Business Main

Large banks most exposed to sovereign risk, says Fitch

02 Jul 2021

0

0

Sri Lanka’s large banks, which hold the highest amount of foreign currency denominated government securities, have the most exposure to the sovereign credit risk and thereby the risk of deterioration in their credit profiles, according to Fitch Ratings.

Local firms cleared to raise dollars on CSE’s Multi-Currency Board

01 Jul 2021

0

0

In a bid to support the expansion plans of local firms outside of Sri Lanka, the Cabinet of Ministers this week decided to relax the foreign exchange controls to allow local firms to raise foreign funds via foreign currency-denominated equity listings and debenture issuances on the Colombo Stock Exchange’s (CSE) Multi-Currency Board.

Credit growth expected to pick up in second half: Acuity Stockbrokers

30 Jun 2021

0

0

The banking sector credit growth could start to pick up from the second half of this year (2H21) after a setback in the 2Q21 due to lockdown-like restrictions, which crippled most business and consumer activity for over two months, according to Acuity Stockbrokers Research.

CB dismisses claims of external sector crunch amid dwindling reserves

29 Jun 2021

0

0

Central Bank Governor Prof. W.D. Lakshman in a fairly detailed statement issued yesterday dismissed the repeated concerns raised by certain quarters of an imminent external sector crisis brewing in the country, often citing weaker external reserves, ahead of the upcoming foreign currency debt obligations.

Sri Lanka getting ready to look beyond GSP Plus: Cabraal

23 Jun 2021

0

0

Sri Lanka is preparing itself for a trade relationship sans GSP Plus with the European Union (EU), said Finance State Minister Ajith Nivard Cabraal, after the European Parliament recently adopted a resolution urging the EU Commission to withhold the benefit over the country’s alleged human rights practices.

Merchandise export earnings resilient in May

22 Jun 2021

0

0

Despite the pandemic-related travel restrictions, Sri Lanka’s merchandise exports remained resilient in May, as exports recovered by 10.7 percent month-on-month (MoM) to US $ 884.2 million in the month from a five-month low in April, due to the initial shocks from the third COVID-19 wave, according to the Export Development Board (EDB).

Sri Lanka’s income inequality worsens in 2020: World Bank

18 Jun 2021

0

0

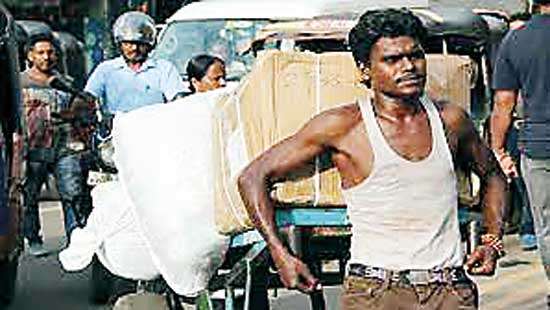

Sri Lanka’s income inequality further worsened last year as the poorest suffered the largest proportionate earnings shock, while the smallest proportionate income losses were suffered by the rich due to mobility restrictions imposed to contain the COVID-19 pandemic, which resulted in unequal opportunities favouring higher income earners.

Fitch expects SL to meet all external debt maturities this year

17 Jun 2021

0

0

Fitch Ratings expects Sri Lanka’s government to meet its remaining external debt maturities for the rest of the year, including a US $ 1 billion International Sovereign Bond (ISB) maturing in July, with the partial easing off external liquidity pressures in recent months while the medium-term debt service challenges persist undermining the country’s debt sustainability.

Low tax regime made meaningless as people confront soaring prices

15 Jun 2021

0

0

The continuous COVID-19-related restrictions are making the government’s low tax regime completely useless, as the consumer and producer prices have surged significantly, adding a much higher tax on people than a true legislated tax imposed on them.

SL gets US $ 40mn additional WB funding to improve water and sanitation services

12 Jun 2021

0

0

The World Bank’s Board of Executive Directors has approved US $ 40 million in additional financing for Sri Lanka to expand water supply, sanitation and hygiene services in seven districts through the Water Supply and Sanitation Improvement Project (WASSIP).

Fiscal deficit blowout likely as restrictions erase tax revenues

11 Jun 2021

0

0

The government is likely to end up with a blowout in the fiscal gap this year with the deficit potentially reaching double digits amid slowing tax income due to COVID-19 related restrictions and heightened expenditure on virus control and welfare spending on those affected by the pandemic.

CB directs NBFI sector to extend relief to borrowers

10 Jun 2021

0

0

The Central Bank this week extended relief to the borrowers of finance and leasing companies, nearly two weeks after it decided to give relief to the borrowers of the banking sector, as the economic fallout of the extended lockdowns are reaching disproportionate levels.

Prez Gotabaya promises investor-friendly Sri Lanka

08 Jun 2021

0

0

The Government of Sri Lanka yesterday went all out to lure investors by showcasing a series of unique selling propositions while making a number of pledges, which included the affirmation of attractive and sustainable returns to those who are willing to take the plunge by investing in the country, in its current position.

Banks wary of long-term loan facilities amid potential hike in interest rates

07 Jun 2021

0

0

Appetite of local banks to facilitate the corporate sector with new loan facilities to reprice their existing debt stocks to long-term fixed-rated loans under the current low-interest rate regime is waning amid concerns over interest rate risks and tightening net interest margins.

Expressway to be listed on CSE via State-owned biz entity

04 Jun 2021

0

0

The government is planning to list the country’s expressways and related assets via a State-owned business entity in the Colombo Stock Exchange (CSE) similar to Selendiva Investments Limited, which was established to hold key State-owned real estate and properties in Colombo, as part of the government’s broader framework to bring reforms into the State-owned enterprise sector.

Virus-related restrictions push over half a million Sri Lankans into poverty

03 Jun 2021

0

0

The pandemic-related restrictions have pushed over 500,000 people in Sri Lanka into the depths of poverty in 2020 alone, while the disastrous implications of the most recent round of controls on people’s lives and livelihoods are yet to be assessed and counted.

Multilateral or bilateral credit lines may not be sufficient to pay back loans: S&P Global Ratings

02 Jun 2021

0

0

Despite the government’s recent success in securing funding from multilateral or bilateral partners to build up the country’s foreign exchange reserves, S&P Global Ratings this week warned that such credit lines and budgetary assistance alone may not be sufficient to cover all external financing requirements over the next one-year period under the extremely challenging external environment.

LOLC Group creates history with Rs.57bn PBT for FY21

01 Jun 2021

0

0

Globally diversified financial conglomerate LOLC Group posted a record-breaking performance for the financial year ending on March 31, 2021, achieving unprecedented Rs.57 billion in profit before tax (PBT) and a profit after tax (PAT) of Rs.53 billion, a first for any corporate in the country.

Impact unlikely on seafood exports due to marine disaster from X-Press Pearl

29 May 2021

0

0

The seafood exports from Sri Lanka will not be impacted due to the contamination of the waters by the chemical spillage from the burning container ship X-Press Pearl, as the bulk is sourced from the Northern region, assured the seafood exporters.

Sri Lanka’s tourist arrivals surpass 2 million in 2024

29 May 2021

0

0

Auction yields slump for third consecutive week

29 May 2021

0

0

Moody’s raises Sri Lanka’s rating

29 May 2021

0

0

ASPI crosses the 15,000 mark for the first time

29 May 2021

0

0

Fight against mosquito breeding on Global Pandemic Preparedness Day

29 May 2021

0

0

Manmohan Singh’s demise a loss for Sri Lanka as well: RW

29 May 2021

0

0

NASA declares spacecraft ‘safe’ after record-breaking Sun approach

29 May 2021

0

0