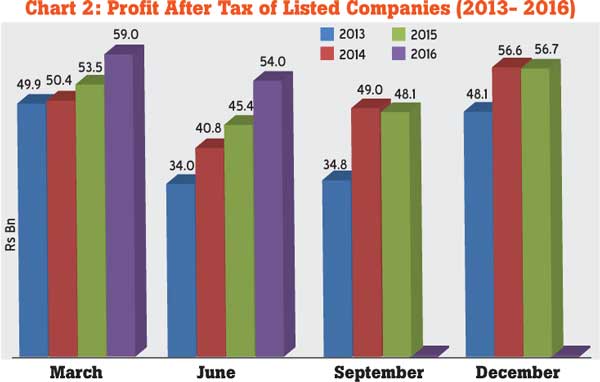

Further on, it was reported that profit after tax of listed companies have increased when compared to the previous years (during the last two quarters). Profit after tax for the first quarter was Rs.59 billion while profit after tax for the second quarter was Rs.54 billion. These impressive figures are expected to be a driving force of market growth.

Certain developed economies are struggling with decreasing profits at a juncture profits of listed entities have increased in Sri Lanka. For an example, earnings have dropped drastically in the US. The second quarter of 2016 was the fifth straight in which the overall earnings fell. Estimates show that earnings will decline further. As explained in Chart 3, all the lines are headed down for companies listed on the S&P 500 Index. It is also important to focus on the gray line on the far right. As you can see, back in April, expectations for the fourth quarter earnings growth were nearly twice as what they are today. It is argued that that this forecast might be overly optimistic as companies have been consistently cutting their estimates for future earnings.

The increase in profits of local listed entities might provide Sri Lanka with a competitive advantage amidst these dull global conditions.

It is well known that economic growth provides impetus for the growth of the stock market. If the government maintains an economic growth of 5.5 percent, investors could expect the current market momentum to continue.

Stock market and ulterior motives

At present, many are actively involved in the market. Similarly there are many more who could be introduced to the stock market. They require an impartial analysis on the market and not a bias interpretation that is fuelled by political objectives. The stock market should not be used as a tool to achieve political objectives. It is important to bear in mind that a robust market is beneficial for the economy irrespective of the group you represent.

“A half-truth is more dangerous than a lie”

- Thomas Aquinas