Reply To:

Name - Reply Comment

By Mirror Business Desk

National consumer prices continued their descent for the third month in a row in November 2024, at a pace much deeper than a month ago as prices either fell or remained unchanged helping the pocketbooks of large swaths of people who were hammered for many years due to runaway prices since 2022.

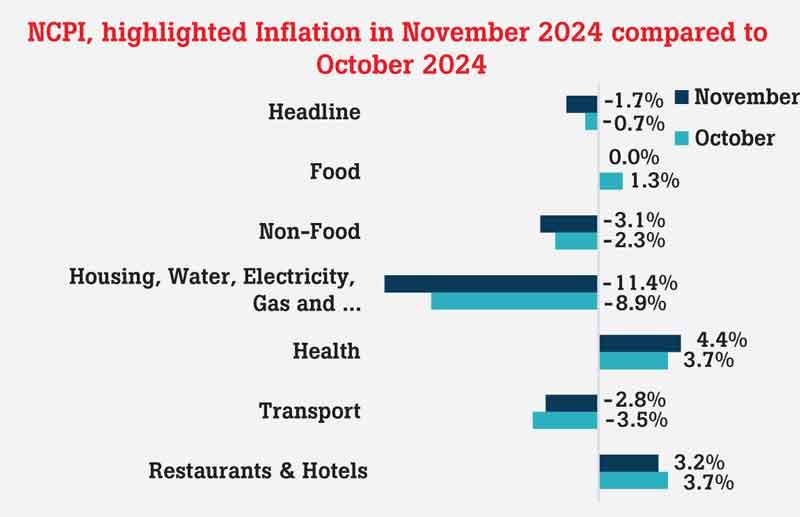

The prices measured by the National Consumer Price Index fell 1.7 percent in the twelve months through November 2024, after falling 0.7 percent through October.

On a monthly basis however the prices ticked higher by 0.1 percent reflecting rising food prices of items such as coconut, coconut oil and rice which became main talking points in both social and political circles as of late.

Prices of coconut rose the most between October and November as production suffered while a lot of nuts are consumed by the export industries.

Price and availability of rice became a hot-button issue, prompting intervention from the highest office of the country to stabilize the rising prices while the Cabinet decided to import rice to ensure there is no shortage of varieties commonly consumed as the country was coming into the year-end festive season.

Food prices overall remained unchanged over the last year through November but these issues related to coconut and rice reflected in the monthly prices which rose by 0.4 percent.

Meanwhile, the non-food prices continued their decline by falling 3.1 percent in November from a year ago while the monthly price declines slowed to 0.1 percent from 0.6 percent decline in October.

The Central Bank last month said they expect the current deflationary conditions to persist through most of the first half of the year before converging towards their 5.0 percent medium term target level.

But it said in the same vein that this situation of price declines is positive for the economy as it unwinds some of the red-hot inflationary pressures which pummeled people in the last three years.

This also helps the people to spend more on things which they had to trim down and restart spending on things which they had to completely forgo, helping a cycle of rising consumer spend and thereby economic expansion.

The coming savings from personal income tax will also help to support further consumer spending.

Meanwhile, the so-called core prices measured barring the often volatile items such as food, energy and transport rose by 1.5 percent in November from a year ago, slowing from 1.7 percent through October, reflecting the cooling in the underlying inflation in the economy.