Reply To:

Name - Reply Comment

By Ajith Siriwardana and

Yohan Perera

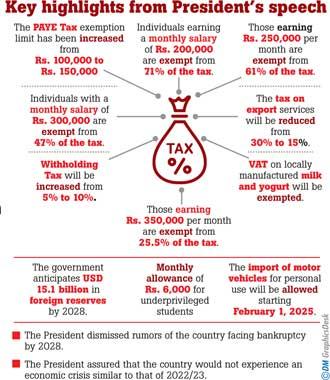

The government was able to make several amendments to the International Monetary Fund (IMF) extended Fund Facility during the third review where an agreement was reached to raise the income tax threshold from Rs. 100,000 to Rs. 150,000 per month, increase withholding tax from 5 per cent to 10 per cent, remove VAT on fresh milk and yoghurt and allow vehicle imports from next year, President Anura Kumara Dissanayake said yesterday.

The government was able to make several amendments to the International Monetary Fund (IMF) extended Fund Facility during the third review where an agreement was reached to raise the income tax threshold from Rs. 100,000 to Rs. 150,000 per month, increase withholding tax from 5 per cent to 10 per cent, remove VAT on fresh milk and yoghurt and allow vehicle imports from next year, President Anura Kumara Dissanayake said yesterday.

Making a special statement in Parliament, the President said that professionals such as doctors, engineers and bank managers raised concerns on the Pay-As-You-Earn (PAYE) tax and that following discussion with the IMF, the government was able to raise the tax threshold from Rs.100,000 to Rs.150,000 per month.

He said the government was also able to extend the first band of the Personal Income Tax (PIT) from Rs. 600,000 Rs.One million subject to 6 percent tax.

The President said accordingly, a person who earns a monthly salary of Rs. 150,000 will get a 100 per cent tax exemption, a person who earns a salary of Rs. 200,000 will get tax exemption of 71 per cent and a person who earns a monthly salary of Rs. 250,000 will get a tax exemption of 61 per cent, a person who earns a monthly salary of Rs. 300,000 will get a tax exemption of 47 per cent and a person who earns a monthly salary of Rs. 350,000 will get a tax exemption of 25.5 per cent. He said the previous government had agreed in the second review to impose a property tax from 2025, replace the Special Commodity Levy with Value Added Tax (VAT) from January next year, to simplify and remove the Surcharge VAT and also to impose a 30 per cent cooperate tax on service exports.

He said businesses in Sri Lanka face significant challenges in obtaining VAT refunds, which affects their operations and the Surcharge VAT had enabled businesses to maintain necessary cash flow, but proposals had been prepared to eliminate it.

The President said it was agreed to reduce the 30 per cent tax on service exports to 15 per cent.

He said the government is planning to open up vehicle imports and that it was agreed with the IMF to allow vehicle imports in three stages from next year. The President said the Import of motor vehicles for personal use will be allowed from February 1, 2025 and added that import of passenger buses and special-purpose motor vehicles commenced on December 14, 2024.

He said the government has also decided to extend the suspension of Parate law till March 31, 2025. He said some groups were claiming that Sri Lanka will again go bankrupt after commencing debt servicing in 2028 and added that the government will not let the country experience a situation similar to 2022 and 2023 in the future. The President said the government was planning to increase the foreign reserves upto USD 15.1 billion by 2028.