Business Main

Data shows signs of front-loading of certain import goods up to July

13 Sep 2021

0

0

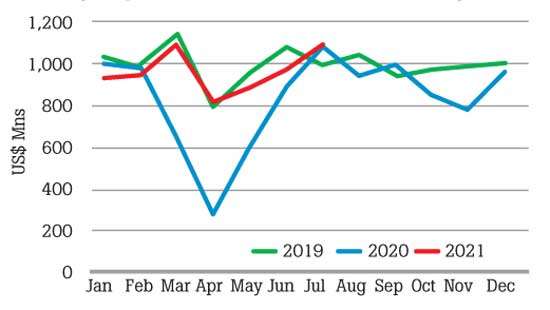

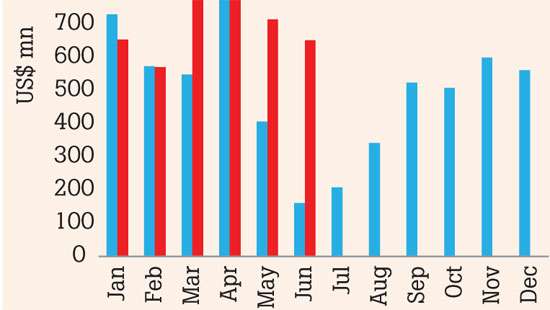

There were signs of excessive imports of certain categories up to July this year, reflecting front-loading by a section of traders, a claim, which was repeatedly made by the Central Bank, while partly attributing it to the current undue pressure on the dollar-rupee exchange rate.

Grip on imports further tightened to mitigate pressure on currency

10 Sep 2021

0

0

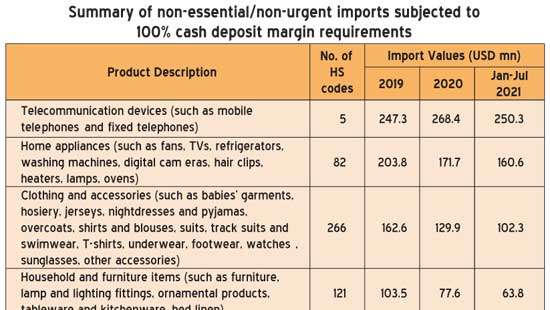

Amid a slew of measures taken in the recent past to alleviate the pressure on the currency, the Monetary Board of the Central Bank this week decided to further limit importation of some 623 products under 11 categories, which are deemed “non-essential /non urgent,” unless such imports are covered by 100 percent cash margin.

No lockdown travel restrictions for tourists

09 Sep 2021

0

0

Quoting a health communiqué issued by Director General of Health Services Dr. Asela Gunawardena, on September 3, the Sri Lanka Tourism Promotion Bureau (SLTPB) yesterday in a statement said the prevailing lockdown and travel restriction rules would not apply to international tourists visiting Sri Lanka.

CB asks banks not to quote above Rs.200 when buying dollars

08 Sep 2021

0

0

The Central Bank has written to banks asking them not to quote outside Rs.200/Rs.203 level for US dollars on all foreign exchange transactions as banks were quoting Rs.238 for a dollar by Monday amid exporters continuing to withhold selling dollars in the domestic market to book massive conversion profits hoping that the rupee would further shed value.

Govt. says no to addition of any new coal-fired power plants

07 Sep 2021

0

0

The government has ruled out any coal-based capacity additions or new coal-fired power plants as it reaffirms on the target set for the country’s power sector to achieve carbon neutrality in 2050 while meeting 70 percent of the country’s power generation through renewable energy sources by 2030.

Lending rates respond to policy rate hike as Average Weighted Prime Lending Rate crosses 6%

06 Sep 2021

0

0

Market lending rates have began responding to the policy rate and banks’ reserves ratio hikes announced on August 19, as prime customers witness their loans becoming pricier for the third straight week as the benchmark rate climbed above 6.0 percent last week.

CB extends loan moratorium, other relief to pandemic-affected borrowers till December

03 Sep 2021

0

0

Borrowers who continue to be battered by the pandemic-induced restrictions on their income generating activities are given further four months of loan relief and a host of other concessions, effective from September 01, 2021. The fresh round of payment holidays for affected borrowers came as the most recent relief scheme—third since the start of the pandemic.

Govt. announces plans for new foreign currency term loan

02 Sep 2021

0

0

In a fresh attempt to rebuild the country’s foreign reserves ahead of external debt services running into billions next year, the Finance Ministry this week called for proposals from banks, investment houses and institutional investors to raise a foreign currency term loan denominated in US dollars, euro, renminbi or Japanese yen.

Govt. prepares for austerity measures; no decision on IMF assistance yet

01 Sep 2021

0

0

Although the government is yet to reach a definite decision whether to go to the International Monetary Fund (IMF) or not, it has begun preparations for austerity measures such as freezing new recruitments and restructuring welfare programmes in order to curtail government expenditure in the upcoming budget 2022 amid a narrowing fiscal path.

Despite policy rate hike, CB stresses still in easing cycle

31 Aug 2021

0

0

Pushing back on claims made to the effect of reversal in the monetary policy towards a hawkish stance from a dovish stance, the Central Bank said it hasn’t made a turnabout and the measures last week were predominantly aimed at addressing some of the imbalances cropped up in the last few months in the foreign exchange market and also to pre-empt signs of some price pressures.

Budget deficit expands in 1H despite higher tax revenue

30 Aug 2021

0

0

Sri Lanka’s fiscal deficit expanded slightly despite higher revenues during the first six months of 2021 compared to the same period last year, made possible by the higher tax revenues collected during the first three months of the year from a burst in economic activities, before things began to sour thereafter due to virus related restrictions on the economy.

IMF’s SDR allocation will only provide some breathing space for Sri Lanka: IIF

27 Aug 2021

0

0

The Internal Monetary Fund’s (IMF) US$ 800 million Special Drawing Rights (SDRs) allocation to Sri Lanka is only likely to provide some breathing space to the debt-ridden nation to delay a much needed IMF programme for a possible debt structuring until early next year, according to the Institute of International Finance (IIF), a Washington-based global association of the financial services industry.

Central Bank imposes 5% maximum rate on forex deposits in local banks

26 Aug 2021

0

0

Reinforcing an early cap imposed on the foreign currency-denominated deposits by the local banks, the Central Bank yesterday issued an order stipulating the maximum rate at 5.0 percent for deposits denominated in foreign currency up to one year, barring for special foreign currency deposits the regulator introduced last year.

PUCSL and CEBEU blame each other over arbitration case that could cost US$ 160mn to SL

25 Aug 2021

0

0

The Ceylon Electricity Board Engineers’ Union (CEBEU) and Public Utilities Commission of Sri Lanka (PUCSL) are throwing the blame at each other as a Malaysia-based renewable energy investor has resorted to arbitrary action against the Ceylon Electricity Board (CEB) for the cancellation of 35MW wind and solar power renewable energy project in Kankesanthurai while claiming US$ 160 million in damages from the Sri Lankan government.

CEB instructed to come up with fresh long-term generation plan

24 Aug 2021

0

0

The Public Utilities Commission of Sri Lanka (PUCSL) has instructed the Ceylon Electricity Board (CEB) to come up with a fresh Long-Term Power Generation Expansion Plan, complying with the 70 percent renewable energy power generation target set by the government for 2030.

Citibank doesn’t rule out further rate hikes by CB

23 Aug 2021

0

0

Citibank in a note issued soon after last week’s monetary policy action said although the Central Bank would pause for sometime given the temporary respite they may get from the envisaged foreign inflows via swaps and others, it did not rule out further hikes in policy rates towards the end of the year and next year to keep external challenges in check.

CB ends pandemic era policy stimulus as key rates raised by 50bps

20 Aug 2021

0

0

The Monetary Board yesterday raised policy interest rates, ending its unprecedented monetary support extended to the pandemic-hit economy in a bid to address recent external sector imbalances and ward off medium term price pressures to make sure the economy is on track to record 5.0 percent growth this year.

Subdued economy to stay through Sept. as Delta wreaks havoc

17 Aug 2021

0

0

The lingering virus could dampen the economic activities through the end of September, further delaying any hopes for a tangible recovery in the economy, which was continuously battered by half a decade of subdued growth before contracting last year.

Trade gap widens for fourth consecutive month in June

14 Aug 2021

0

0

The trade deficit continued to widen for the fourth consecutive month in June on a year-on-year (YoY) basis, as imports grew at a faster pace, driven by consumer and investment goods, surpassing the pre-COVID levels, despite a decline in the fuel import bill and import restrictions in place.

Hela plans Rs.4bn IPO on CSE to fund growth here and Africa

13 Aug 2021

0

0

One of the fastest growing apparel manufacturers in Africa, Sri Lanka-headquartered Hela Apparel Holdings plans to raise up to Rs.4 billion (US$ 20 million) by offering 20 percent stake in the company through an initial public offering (IPO) on the Colombo Stock Exchange (CSE) to fund growth initiatives in Sri Lanka and Africa, including its immediate expansion into Egypt.

Cement industry likely to be next victim of price controls

11 Aug 2021

0

0

Sri Lanka’s cement industry could become the latest victim of controlled prices as manufacturers are contending with input and other costs, which are rising at a level that no longer enables them to stay solvent at the current retail price for cement.

SDAs with higher rate identified as catalyst for increased remittances

10 Aug 2021

0

0

The Special Deposit Accounts (SDAs) introduced last year at the onset of the pandemic, offering a higher rate of interest for foreign currency deposits, are also playing a role in drawing more foreign earnings from the Sri Lankan expatriates working particularly in the developed countries, ICRA Lanka has observed.

Poor quality white sugar hampers quality of local confectionaries: LCMA

09 Aug 2021

0

0

Sweet turns sour for local confectionery manufacturers as they are expected to feed into their production process substandard sugar which has hampered the overall quality of the end product reaching the market.

Sri Lanka’s tourist arrivals surpass 2 million in 2024

09 Aug 2021

0

0

Auction yields slump for third consecutive week

09 Aug 2021

0

0

Moody’s raises Sri Lanka’s rating

09 Aug 2021

0

0

ASPI crosses the 15,000 mark for the first time

09 Aug 2021

0

0

Fight against mosquito breeding on Global Pandemic Preparedness Day

09 Aug 2021

0

0

Manmohan Singh’s demise a loss for Sri Lanka as well: RW

09 Aug 2021

0

0