Business Main

Trade gap continues to narrow as imports slip; exports languish

12 Mar 2021

0

0

Sri Lanka continues to trim the trade account deficit as merchandise imports slip amid the lid on non-essential imports and weak textiles exports, but a higher fuel bill is likely to make a comeback amid rising global crude prices.

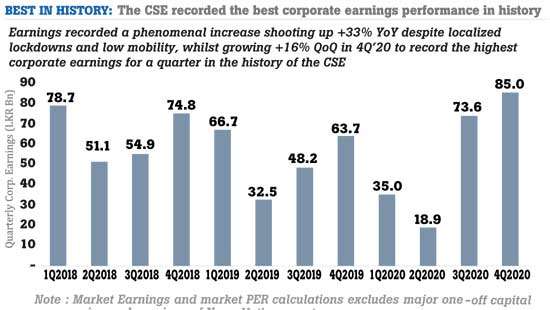

Dec. quarter corporate earnings hit all-time high defying virus scare

11 Mar 2021

0

0

Sri Lanka’s listed entities reported their best-ever earnings in the three months ended in December 2020, defying the pandemic-triggered disruptions and the worst predictions by certain rating agencies and other analysts who painted a gloomy outlook.

People’s Bank reports highest ever balance sheet growth in 2020

10 Mar 2021

0

0

People’s Bank yesterday announced the results for its year ended December 31, 2020 reporting consolidated net loan growth of Rs.315.7 billion, representing 21.6 percent growth year-on-year (YoY), and accounting for close to one third of overall net sector credit extended during the period.

Stock market investors hold “wide-ranging discussion” with Capital Market Minister

08 Mar 2021

0

0

A few high net worth stock market investors met with State Minister of Money & Capital Markets and State Enterprise Reforms, Ajith Nivard Cabraal last week to discuss a sustainable way forward for the country’s capital market, which saw increased investor participation in recent times, largely due to lower interest rates and limited options for other investments.

Norfund to invest up to 9.99% stake in NDB

06 Mar 2021

0

0

Norwegian Development Finance Institution (Norfund), which is owned and funded by the Norwegian government, yesterday entered into an agreement with Sri Lanka’s National Development Bank PLC (NDB) to invest up to a 9.99 percent stake in the bank.

CB pledges to continue with “historically low” interest rates

05 Mar 2021

0

0

While expressing concerns on the recent spike in market interest rates and slowdown in credit disbursements to the private sector combined with inadequate lending to productive sectors, the Central Bank (CB) vowed to continue with the “historically low” interest rate structure until the economy shows signs of sustained revival.

Price and demand for oil could decide rupee’s fate: ICRA Lanka

04 Mar 2021

0

0

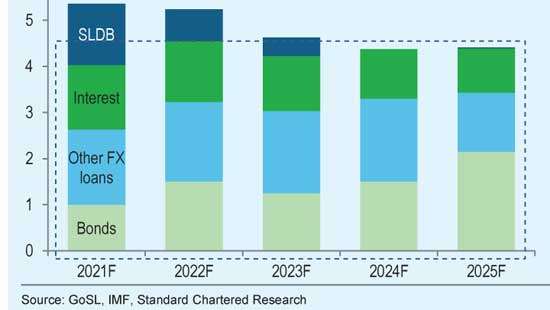

The crude oil prices, which began to nudge ahead to reach pre-pandemic highs in recent weeks and the growing demand for oil due to the improving economic activities, both domestically and globally, could determine where the rupee would be in relation to the US dollar, says ICRA Lanka Limited.

Cabinet go-ahead for WCT as public-private partnership project

03 Mar 2021

0

0

The Cabinet of Ministers granted approval to develop the West Container Terminal (WCT) of Port of Colombo on build, operate and transfer (BOT) basis for a period of 35 years as a public-private partnership (PPP) with India’s largest terminal operator, Adani Ports and Special Economic Zone (APSEZ) Limited, and its local representative John Keells Holding PLC (JKH), with Sri Lanka Ports Authority (SLPA) taking a minority stake in the project.

Private credit expands in Jan. albeit slower compared to Dec.

02 Mar 2021

0

0

Bank credit to the private sector expanded in January, continuing the growth momentum set forth in August, last year, indicating the potential for higher economic growth at the dawn of the new year, after a pandemic-hit 2020. According to the latest Central Bank data, the licensed commercial banks expanded their outstanding private sector credit by 6.9 percent in January, up from 6.5 percent in December and 4.5 percent recorded in January 2020.

Apparel exports get off to gloomy start in January

01 Mar 2021

0

0

Sri Lanka’s apparel exports got off to a gloomy start in 2021 with export earnings recording 11 percent decline in January, which is below the US$ 400 million mark, as constant COVID-19 related disruptions undermined buyers’ confidence concerning timely delivery of export orders, combined with growing competition.

Central Bank Governor suspects link between recent ‘damaging reports’ and UNHRC sessions

26 Feb 2021

0

0

While acknowledging that Sri Lanka will have to undergo a period of austerity under the government’s alternative policy approach to break out from the debt trap, the Central Bank (CB) suspects a possible link between the recently published “damaging reports” on Sri Lanka’s external sector by certain institutions with the events taking place at the UN Human Rights Council (UNHRC) on Sri Lanka in Geneva.

Sri Lanka-Pakistan pledge to deepen bilateral trade relations

25 Feb 2021

0

0

Sri Lanka and Pakistan yesterday affirmed commitment to actively explore and further deepen trade relationships, an effort that would not only benefit the two nations but also help the Indian subcontinent emerge stronger on the world stage.

Exporters criticize ‘lack of dialogue’ over mandatory dollar conversion rule

24 Feb 2021

0

0

Exporters lament the lack of stakeholder consultation when the Central Bank last week abruptly decided to impose fresh regulations on exporters to immediately convert 25 percent of their export proceeds to rupees through licensed banks.

Plantation sector wage hike likely to get delayed

23 Feb 2021

0

0

After failing to meet the quorum at the last meeting of the wages control board for Tea Growing and Manufacturing Trade to consider the objections against the Rs.1,000 proposed daily minimum wage for plantation workers, the Labour Ministry has set a fresh date for the next meeting, vowing to move ahead with the wage hike, despite the industry objections.

Govt. mulls restarting batik dye imports to break monopoly

20 Feb 2021

0

0

In an attempt to bring down the rising prices of local batik products, the government plans to restart importation of dyes required for the county’s batik industry, through state-owned Lanka Salu Sala Limited, amidst the accusations of the sole batik dye importer charging exorbitant prices for dyes in monopolising the trade and incurring additional costs

Govt. keen on foreign funding, not capacity building: Cabraal

19 Feb 2021

0

0

The government yesterday stressed it is less inclined to accept foreign assistance in capacity building for economic development as it has confidence in the capabilities of local experts in tackling challenges and charting the way forward for the country.

Cigarette sales fall in December quarter

18 Feb 2021

1

1

The pandemic-induced intermittent lockdowns put a damper on the financial performance of Sri Lanka’s monopoly cigarette operator Ceylon Tobacco Company PLC (CTC), with the October-December 2020 quarter (4Q20) recording lower cigarette sales.

Colombo Port needs global partners to retain hub status

17 Feb 2021

1

1

Failure to get global shipping industry players onboard as joint venture (JV) partners in operations and development of the Colombo Port could potentially threaten its status as a top transshipment hub in the region, as Chinese-managed Hambantota Port plans to begin handling containerised cargo over the next 5 to 10 year period, according to a shipping industry expert.

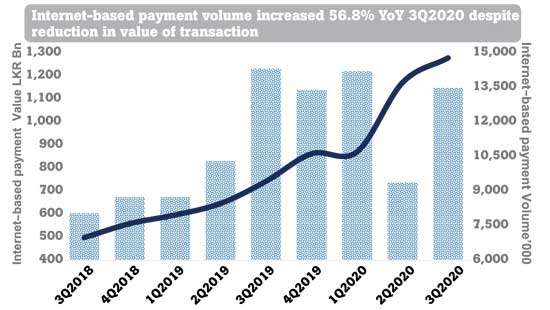

Digitalisation cuts banks’ costs significantly

16 Feb 2021

0

0

The rapid transition of banks and their customers on to digital platforms from the conventional brick-and-mortar banking helped the former the most, as such shift saved billions of rupees in near-term costs alone but questions linger to what extent such cost savings were passed on to the customers.

CB expects marked improvement in economy this year

13 Feb 2021

0

0

While dismissing the ‘doom and gloom predictions’ of international agencies, the Central Bank (CB) expects a marked improvement in Sri Lanka’s macroeconomic fundamentals this year, under the government’s ‘alterative policy’, recovering from the impacts of the pandemic, last year.

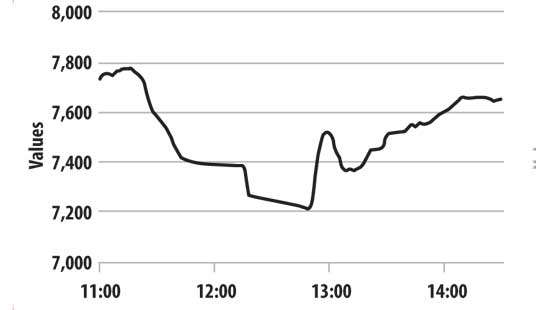

Wild swings at Colombo bourse

12 Feb 2021

0

0

The indices at the Colombo Stock Exchange (CSE) saw some wild fluctuations during intra-day trading yesterday, with negative sentiment creeping in mainly as a result of forced selling, though they closed on a strong note regaining some of the lost ground.

Port City SEZ identified key to positioning SL as top financial hub

11 Feb 2021

0

0

With the COVID-19 pandemic slowing down the global investment flows, the rapid implementation of the special economic zone (SEZ) framework proposed for Colombo Port City (CPC) stands to play a decisive role in placing Sri Lanka as a premier financial services hub, rivalling Dubai to the West and Singapore to the East, in a post-COVID-19 world economy, according a top economist.

CB dismisses possibility of interest rates going up

10 Feb 2021

0

0

Responding to concerns raised by some sections on the potential of interest rates to increase towards the second half of the year, the Central Bank said the consumer prices, which is the often-used gauge to guide interest rates by the Monetary Board, do not signal nor make a case for a reversal in the current monetary policy.

Prime lending rate hits new low despite rate hike expectations

08 Feb 2021

0

0

The prime lending rate or the benchmark rate at which most prime customers of banks get their loan facilities approved— mostly for shorter tenors—touched a fresh low last week despite speculation that the prevailing lower rates environment would end towards the second quarter of this year.

Banks asked to sell 10% of worker remittance income to Central Bank

05 Feb 2021

0

0

The Central Bank has asked licensed banks to sell 10 percent of the worker remittance income that they collect, back to the Central Bank on a daily basis when such remittance income reaches US$ 10 million threshold.

Sri Lanka’s tourist arrivals surpass 2 million in 2024

05 Feb 2021

0

0

Auction yields slump for third consecutive week

05 Feb 2021

0

0

Moody’s raises Sri Lanka’s rating

05 Feb 2021

0

0

ASPI crosses the 15,000 mark for the first time

05 Feb 2021

0

0

BIA braces for special drug busting operations during New Year

05 Feb 2021

0

0

Funeral of Sita Ratwatte today

05 Feb 2021

0

0