Business Main

Political will crucial to central bank digital currency

21 Mar 2024

0

0

The senior representatives of the financial sector yesterday raised significant concerns about the government’s commitment to enacting the necessary legislation for the introduction of a central bank digital currency (CBDC) in Sri Lanka.

Economy surges in 4Q23, narrowing full year contraction to 2.3%

18 Mar 2024

0

0

Sri Lanka’s economy surged in the fourth quarter, marking a swift recovery from the prolonged recession that began 18 months ago. The growth rate exceeded expectations, outpacing third quarter’s performance. Sri Lanka’s full-year contraction narrowed to 2.3 percent, a significant improvement from the steeper 7.3 percent contraction recorded in 2022. According to the Census and Statistics Department which released the national accounts data for t

Selyn Foundation advances fight against period poverty in SL

16 Mar 2024

0

0

Sri Lanka this week took a progressive step towards tackling period poverty, with the Selyn Foundation stepping up efforts to redefine access to menstrual hygiene and support for women across Sri Lanka. The Selyn Foundation this week unveiled its flagship #BleedGood initiative, which marked a pivotal moment in the fight against period poverty while championing sexual and reproductive health rights. #BleedGood encompasses an ecosystem of collecti

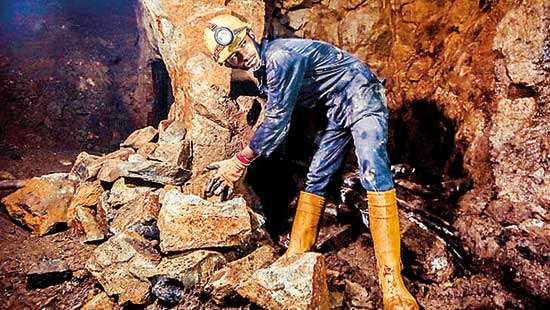

Sri Lanka poised to benefit from demand surge for ‘non-China origin’ graphite

13 Mar 2024

2

2

Sri Lanka, renowned for its high-quality vein graphite, is poised to benefit from the increasing demand for “non-China origin” graphite driven by the global push towards electromobility and the US Green....

Foreign reserves expand reaching US$ 4.5bn in February

11 Mar 2024

7

7

In February, official foreign currency reserves inched up as the Central Bank maintained its efforts to shore up reserves by accumulating foreign currency from banks. This accumulation comes at a time when demand for foreign currency remains subdued compared to the ample supply from remittances, tourism, and robust exports.

IMF second review kicks off on a positive note

08 Mar 2024

1

1

In kicking off the second review under the Extended Fund Facility (EFF) programme yesterday, IMF highlighted that Sri Lanka’s economy has started to turn around with policy decisions taken under the programme translating into tangible outcomes. In the opening mee

Salary hike exaggerated to erode independence: Dr. Weerasinghe

07 Mar 2024

80

80

The recent uproar over the Central Bank’s salary increases has caught widespread attention and according to Governor Dr. Nandalal Weerasinghe, this controversy is a deliberate attempt to undermine the institution’s autonomy.

Bondholder agreement delay unlikely to affect IMF review: Coomaraswamy

05 Mar 2024

5

5

A potential delay in securing an agreement-in-principle (AIP) with Sri Lanka’s private bondholders is unlikely to impact the second review of the International Monetary Fund (IMF) programme, former Central Bank Governor Dr. Indrajit Coomaraswamy said.

Consumer price increase slows down in February

01 Mar 2024

0

0

Consumer prices in Colombo rose at a slower pace in February compared to the previous month, indicating a slight dampening in the cost of living. Data from the Department of Census and Statistics (DCS) revealed that the Colombo Consumer Price Index (CCPI) recorded a year-on-year inflation rate of 5.9 percent in February, down from 6.4 percent in January. This decline follows two consecutive months of expansion in December 2023 and January 2024. T

Government to empower women to drive economy

29 Feb 2024

1

1

Sri Lanka’s women entrepreneurs, who have for long been held back, will soon be able to take the front seat as President Ranil Wickremesinghe this week pledged more would be done to allow this segment to increase their contribution to the national economy.

Tourists have no business in doing business

27 Feb 2024

31

31

The tourism sector stakeholders yesterday confirmed that Sri Lanka is witnessing an increasing trend of international visitors engaging in business activities and warned that the industry, in certain parts of the country, is impacted as a result.

Tax and supply chain woes propel inflation to 6.5%

22 Feb 2024

3

3

Sri Lanka’s inflation expanded by 6.5 percent year-on-year in January, as the prices rose across almost all categories from the one-off impact from the higher Value Added Tax and supply chain disruptions caused by the weather-related conditions.

Lifeline for borrowers under Revival Units: CB

21 Feb 2024

1

1

While some borrowers have criticised the loan recovery methods of financial entities, the Central Bank (CB) has stated that under the proposed detailed guidelines for the establishment of Business Revival Units, borrowers can negotiate with their banks to stay financially afloat.

Central Bank urges legal reforms for stronger credit recovery

19 Feb 2024

30

30

With a view to ensure continuity of businesses and job security of employees, the Central Bank (CB) has called for legal reforms to further strengthen Sri Lanka’s Parate execution law and other credit recovery laws in order to shorten the credit recovery cycle on par with global practices .

SLTPB sets sights on global stage with Rs.5.03bn

17 Feb 2024

1

1

The Sri Lanka Tourism Promotion Bureau (SLTPB) has announced plans to participate in all major international tourism events and conduct several road shows this year, with a budget of Rs.5.03 billion allocated for these activities. SLTPB Managing Director Nalin Perera stated that Sri Lanka aims to attract 2.3 million tourists this year, expecting to generate Rs.7.18 billion in revenue. This revenue target includes Rs.2.08 billion from the Tourism

Sri Lanka’s economic revival hinges on IMF deal: CB

16 Feb 2024

0

0

Sri Lanka’s economic recovery is gaining momentum, with the continuation of the International Monetary Fund (IMF) Extended Fund Facility (EFF) arrangement and progress on structural reforms being key factors, the Central Bank announced. However, the financial sector regulator warned that any disruption to this programme would incur significant economic costs, including growth setbacks, loss of confidence, and prolonged negative investor sentiment

SL exits ’Restricted Default’ rating

15 Feb 2024

69

69

SriLankan airlines hosts agents’ tour to Gan island

15 Feb 2024

69

69

First Capital crowned as Brand of the Year at SLIM Brand Excellence 2024

15 Feb 2024

69

69

Bitcoin surges past $100k for first time

15 Feb 2024

69

69

USAID, CBL group to boost SL’s coconut industry

15 Feb 2024

69

69

crisis spirals, Govt. extends deadline for imports till January 10

15 Feb 2024

69

69

Suspect dies after collapsing in Chilaw Police custody

15 Feb 2024

69

69

Dayasiri defends use of President’s Fund, rejects misuse allegations

15 Feb 2024

69

69

Special crimes investigation units to be set up covering all provinces

15 Feb 2024

69

69