Business Main

SL’s financial market woes defy Colombo Dockyard growth targets

05 Jun 2024

0

0

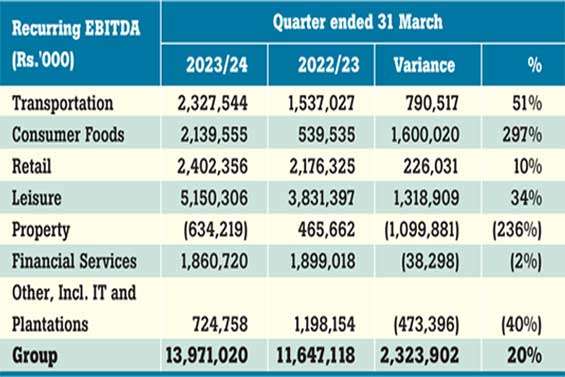

The global market demand for ship building and ship repairs looks promising in the near future. However, financial market problems in Sri Lanka will continue to pose a challenge to the growth targets of Colombo Dockyard PLC.

Exports continue to do well in April narrowing trade deficit

03 Jun 2024

3

3

The growth in merchandise exports outstripped the growth in imports to help narrow the trade deficit in April compared to a year ago levels, but the cumulative four months deficit stands higher compared to the corresponding period of last year signalling an expanding economy.

CSE sees growing trend among listed entities adopting ESG standards

31 May 2024

0

0

Having nearly one third of listed entities adopting Environmental, Social and Governance (ESG) principles in their business models and reporting, the Colombo Stock Exchange (CSE) Chief acknowledges a growing interest among listed entities to adopt ESG principles.

Central Bank hopeful of faster recovery in credit to private sector

30 May 2024

2

2

Although the private sector credit growth hasn’t so far picked up to the desired levels, the Central Bank said it is hopeful that the pace of growth would improve along with the recovery in the economy as well as the easing of credit conditions, alongside the easing of interest rates.

Industry fears wage hike impact on Ceylon Tea brand

28 May 2024

14

14

The tea industry veterans warned that the Ceylon Tea brand would face irreparable damage in international markets, leading to both decline in auction prices and global market share, if the government forced the plantation companies, including the smallholder sector, to implement the unprecedented 70 percent minimum wage hike arbitrarily.

CB launches SL’s first-ever Financial Literacy Roadmap

23 May 2024

7

7

The Central Bank on Tuesday launched Sri Lanka’s first-ever Financial Literacy Roadmap (2024-2028), in particular targeting to promote financial literacy among the youth and women in the micro, small and medium enterprise (MSME) sectors.

State coffers lose billions as Customs officers enjoy unfair benefits

21 May 2024

15

15

The state coffers have been deprived of billions of rupees, as Sri Lanka Customs (SLC) officers enjoy unfair benefits in penalties related to customs offenses and overtime pay, a special audit carried out by the Auditor General on the management/administration of various funds in SLC revealed.

Govt. revenue in January surge 62% on economic turnaround, higher taxes

20 May 2024

7

7

The revenue to the government, including the grants, rose by a staggering 61.8 percent in January 2024. This is a result of the government raking in billions of rupees out of people’s pockets to appease the International Monetary Fund’s revenue targets.

SL’s digital transformation lags behind despite online transaction surge: Industry

17 May 2024

0

0

Despite the significant surge in adoption of digital payment in 2023, Sri Lanka is yet to reach inflection point in digital transformation as the economy still remains largely a cash-based, industry stakeholders said. In 2023, the number of dig

FX Global Code to be rolled out by end 2024

15 May 2024

2

2

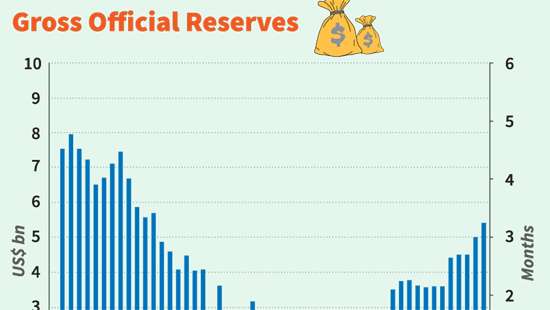

In line with the objectives to foster a deeper and more liquid foreign exchange market and develop adequate systems for managing exchange rate risks, the Central Bank (CB) plans to implement the FX Global Code (FXGC) in the domestic forex market by the end of this year.

Digitised maritime trade adoption Logistics sector concerned about delaying tactics

10 May 2024

0

0

The logistics sector has raised concerns over delaying tactics, as that could hinder the full adoption of the ASYCUDA World and ASYHU8S System. These systems aim to transition from cumbersome, paper-based processes to streamlin

VFS gears up to promote Sri Lanka amid visa woes

07 May 2024

18

18

VFS Global, which is currently facing a backlash, vows to boost Sri Lanka’s global image through a robust marketing plan with Sri Lanka Tourism. However, the details remain under wraps from the tourism authorities, Mirror Business learns.

Planters’ Association slams daily wage increase announcement

03 May 2024

21

21

The Planters’ Association (PA) of Ceylon representing Regional Plantation Companies (RPC) is moving ahead to object to the Rs.1700 daily wage increase proposed for plantation workers, while asserting that a final decision is yet to be reached on the matter.

March exports reflect continued heft despite strengthening rupee

02 May 2024

3

3

The growth in exports in March outstripped the increase in the expenditure for merchandise imports for the same month, as the exports of textiles and garments showed strength once again, after losing a bit of steam in the recent months.

Tourism Minister to fix new visa system issues by May 7

01 May 2024

24

24

Tourism Minister Harin Fernando has pledged to address technical issues of the new visa system by May 7. This comes amid concerns of potential losses of 230,000 tourist arrivals and US$ 425 million in tourism earnings for the year.

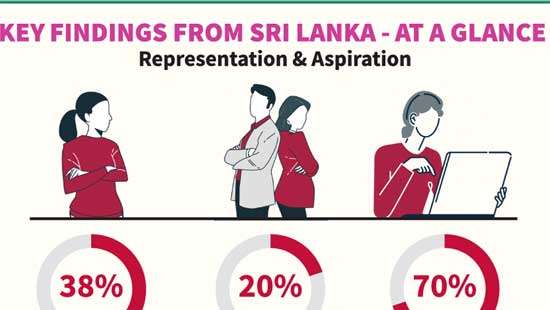

Sri Lankans rich in financial knowledge but poor in practice: CB

30 Apr 2024

13

13

The financial knowledge of Sri Lankans is at satisfactory levels when compared with the other countries but the island nation is lagging behind financial behaviour, the financial sector regulator, the Central Bank said.

CB optimistic of stability amidst ongoing economic reforms

29 Apr 2024

6

6

The Central Bank of Sri Lanka sounded optimistic about Sri Lanka witnessing stability on multiple fronts, provided that the ongoing ambitious reforms and economic adjustments underpinned by the Extended Fund Facility (EFF) programme of the International Monetary Fund (IMF) continue without any interruptions.

SL exits ’Restricted Default’ rating

29 Apr 2024

6

6

SriLankan airlines hosts agents’ tour to Gan island

29 Apr 2024

6

6

First Capital crowned as Brand of the Year at SLIM Brand Excellence 2024

29 Apr 2024

6

6

Bitcoin surges past $100k for first time

29 Apr 2024

6

6

USAID, CBL group to boost SL’s coconut industry

29 Apr 2024

6

6

crisis spirals, Govt. extends deadline for imports till January 10

29 Apr 2024

6

6

Suspect dies after collapsing in Chilaw Police custody

29 Apr 2024

6

6

Dayasiri defends use of President’s Fund, rejects misuse allegations

29 Apr 2024

6

6