Reply To:

Name - Reply Comment

The signing of debt restructuring agreements with the Paris Club of Nations, EXIM Bank of China and India appeared to have borne immediate results with Japan bracing for the announcement of the resumption of all the stalled loan projects except the light rail project.

In the immediate aftermath of signing the agreement, the Foreign Ministry announced the invitation extended by Japanese Foreign Minister Yoko Kamikawa to her Sri Lankan counterpart Ali Sabry who is now scheduled to undertake an official visit to Japan from July 1, 2024. An informed source said that Japan would announce its plans for resumption of the projects stalled due to bankruptcy announced in April, 2022. It will include the development of the Bandaranaike International Airport.

The Minister will engage in bilateral discussions with his Japanese counterpart which will focus on making further progress on the outcome of the latter’s official visit to Sri Lanka in May 2024. He will also call on several other dignitaries including Chief Cabinet Secretary of Japan Yoshimasa Hayashi, according to the Ministry.

Meanwhile, the debt restructuring agreement with EXIM Bank of China was signed in Beijing yesterday securing a grace period of five years for Sri Lanka to settle its loans. Daily Mirror learns that the Chinese bank offered Sri Lanka more than two decades to service its debts in instalments. The agreement provides for restructuring Chinese debts amounting to US $ 4.2 billion. However, interest payments will continue even during the grace period. Also, there is no reduction of the debt component to be settled.

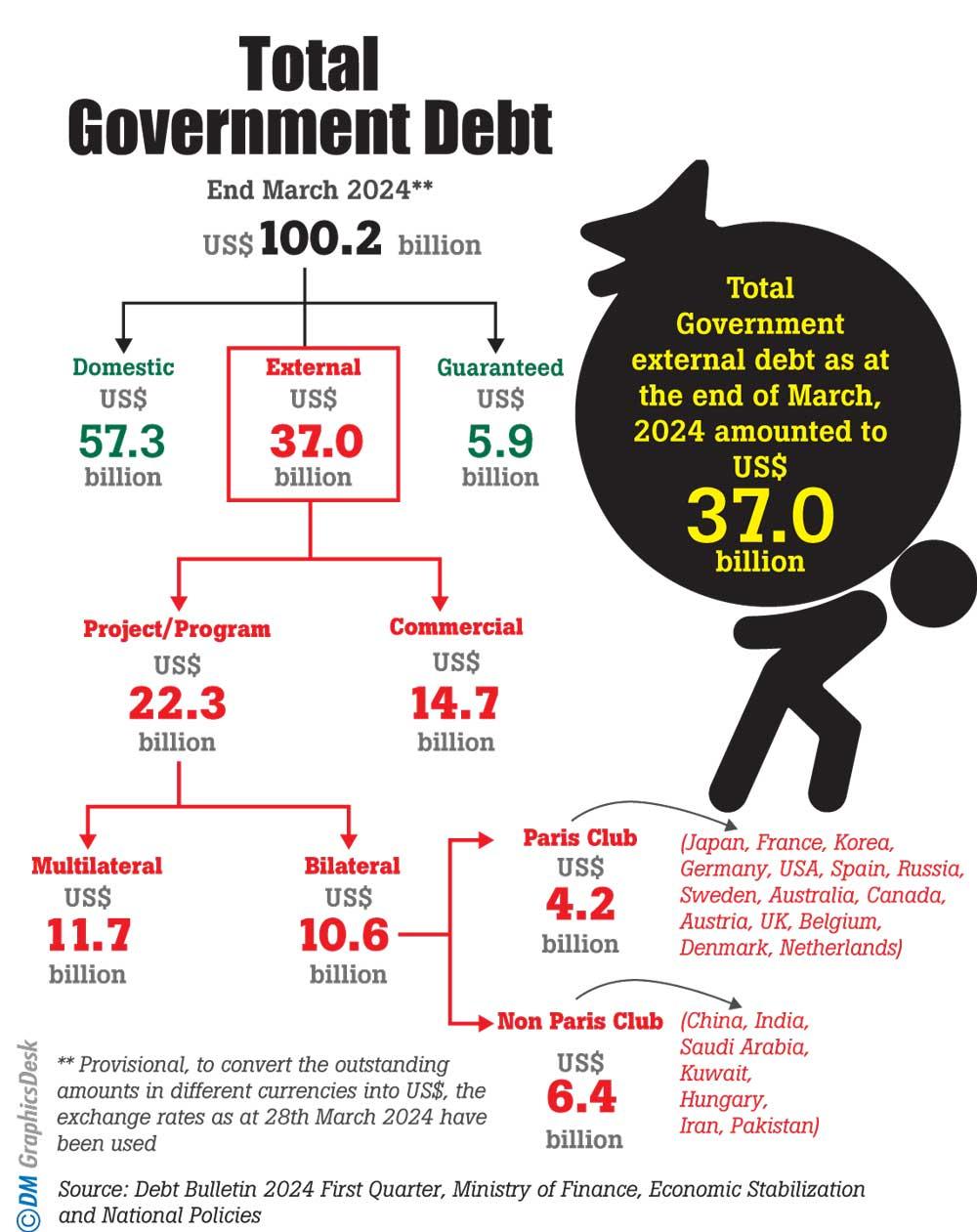

According to the government’s statistics, bilateral creditors account for 28.5 per cent of outstanding foreign debt of $37 billion. China is the largest single bilateral creditor, accounting for $4.66 billion. Japan is second, with $2.35 billion, and India third with $1.36 billion.

Sri Lanka dealt with India and the Paris Club of Nations that included countries such as Japan, France and the United Kingdom together and China separately in restructuring its debts.

Sri Lanka’s commercial borrowings include US $12.55 billion raised through International Sovereign Bonds (ISB), and another $2.18 billion from the China Development Bank. The major global players- the United States, Japan, the United Kingdom, France and India- played a key role in getting Sri Lanka’s debts restructured. China, a country with geopolitical rivalries with these nations, played a pivotal role in restructuring its debts with Sri Lanka. Sri Lanka managed to have an even-handed approach in debt treatment with all the nations accordingly.

All these powers had reason to fall in line with Sri Lanka in helping it get over the economic crisis. Japanese Foreign Minister Kamikawa who visited Sri Lanka last month even mentioned that strategically placed Sri Lanka’s economic recovery is essential for stability in the Indo-Pacific region and urged the government to swiftly restructure its foreign debt. Sri Lanka is located halfway along the main east-west international shipping route.

“The restoration of stability and economic development of Sri Lanka, which is at a strategic location in the Indian Ocean, is essential for the stability and prosperity of the entire Indo-Pacific region,” she added at a press conference last month in Colombo.

Sri Lanka’s final agreement on debt restructuring signed on the sidelines of the Paris Forum 2024 was welcomed by the United States. US Ambassador to Sri Lanka Julie Chung, taking to X formerly known as Twitter, said it is a positive step in the country’s economic recovery. She said her country encourages Sri Lanka to continue the reform process.

Altogether, the agreements, valued at a combined US $ 10 billion, encompass restructuring arrangements with major bilateral lenders under the auspices of the OCC, co-chaired by Japan, India, and France.

The other committee members include Australia, Austria, Belgium, Canada, Denmark, Germany, Hungary, South Korea, the Netherlands, Russia, Spain and Sweden.