Business Main

Capital market told to step out of comfort zone and think big

18 Sep 2020

0

0

The government yesterday did not mince its words to clearly lay out what is expected from the country’s capital market as the stakeholders were told to venture out from their comfort zones and work judiciously towards the development and expansion of the market.

Govt. says import restrictions imposed to honour debt repayments will pay off in long-term

17 Sep 2020

0

0

The government expects the “tough” decision to honour the country’s external debt servicing commitments imposing import restrictions, which has come at the expense of living standards of the people amid a shortfall in foreign inflows due to the COVID pandemic, would be recognised by the international community including international markets.

Palihapitiya in US$ 4.8bn SPAC deal to take SoftBank-backed Opendoor public

16 Sep 2020

0

0

SoftBank-backed home-selling platform Opendoor is going public through a merger with a blank-check company led by venture investor Chamath Palihapitiya in a deal that will value the combined entity at US$ 4.8 billion, the companies said yesterday.

CB takes LANKAQR countrywide

15 Sep 2020

0

0

The Central Bank, together with financial institutions and LANKAQR, last weekend launched the Ratapuraama LANKAQR public awareness campaign in Matale, under the theme of ‘Mataleta LANKAQR’ (Taking LANKAQR to Matale). The chief guest of this inaugural ceremony was Deshamanya CB Governor Prof. W.D. Lakshman.

Enterprise Development Advisory Board established to support local industries

14 Sep 2020

0

0

State Minister of Money, Capital Markets and State Enterprises Reforms Ajith Nivard Cabraal has appointed an Enterprise Development Advisory Board to make local industries competitive in the international market while protecting and empowering them.

WB supports Sri Lanka with US$56mn to lessen COVID-19 impacts

12 Sep 2020

0

0

The World Bank has reallocated US$ 56 million from ongoing projects in Sri Lanka to protect the most vulnerable in the agriculture sector, improve COVID-19 protection measures on public transport, facilitate tele-education for school children, and provide digital solutions to improve delivery of public services. This new financing complements the US$ 128.6 million Sri Lanka COVID-19 Emergency Response and Health System Preparedness Project, whic

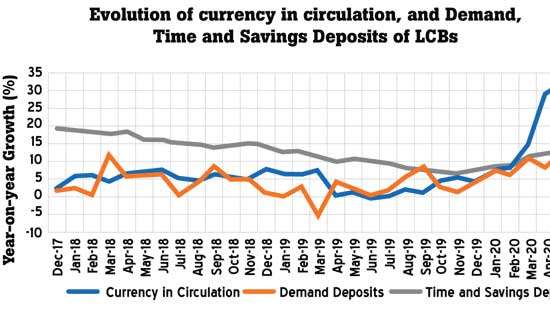

Lankans return to savings in record pace during pandemic

11 Sep 2020

0

0

Sri Lankans have returned to save more during and in the immediate aftermath of the pandemic-induced lockdowns as they appeared to have become little more frugal in spending habits, restrained by the limited mobility and social distancing practiced to contain the virus spread.

FMCG players call for reasonable time frame to comply with sachet ban

08 Sep 2020

1

1

The fast-moving consumer goods (FMCG) manufacturers in the country at the outset have endorsed the government’s decision to ban single-use sachets, an effort towards conserving the environment but stressed the need for an all-inclusive approach, one that would allow a seamless transition to alternatives.

Yala paddy harvesting season

07 Sep 2020

0

0

With Yala paddy harvesting season slowly coming to an end, paddy farmers in Padaviya are seen drying their paddy harvest on the road. Based on the cultivated extent of paddy lands as at end-May, the Agriculture Department has said Yala harvest is expected to yield 1.72 million metric tonnes of paddy, a 13 percent increase over the 2019 Yala yield.

Breakfast Meeting with State Minister

05 Sep 2020

0

0

Sri Lanka - Germany Business Council of the Ceylon Chamber of Commerce organised a Breakfast Meeting at Kingsbury hotel yesterday with State Minister Ajith Nivard Cabraal for its members to obtain an overview of the financial and economic policies of the government.

Cabraal wants “out of the box” thinking to develop capital market

04 Sep 2020

2

2

State Minister of Finance, Capital Market Development and Public Enterprise Reforms Ajith Nivard Cabraal yesterday told Sri Lanka’s capital market officials to think “out of the box” to develop the island nation’s capital market.

Chinese builder says US blacklisting has no impact on Port City

03 Sep 2020

1

1

Colombo Port City builder, China Harbour Engineering Company (CHEC), yesterday affirmed that Sri Lanka’s upcoming mega project would not be hindered by the United States (US) blacklisting 24 Chinese state-owned companies, including the ultimate parent of CHEC.

Govt. firm on import controls on certain food items

02 Sep 2020

1

1

It is unlikely that Sri Lanka would roll back some of the controls in place on the import of food items even though their prices have risen in recent times such as in the case of turmeric as the government appears to remain firm on re-building the rural economy and durable growth.

EDB and DCS collaborate to capture logistics sector data

28 Aug 2020

0

0

In an effort to capture accurate and timely logistics industry data, the Export Development Board (EDB) and Department of Census and Statistics (DCS) have collaborated to set up a special data unit that will gather and analyse sector data.

SL to embark on R&D related to modern agriculture

27 Aug 2020

0

0

Sri Lanka will soon embark on research and development (R&D) related to modern agricultural technologies with state patronage, as the focus is rapidly shifting towards building a robust domestic agricultural economy premised on achieving food security and exports of agricultural produce.

CB forecasts 15% decline in worker remittances for 2020

24 Aug 2020

1

1

The Central Bank for the first time gave its forecast last week for the estimated decline in worker remittances expected in 2020 after the coronavirus related lockdowns around the world dampened the prospects for overseas jobs and such incomes.

CB steps up efforts to address grievances of financial consumers

22 Aug 2020

0

0

Stakeholders of the national financial system will witness their grievances receive due emphasis hereafter as the Central Bank of Sri Lanka (CBSL) has taken a progressive step towards establishing a single point of contact to handle complaints.

Sharp 4Q rebound essential to avert economic contraction: CB

21 Aug 2020

0

0

The Central Bank (CB) says a substantial rebound in economic activity in the fourth quarter is essential for Sri Lanka to avert an economic contraction this year following the “unexpected” contraction in the economy in the first quarter.

July vehicle registrations strong, but momentum unlikely to continue

20 Aug 2020

0

0

Vehicle registrations in the month of July remained strong, even though lower from June, driven by existing inventories but the momentum could slow in August due to potential stockouts in certain vehicle categories as the government has put a lid on vehicle imports.

Kotagala recognised for following COVID health guidelines

19 Aug 2020

0

0

Sri Lanka’s Kotagala Plantations PLC has become the first tea manufacturer in the world to produce tea strictly following COVID-19 health guidelines issued by the World Health Organisation. The Mount Vernon Factory in Hatton, belonging to Kotagala Plantations, this week received the certification in this regard from Sri Lanka Standards Institute.

Lower costs and export biz help Hayleys navigate COVID-19 storm in 1Q

17 Aug 2020

0

0

Diversified conglomerate and export major Hayleys PLC recorded higher operating profits for the quarter ended June 30, 2020 (1Q21) as the group managed to reduce its overheads while its export-oriented business performed strongly.

Aitken Spence 1Q performance clouded by tourism sector woes

14 Aug 2020

0

0

Diversified conglomerate, Aitken Spence PLC, which has extensive interests in travel and hospitality business, saw its June quarter (1Q21) revenues and profits eroded by the economic malaise created by the COVID-19 pandemic, though the group said it saw a strong pick up in business in the month of June, barring tourism.

Business community welcomes New Year with positive sentiments

14 Aug 2020

0

0

New Year New Challenges New Opportunities

14 Aug 2020

0

0

Emirates launches additional flight to CMB-DXB route

14 Aug 2020

0

0

CCC sets record straight on media statements relating to CBSL policies

14 Aug 2020

0

0

Sri Lanka’s tourist arrivals surpass 2 million in 2024

14 Aug 2020

0

0

Govt. aims to attract high-end tourists: Vijitha Herath

14 Aug 2020

0

0

Saman Devalaya on strike over political appointment

14 Aug 2020

0

0

Should public be worried about virus spreading in China?

14 Aug 2020

0

0

Rice shortage creeps into schools

14 Aug 2020

0

0