Business Main

Reclassification of ComBank shares lifts DFCC Bank June earnings

13 Aug 2020

0

0

Reclassification of investments in the shares of Commercial Bank, from the earnings to comprehensive income, helped DFCC Bank PLC to lift its June quarter earnings but the impact from narrowing margins, loss of cash flows from moratoria, heavy provisions against possible loan defaults and overall muted business volumes, weighed on the company’s core banking performance.

Sri Lanka’s Rs.100mn Angel Fund accepts applications from startups

12 Aug 2020

0

0

The Angel Fund, an initiative of the Lankan Angel Network (LAN), established with the support of ecosystem development partner Ford Foundation, has begun accepting applications from early-stage startups in Sri Lanka with regional and global growth potential which are not limited to the tech industry.

China exports see unexpected spike in July

08 Aug 2020

0

0

China saw another surprise jump in exports last month as the global economy slowly reopened after virus lockdowns, data showed yesterday, but there were warnings that while the country is expected to get back on track by year’s end overseas shipments would likely struggle.

Sri Lanka’s national milk output tumbles in 2019

07 Aug 2020

0

0

Sri Lanka’s national milk output tumbled in 2019 amid an outbreak of foot and mouth disease in certain parts of the country and closure of several large-scale farms operating with imported cows, leading to an increase in cost of production and lower profit margins for farmers with no improvement in quality.

Central Bank liquidity facility extended to pharmaceutical suppliers

06 Aug 2020

0

0

The Central Bank (CB) has decided to expand its liquidity facility for the construction sector to include the government contractors and suppliers in the pharmaceutical sector, to let them borrow at concessionary rates against the unsettled bills from the government.

Pro-rate wages pact likely to be further extended: EFC

31 Jul 2020

0

0

The tripartite agreement applicable to all industries that was extended till September is likely to be further extended as private sector businesses that were dealt a crippling blow by the pandemic have appealed for further assistance in dealing with their workforce.

JKH 1Q succumbs to pandemic-related biz disruptions

30 Jul 2020

0

0

John Keells Holdings PLC (JKH) succumbed to the pandemic-induced business disruptions during the April-June 2020 quarter (1Q21), as the lockdowns, which remained for half of the quarter, erased nearly a third of its revenues, plunging the group deep into red.

Slowdown in worker remittances puts dampener on growth: Moody’s

29 Jul 2020

0

0

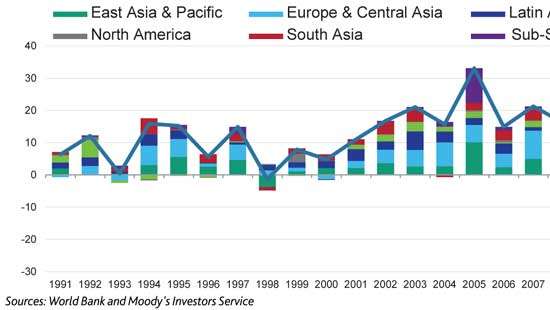

The slowdown in worker remittances resulted from the pandemic could weigh on economic growth of countries heavily dependent on the foreign income flow as it could cut into the incomes, consumption and thereby the investments of recipient economies raising their credit risk, cautioned Moody’s Investors Service.

Decline in private sector credit decelerates in June

27 Jul 2020

0

0

The decline in the private sector credit in June decelerated from May indicating that the banking sector is ramping up fresh credit to the private sector under both the Central Bank’s refinance credit scheme and from their own funds.

Turmeric sold at exorbitant prices due to massive shortage

24 Jul 2020

0

0

Sri Lanka is currently facing a massive shortage in turmeric in the country leading traders to sell the processed spice via informal channels at prices that are over five fold higher than the government imposed maximum retail price (MRP).

Fitch-rated firms here estimated to lose Rs.30bn in revenue to pandemic

22 Jul 2020

0

0

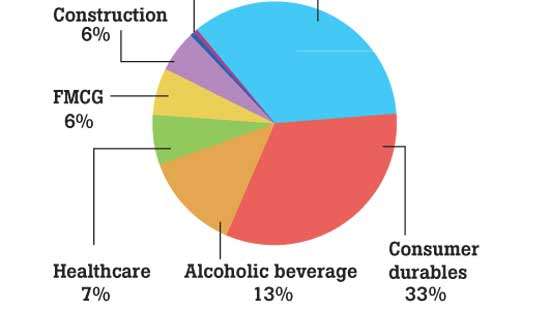

Fitch Ratings has estimated that the Sri Lankan corporates rated by it could lose up to 7 percent or Rs.30 billion in revenues during the financial year ending in March 2021 from a year earlier, with the COVID-19 pandemic taking a toll on industries and businesses leaving only a few unscathed, before staging a recovery in the following year.

Lankan banks’ operating environment deteriorates

21 Jul 2020

0

0

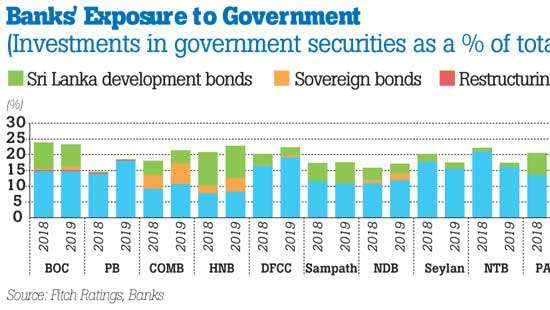

Fitch Ratings Lanka yesterday reminded that the operating conditions for the banking sector have weakened, exerting further pressure on banks’ ratings, after the rating agency downgraded the country rating in April, citing heightened public and external debt sustainability challenges caused by the pandemic-induced economic difficulties and the tax cuts late last year.

Merchandise exports rebound in June as exporters rise up to occasion

20 Jul 2020

0

0

Sri Lanka’s merchandise exports recovered strongly in June, staging what looks like a V-shaped recovery in most of the sectors, as the country’s exporter community responded to the call to ramp up their contribution to support the economy and employment.

China’s 2Q GDP grows 3.2%, beats expectations

17 Jul 2020

0

0

China’s economy returned to growth in the second quarter after a deep slump at the start of the year, but unexpected weakness in domestic consumption underscored the need for more policy support to bolster the recovery after the shock of the coronavirus crisis.

Right balance between credit growth and system stability urged

15 Jul 2020

0

0

The extremely dovish monetary policy and liquidity injections into the system may be required to resuscitate the pandemic-hit economy, but that should not undermine the strength and stability of the financial institutions as excessive credit could increase credit risks of the system, specially at a time when certain rules on capital, liquidity and supervisory requirements are relaxed, according to ICRA Lanka.

Funding sources broadened, loans offered to lure more forex into Special Deposit Account

14 Jul 2020

0

0

Sri Lanka broadened the funding sources that can be collected into the Special Deposit Account (SDA) and made possible cash-backed loans against such deposits, in a further attempt to lure foreign currency deposits, as the Monetary Board and government work together to bolster the country’s foreign currency reserves.

SL Police gets Rs.340mn Japanese grant to reinforce anti-narcotic activities

14 Jul 2020

0

0

Based on a request by the Government of Sri Lanka (GoSL), the Government of Japan has agreed to provide a Japanese yen 200 million (approx. Rs.340 million) grant, under the Japanese non-project grant aid scheme, for provision of the necessary equipment to strengthen the investigation and detection capacities of drugs and related anti-narcotic activities of Sri Lanka Police.

Local value addition industries not denied of imports, says CB

13 Jul 2020

0

0

It is inaccurate to say that import controls have hamstrung the local manufacturers and will impinge economic growth, as those who are engaged in domestic value addition industries can continue to import the required inputs, while essential industries such as agriculture and pharmaceuticals among others have also been freed from any restrictions, the Central Bank (CB) said.

CB approves Rs.60bn in loans for COVID-hit biz

11 Jul 2020

0

0

The Central Bank of Sri Lanka (CBSL) had approved 22,306 loans amounting to Rs. 60, 250 million under the Saubagya COVID-19 renaissance facility as of yesterday with approval given for 2,066 new loans, amounting to Rs. 6,978 million during the week ended July 10, 2020.

CB expects economy to rebound in second half

10 Jul 2020

0

0

The Central Bank (CB) anticipates a strong economic rebound in the second half of this year from the expected contraction in the second quarter due to COVID-19 related lockdown, although the growth projection of 1.5 percent could be subject to revisions in future.

Committee makes proposals to address irregularities in finance and leasing businesses

09 Jul 2020

0

0

In view of the recent developments in the finance leasing business, Central Bank Governor Prof. W.D. Lakshman appointed a three-member committee to examine and report on the irregularities and illegal activities of the finance and finance leasing businesses and to make recommendations to curtail such activities.

Business community welcomes New Year with positive sentiments

09 Jul 2020

0

0

New Year New Challenges New Opportunities

09 Jul 2020

0

0

Emirates launches additional flight to CMB-DXB route

09 Jul 2020

0

0

CCC sets record straight on media statements relating to CBSL policies

09 Jul 2020

0

0

Sri Lanka’s tourist arrivals surpass 2 million in 2024

09 Jul 2020

0

0

Govt. aims to attract high-end tourists: Vijitha Herath

09 Jul 2020

0

0

Saman Devalaya on strike over political appointment

09 Jul 2020

0

0

Should public be worried about virus spreading in China?

09 Jul 2020

0

0

Rice shortage creeps into schools

09 Jul 2020

0

0