Business Main

Prime lending rate hits new low despite rate hike expectations

08 Feb 2021

0

0

The prime lending rate or the benchmark rate at which most prime customers of banks get their loan facilities approved— mostly for shorter tenors—touched a fresh low last week despite speculation that the prevailing lower rates environment would end towards the second quarter of this year.

Banks asked to sell 10% of worker remittance income to Central Bank

05 Feb 2021

0

0

The Central Bank has asked licensed banks to sell 10 percent of the worker remittance income that they collect, back to the Central Bank on a daily basis when such remittance income reaches US$ 10 million threshold.

First Capital paints gloomy outlook for economy

04 Feb 2021

0

0

In what could be the gloomiest forecast issued by an independent research body so far, First Capital Research (FCR) this week said the sharp depreciation of the rupee against the US dollar, followed by a spike in interest rates — beginning from as early as the second quarter of 2021 — could send Sri Lanka’s economy reeling as the country scrambles to find growth.

Market tanks as investor sentiment turns sour

03 Feb 2021

0

0

The Colombo Stock Exchange (CSE), which was on a extraordinary bull run, largely due to prevailing historically low interest rates in the country, tanked yesterday, with investor sentiment going south amid possible indications that the market regulator is becoming anxious over the credit exposure of some brokers on certain identified stocks. The benchmark All Share Price Index (ASPI) yesterday recorded the highest-ever single day slide in the mar

Govt. borrowings up on liquidity injections and loans from banks

02 Feb 2021

0

0

The borrowings by the government from the Central Bank as well as the licensed commercial banks rose again in December, after some slowdown seen in November, following the settling of a US $ 1 billion sovereign bond in October.

BOI, CSE and Ceylon Chamber in major foreign investment push

01 Feb 2021

0

0

To feature eminent line-up of speakers, presenters and panellists including policy makers and business leaders The Board of Investment of Sri Lanka (BOI), Colombo Stock Exchange (CSE) and Ceylon Chamber of Commerce (CCC) are set to organise a first-of-its-kind virtual investment forum to collectively promote direct and equity investment opportunities in Sri Lanka on 6th 7th and 8th April 2021.

RPCs, trade unions issued one-week ultimatum to reach wage deal

27 Jan 2021

0

0

After securing the Cabinet nod to increase the daily minimum wage of plantation workers up to Rs.1000 under the provisions of the Wages Board Ordinance, Labour Minister Nimal Siripala de Silva has issued one-week ultimatum to Regional Plantation Companies (RPCs) and plantation sector trade unions to reach a consensus to implement the proposed wage hike through the collective bargaining process.

Budget deficit hits Rs.1.3tn as revenues languish

25 Jan 2021

0

0

Sri Lanka’s fiscal deficit for the first 10 months of 2020 expanded by nearly Rs.488 billion from the same period in 2019 as revenues, mainly coming from taxes declined. According to the latest fiscal data available from January through October, the government recorded a budget deficit of Rs.1, 317.2 billion compared to Rs.829.3 billion in the same period in 2019.

Market bull run continues; ASPI sets new all-time high

23 Jan 2021

0

0

Turnover tops Rs.12.8bn amid highest number of trades carried out in a single day The Colombo Stock Exchange’s (CSE) phenomenal ascent continued yesterday also, renewing records set just the previous day and market turnover hitting double-digits.

Stocks hit new all-time high; ASPI crosses 8,000-point mark

22 Jan 2021

0

0

Sri Lanka’s stocks yesterday hit fresh highs with benchmark All Share Price Index (ASPI) crossing the 8,000-point mark for first time in Colombo Stock Exchange’s (CSE) 35-year history amid more than dozen Hayleys group companies announcing share splits.

Merchandise exports flirt with US $ 10bn surpassing target

21 Jan 2021

0

0

Sri Lanka has recorded an income of US $ 9.9 billion from merchandise exports in 2020, surpassing the US $ 9.5 billion new target set in the middle of the year, after the pandemic crippled trade flows, forcing the authorities to revise down the US $ 13.5 billion target set at the beginning of the year.

Dovish Central Bank introduces small biz lending targets

20 Jan 2021

0

0

While deciding to keep policy rates unchanged at the maiden policy meeting held for this year on Monday, the Monetary Board of the Central Bank yesterday announced the introduction of lending targets for small business to accelerate the money flow into the productive economy.

Plantation sector wage deal hits deadlock

18 Jan 2021

0

0

With the latest attempt to reach a consensus between Regional Planation Companies (RPCs) and trade unions on a wage structure to grant Rs.1, 000 minimum daily wage to plantation workers bearing no fruit, Labour Minister Nimal Siripala de Silva is looking forward to seek the approval of the Cabinet of Ministers this week to grant the proposed wage increase under the provisions of the Wages Board Ordinance.

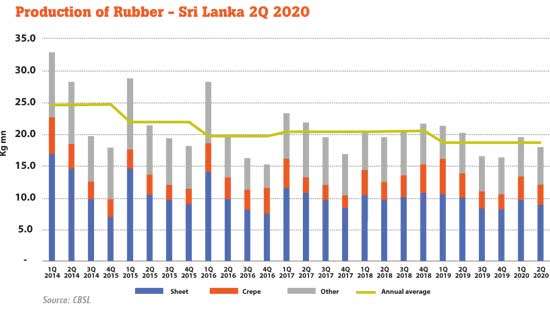

Poor show of rubber plantations set to jeopardise entire sector

13 Jan 2021

0

0

The continuing poor performance of rubber plantations could pull down the entire industry in the near future, including the manufacturers who are making steady progress, unless new strategies are conceptualised, a senior industry representative said.

LanwaSanstha to commission US $ 75mn cement plant this May

12 Jan 2021

0

0

LanwaSanstha Cement Corporation Limited expects to commission the operations of its US $ 75 million state-of-the-art cement manufacturing cement plant in May this year, adding three million metric tonnes (MT) to Sri Lanka’s cement output.

Cabinet decision sought to overcome plantation sector wage stalemate

11 Jan 2021

0

0

Amid continuous opposition from the Regional Plantation Companies (RPCs) to implement the proposed Rs.1, 000 daily wage for plantation workers, Labour Minister Nimal Siripala de Silva is expected to present a proposal to the Cabinet of Ministers today compelling the RPCs to grant the wage increase.

Indian Foreign Minister interacts with captains of local biz and industry

09 Jan 2021

0

0

Indian External Affairs Minister Dr. S. Jaishankar on Thursday interacted with the captains of Sri Lankan business and industry that represented prominent business conglomerates and manufacturing entities in the country.

Fresh health guidelines issued to resume tourism

08 Jan 2021

0

0

The local tourism sector was issued with a fresh set of health guidelines this week to accommodate international travellers in the coming months with the anticipated opening up of the country’s airports for tourism by end of this month.

Tea output projected to recover this year

07 Jan 2021

0

0

Sri Lanka’s tea output is projected to recover this year, following an estimated 10 percent or 30 M/Kgs year-on-year (YoY) decline in the output in 2020, mainly due to the adverse weather conditions prevailed in the country, according to Forbes & Walker Tea Brokers.

World Bank forecasts 3.3% economic growth for Sri Lanka this year

06 Jan 2021

0

0

The World Bank projects Sri Lanka’s economy to grow at the modest rate of 3.3 percent this year before decelerating to 2 percent in 2022, the global lender said in its January 2021 Global Economic Prospects report released this week.

Central Bank sees need for continuous interventions to support economy

05 Jan 2021

0

0

With Sri Lanka’s economy estimated to have recorded a contraction in 2020, the country’s Central Bank (CB) yesterday assured continuous monetary and fiscal interventions to support the economy to regain its “lost momentum” to the COVID-19 pandemic and to return to the envisaged high growth path.

Business community welcomes New Year with positive sentiments

05 Jan 2021

0

0

New Year New Challenges New Opportunities

05 Jan 2021

0

0

Emirates launches additional flight to CMB-DXB route

05 Jan 2021

0

0

CCC sets record straight on media statements relating to CBSL policies

05 Jan 2021

0

0

Sri Lanka’s tourist arrivals surpass 2 million in 2024

05 Jan 2021

0

0

Mother of Altair victim to sue CIS for alleged negligence

05 Jan 2021

0

0

Chief of National Intelligence Kulatunga retires

05 Jan 2021

0

0

Asoka Ranwala’s ‘Dr’ post takes a ridiculous turn

05 Jan 2021

0

0