Business Main

‘Agrahara’ becoming yet another burden to State coffers, warns AG

25 May 2021

0

0

Engulfed with years of poor planning, execution coupled with inefficient operations, Sri Lanka’s public sector health insurance scheme, Agrahara, partly funded by the Treasury, has been failing to achieve its key objectives while increasingly relying on State-coffers to stay afloat, Auditor General Department cautioned.

Central Bank in talks with finance sector to provide fresh relief to borrowers

24 May 2021

0

0

The Central Bank is engaged with banks and finance companies to see if some form of relief could be afforded to borrowers troubled by the ongoing restrictions on businesses and livelihood imposed by the authorities to stem to virus spread.

April worker remittance income jumps 38% from low base

22 May 2021

0

0

The remittance income in April jumped 38.3 percent from a low base a year ago, as such income plunged to its worst in April last year when the pandemic made a large part of the world economy to go into lockdowns, disrupting financial and trade flows.

CB keeps policy rates steady amid worsening economic outlook

21 May 2021

0

0

The Monetary Board of the Central Bank, which met Wednesday to assess the current monetary policy stance decided to keep the key policy interest rates at the prevailing historically low levels as they were of the belief that the current policy stance is sufficient to deal with the fresh challenges posed by the third COVID-19 wave, and stressed that the pressure seen on the consumer prices is only transitory.

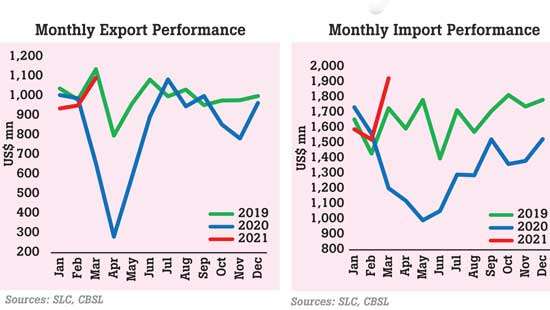

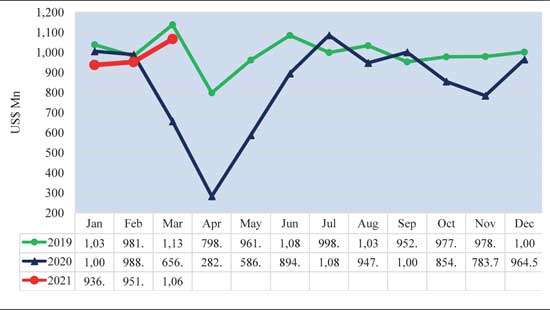

Trade deficit widens in March for first time in almost a year

19 May 2021

0

0

Trade deficit in March widened for the first time nearly in a year as imports recovered almost at the same pace as exports partly driven by seasonal demand, leading to a widening of the trade deficit in the first quarter, the latest data released by the Central Bank showed.

CB largely expected to hold rates on Thursday

18 May 2021

0

0

Despite the ongoing COVID-19 third wave in the country, First Capital Research (FCR) is largely ruling out a possible rate cut and expects the Central Bank (CB) to hold policy rates at the fourth monetary policy review announcement of the year scheduled for this Thursday (20th).

BoC first quarter profit soars on surge in loans

17 May 2021

0

0

Profits at Bank of Ceylon (BoC) soared as the State lending giant saw a burst in loans in the three months ended in March (1Q21) as the economy was off to a robust start while the lender was also at the forefront in channelling billions of funds into priority economic sectors promoting the government’s economic agenda.

EPF’s asset base grows in 2020; but returns to members slip

11 May 2021

0

0

The Employees’ Provident Fund (EPF), Sri Lanka’s largest retirement savings fund, grew by 11.2 percent or Rs.283.9 billion in assets in 2020, albeit the returns afforded to the member accounts slipped amid the fast descent seen in the country’s interest rates.

Commercial agriculture sector fears worst from proposed fertilizer ban

10 May 2021

0

0

While calling for wide stakeholder consultations in implementing the announced ban on chemical fertilizers and agrochemicals in Sri Lanka, the country’s tea, rubber, coconut and fruit & vegetable growers in commercial agriculture warned of far reaching implications from such a ban.

CB hints at when it could apply brakes on record stimulus

08 May 2021

0

0

For the first time since the current dovish policy run began in January 2020, the Central Bank recently insinuated that at which point it could either end or reduce providing more gas by way of monetary stimulus, which was unleashed to power the current expansion seen in the economy.

Five-year consolidation plan for NBFI sector

07 May 2021

0

0

The Central Bank says it would put in place a five-year consolidation plan for the non-bank financial institution (NBFI) sector, embarking on a time-bound execution framework to reduce the number of finance companies to 25 from the current 40.

Central Bank mulls dedicated AMC to manage sour assets

06 May 2021

0

0

NBFI sector NPLs rose sharply to 13.9% in 2020, from 10.6% in 2019, steadily rising from 5.3% in 2016 Sri Lanka is planning to set up a dedicated institution where the banks can sell their distressed assets for third party institutions for their separate management,

SL overshoots budget deficit as pandemic puts strain on state revenue

04 May 2021

0

0

Sri Lanka’s fiscal deficit for 2020 exceeded both the deficit target for the year and the deficit in 2019, as the pandemic-induced economic disruptions put a strain on revenues, while the tax cuts failed to produce their desired economic resurgence.

March worker remittance income soars over 24%

03 May 2021

0

0

Remittance incomes from Sri Lankans working abroad continued its climb for the eleventh consecutive month as March earnings accelerated over 24 percent over the same month in 2020, marking the recent highest jump since the current run began in May last year.

Central Bank releases 2020 annual report

01 May 2021

0

0

In terms of Section 35 of the Monetary Law Act No. 58 of 1949, the seventy first annual report of the Monetary Board of the Central Bank of Sri Lanka was presented to Prime Minister and Finance Minister Mahinda Rajapaksa by Central Bank Governor Deshamanya Prof. W.D. Lakshman.

Private sector players forward 25-point list on Tourism Act amendment

30 Apr 2021

0

0

The private sector stakeholders of the tourism sector continue to advocate halting the amendments to the current Tourism Act, however should the legislation governing the industry be changed, the sector players said it is essential for the relevant authorities to take into account a list of their requirements.

Firms raise record debt making the most of low rates

28 Apr 2021

0

0

A record amount of money has been raised by Sri Lankan companies as historically low interest rates have drawn them to the debt capital market, looking for the best deal in town with the aim of locking in low cost funds at least for the next five to seven years.

CB issues priority sector lending targets to banks

27 Apr 2021

0

0

The Monetary Board of the Central Bank has issued priority sector lending targets to banks as part of its wide-ranging efforts to direct funding to the sectors identified as priority and deemed as high potential in generating jobs, export earnings and overall economic growth.

Top Chinese academic advises Sri Lanka to consider joining RCEP

23 Apr 2021

0

0

A leading Chinese academic and free trade zone expert urged Sri Lanka to consider joining the newly formed multilateral trade pact, the Regional Comprehensive Economic Partnership (RCEP), to reap the full benefits of China’s Belt and Road Initiative (BRI).

CB plans to raise up to US $ 750mn in SLDBs ahead of record maturities

22 Apr 2021

0

0

The Central Bank (CB) plans to raise up to record US $ 750 million in Sri Lanka Development Bonds (Treasury Bonds denominated in US dollars) ahead of the US $ 694 million SLDB maturity scheduled for May 1, this year.

Port City to add US$ 30bn to Sri Lanka’s economic output

21 Apr 2021

0

0

The Colombo Port City (CPC) project is estimated to add a mammoth US$ 30 billion in fresh economic output to Sri Lanka’s gross domestic product through 2041, propelling the country towards the developed country club, according to a study by PricewaterhouseCoopers (PwC). Sri Lanka’s current gross domestic product (GDP) is estimated to be around US$ 84 billion.

Sri Lanka’s tourist arrivals surpass 2 million in 2024

21 Apr 2021

0

0

Auction yields slump for third consecutive week

21 Apr 2021

0

0

Moody’s raises Sri Lanka’s rating

21 Apr 2021

0

0

ASPI crosses the 15,000 mark for the first time

21 Apr 2021

0

0

Fight against mosquito breeding on Global Pandemic Preparedness Day

21 Apr 2021

0

0

Manmohan Singh’s demise a loss for Sri Lanka as well: RW

21 Apr 2021

0

0

NASA declares spacecraft ‘safe’ after record-breaking Sun approach

21 Apr 2021

0

0