Reply To:

Name - Reply Comment

By Nuzla Rizkiya

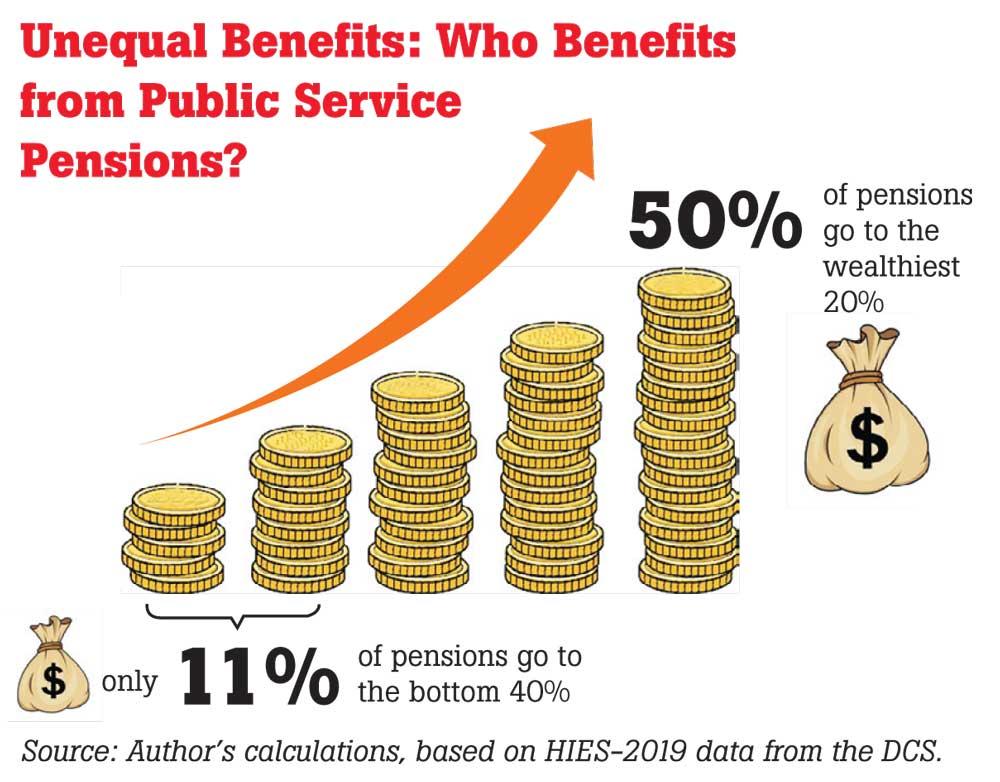

A recent study conducted by the Institute of Policy Studies (IPS) highlighted a significant disparity in Sri Lanka’s Public Service Pension distribution scheme, revealing that around 50 percent of the pension benefits were enjoyed by the wealthiest 20 percent of the population.

The findings emerged from the IPS study that sought to explore the equity of tax and government welfare programmes, in an effort to understand which part of the population bears the largest tax burden and who benefits the most from the government welfare schemes.

The analysis was conducted using the data from the Household Income Survey (HIS) in 2019 and Labour Force Survey from 2022, to examine both the direct and indirect taxes as well as government spending on key welfare programmes such as pensions and subsidies.

“The Public Service Pensions, which account for 8 percent of the government’s recurrent expenditure, favours the richest of households. Forty-four percent of the pension receivers belong to the wealthiest 20 percent of the population. Only 11 percent of the pension benefits are directed towards the bottom 40 percent,” the study stated.

Moreover, the study revealed that the pension expenditure in Sri Lanka increased by 20.5 percent in 2023, due to a policy decision to reduce the retirement age from 65 to 60, leading to a sudden surge in the number of retirees.

The number of pensioners increased by 4.2 percent, from 676,430 in 2022 to 704,795 in 2023, after the government mandated the retirement of public servants aged above 60 by the end of 2022.

The move was among several other measures taken to cut down the capital expenditure from the state coffers, as the country grappled with an unprecedented economic crisis during the time period.

“We can observe that the Public Service Pension programme in Sri Lanka is not progressive. One of the main reasons for the unequal distribution is that most pension beneficiaries come from the better-off segment of society. Therefore, implementing a contributory pension fund is crucial for the sustainability of the system,” said IPS Research Economist Priyanka Jayawardena during the launch of the IPS annual report, Sri Lanka: State of the Economy 2024.

The Public Service Pension scheme in Sri Lanka is the primary pension programme allocated to the permanent public sector workers in Sri Lanka, who must complete a minimum of 10 years of service to qualify.

The findings of the IPS analysis were calculated using the household income groups derived from the 2019 HIS data.