Business Main

Government delays decision on future of oil palm cultivation

27 Apr 2024

16

16

The government has been sitting on an expert committee report on how to permit oil palm cultivation in identified Mahaweli areas and other areas, without deciding for nearly five months. According to the Agriculture and Plantation Industries Ministry, the ministry forwarded the report to the secretary to the Cabinet of Ministers on January 12. In November 2022, the Cabinet of Ministers decided to appoint an expert committee to explore the possibi

Colombo skyline redefined with India's ITC Ratnadipa

26 Apr 2024

0

0

As a testament to Sri Lanka’s comeback in tourism and returning investor confidence, India’s luxury hotel giant yesterday launched its first ever international venture, US$ 500 million investment ITC Ratnadipa in the iconic Colombo

CB releases its inaugural Annual Economic Review for 2023

26 Apr 2024

0

0

Central Bank Governor Dr. P Nandalal Weerasinghe yesterday presented its Annual Economic Review 2023 and Financial Statements and Operations to President Ranil Wickremesinghe, who’s also the Minister of Finance, Economic Stabilisation and National Policies.

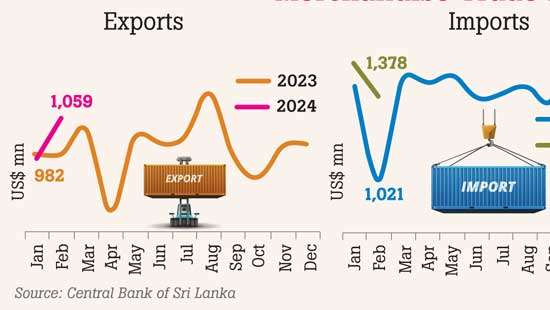

Improved interest in SL as brands rethink strategies: JAAF

25 Apr 2024

0

0

Sri Lanka’s apparel sector is witnessing a resurgence of interest, as brands reassess their purchasing strategies and are on the lookout for safe and secure homes to place their orders. The Joint Apparel Association Forum (JAAF) shared that the apparel manufacturers have had several high-profile visits from brands, as buyers are returning to the country to meet with the suppliers and to work on long-range plans with their suppliers. “This augurs

Loosening fiscal squeeze could derail IMF programme commitments: Economist

24 Apr 2024

6

6

A top economist yesterday raised concerns over the “loosening of fiscal squeeze” by authorities to stimulate economic growth. Since doing so could lead to potential risks of jeopardising Sri Lanka’s agreements with the International Monetary Fund (IMF).

IMF gives thumbs up for SL’s progress but cautions road ahead still difficult

20 Apr 2024

0

0

The International Monetary Fund (IMF) this week commended Sri Lanka for going forward and being successful to a great extent to implement the “ambitious” programme; however, it cautioned that the road ahead is till bumpy. IMF Director Asia and Pacific Department Krishna Srinivasan asserted that the programme is bearing fruit. When Sri Lanka embarked on this adjustment programme, it had its back to the wall but now signs of early recovery are see

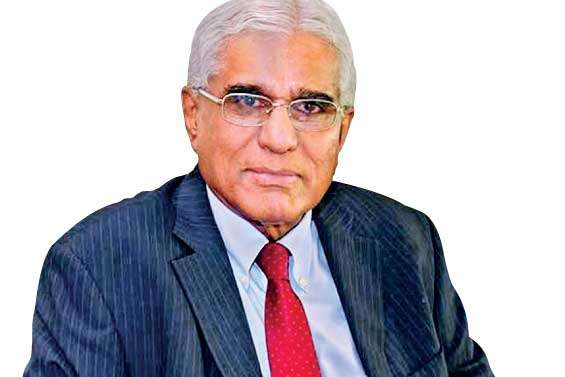

Bondholders’ agreement delay won’t hinder IMF third tranche payout: Dr. Coomaraswamy

19 Apr 2024

7

7

Possible delays in reaching an agreement (in principle) with private bondholders is unlikely to impact the disbursement of the third tranche under IMF’s US$ 3billion bailout package, given negotiations are moving ahead in good faith, Former Governor of Central Bank (CB) and renowned economist, Dr. Indrajit Coomaraswamy said.

Tensions in Gulf could hurt Ceylon Tea cuppa: Industry

18 Apr 2024

1

1

The mounting tensions in the Middle East that are becoming increasingly unpredictable are likely to impact the Ceylon Tea cuppa, the industry stakeholders said, especially since over 50 percent of the island nation’s tea is exported to that region.

Global expansion of single-origin Sri Lankan chocolate a major struggle: Mendis

16 Apr 2024

12

12

Sri Lanka’s celebrity chocolatier, chef and agriculture enthusiast Gerard Mendis faces an uphill battle in his bid to take single-origin Sri Lankan chocolates global. This is primarily due to the shortage of cocoa beans and absence of active cooperation of authorities.

UK’s revised travel advisory boosts confidence in Sri Lankan tourism

08 Apr 2024

7

7

Sri Lanka’s tourism sector is expecting a multiplier effect across all key source markets following United Kingdom’s recent update on the travel advisory for Sri Lanka, which will immediately result in a significant boost in tourist arrivals in the upcoming summer season.

SOE reforms must move ahead without disruptions: Shah

05 Apr 2024

3

3

It is essential for the reforms planned for the government owned entities to go ahead without further disruptions, else it is the general public that will continue to take on the burden, State Owned Enterprises Restructuring Unit (SOERU) Head Suresh Shah said.

ADB urges SL to adopt realistic expectations for reform efforts

04 Apr 2024

0

0

The Asian Development Bank (ADB) yesterday pledged its support to help Sri Lanka steer through the ongoing reform process; however, it noted that there needs to be “realistic expectations”. Acknowledging that Sri Lanka is at the initial stages of implementing challenging reforms within a tight time-frame, the ADB emphasised the need for a more sustainable approach to their implementation. “There needs to be a realistic expect

World Bank stresses need for sustained reform implementation

03 Apr 2024

7

7

As Sri Lanka is looking to leave behind the effects of the crisis and move towards development, sustained reform implementation is essential for Sri Lanka to have a stronger and more resilient economy, the World Bank said yesterday.

Jan. credit dip linked to strong rupee, post-festive settlements

28 Mar 2024

2

2

The Central Bank has been caught off guard by the break in the months-long expansion seen in the private sector credit in January and considered it to be a one-off development and attributed it to the appreciation of the rupee and after-season settlement of facilities by the borrowers.

SL currently on a knife- edge path, cautions IMF

23 Mar 2024

0

0

While Sri Lanka is gearing up for elections this year, which could result in uncertainties, the International Monetary Fund (IMF) cautioned that it is absolutely key that the programme objectives are achieved, because with those, Sri Lanka has a chance of emerging from the crisis. “The path is a knife-edge path. We have to remember that. So, yes, we acknowledge in our press report the green shoots that we see for the economy and that’s the beginn

Political will crucial to central bank digital currency

21 Mar 2024

0

0

The senior representatives of the financial sector yesterday raised significant concerns about the government’s commitment to enacting the necessary legislation for the introduction of a central bank digital currency (CBDC) in Sri Lanka.

SL exits ’Restricted Default’ rating

21 Mar 2024

0

0

SriLankan airlines hosts agents’ tour to Gan island

21 Mar 2024

0

0

First Capital crowned as Brand of the Year at SLIM Brand Excellence 2024

21 Mar 2024

0

0

Bitcoin surges past $100k for first time

21 Mar 2024

0

0

USAID, CBL group to boost SL’s coconut industry

21 Mar 2024

0

0

crisis spirals, Govt. extends deadline for imports till January 10

21 Mar 2024

0

0

Suspect dies after collapsing in Chilaw Police custody

21 Mar 2024

0

0

Dayasiri defends use of President’s Fund, rejects misuse allegations

21 Mar 2024

0

0