Business Main

Ranil takes CB, SEC and Statistics office under his wing

22 Jan 2015

0

0

In an interesting turn of events, the Central Bank (CB) and Securities and Exchange Commission (SEC) have been placed under Prime Minister Ranil Wickramasinghe, who is also the Policy Planning, Economic Affairs, Child, Youth and Cultural Affairs Minister, breaking the tradition of keeping the two institutions with the Finance Minister.

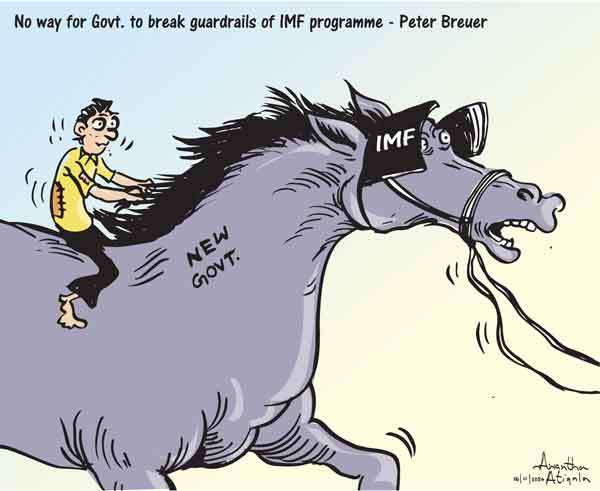

IMF help sought to cut debt burden

21 Jan 2015

0

0

The new government plans to resume discussions with the International Monetary Fund (IMF) on reducing the debt burden that bloated under the previous regime, Bloomberg said quoting Sri Lanka’s new Finance Minister Ravi Karunanayake.According to Bloomberg, Karunanayake was scheduled to meet IMF officials yesterday.Sri Lanka’s total debt is estimated to be at Rs.7.2 trillion and the new President Maithripala Sirisena wants to reduce the

Planters renew call for alternative worker wage model

20 Jan 2015

0

0

The Planters’ Association of Ceylon (PA) said t hat they will be lobbying for an alternative payment strategy such as a contract or an ownershipbased structure for estate workers, in face of unsustainable wage increases, during a round table discussion yesterday.“We need to move away from a wage-based payment structure,” Sunshine Holdings PLC CEO Dr. Dan Seevaratnam said.

CB caps senior citizen deposits to Rs.1mn at 12%

19 Jan 2015

1

1

The Central Bank last week informed all commercial banks in the country to cap the single senior citizen’s deposit value to Rs.1 million from the previously announced maximum of Rs.2.5 million, a Central Bank source told Mirror Business.

Tourism stakeholders delighted over dedicated ministry

16 Jan 2015

0

0

Tourism i ndustry experts have responded positively to the new regime’s decision to create a dedicated ministry for tourism under Minister Navin Dissanayake, and are hoping it would swiftly address issues and support the third highest exchange earner of the country.“I am very happy that there is a dedicated ministry. We haven’t met the Minister as of yet, but we’ll hopefully meet him early next week. He is a young, dynamic

Samaratunga appointed Treasury Secretary

13 Jan 2015

0

0

Career civil servant and former Deputy Secretary to the Treasury Dr. R.H.S. Samaratunga yesterday assumed duties as the Finance Ministry Secretary.Samaratunga replaces longserving Dr. P.B. Jayasundera, the influential Finance Ministry Secretary under former Presidents Mahinda Rajapaksa and Chandrika Bandaranaike Kumaratunga.Samaratunga was previously the Secretary to the Petroleum Ministry and one-time Director at Bank of Ceylon.

Banking sector struggle to end this year

12 Jan 2015

0

0

The Sri Lankan banking sector is to see a reversal of most of the negatives experienced during last three years, and will usher in an era of prosperity with the pick-up in private sector credit growth, improving asset quality and rising returns.

Stocks at near 4-year high on economic reform hopes

10 Jan 2015

0

0

yesterday, while exporters stayed away awaiting clear policy direction after the election, dealers said.Four-day forwards, which were actively traded, ended at 132.75/85 per dollar compared with Thursday’s close of at 132.80/90, dealers said.“It was very dull. Everybody is awaiting to see the policies of the new government,” a dealer said.

Asian markets boosted by US data, Europe easing talk

09 Jan 2015

0

0

Asian equity markets mostly rallied yesterday, while oil prices enjoyed a rare fillip following a surge in New York and Europe on strong US data and expectations for fresh eurozone stimulus measures.Confidence was also given a much needed boost by minutes from the US Federal Reserve’s December meeting suggesting it will not hike interest rates before April.

Tourist arrivals up 20% in 2014

07 Jan 2015

1

1

Sri Lanka attracted 1,527,153 tourists for the past calendar year recording a 19.8 percent growth year-on-year (yoy), with India, UK and China leading the pack, according to statistics released by Sri Lanka Tourism Development Authority yesterday.While December observed the highest number of visitors for the year at 178,672, it recorded the fifth lowest monthly growth number at 16.1 percent yoy.State holidays and travel patterns of the exploding

Hambantota Port Records Rs.5.4bn Revenue In 2014

29 Dec 2014

2

2

The Chinese-funded Magam Ruhunupura Mahinda Rajapaksa Port (MRMRP) in Hambantota has recorded revenue of Rs.5.39 billion for the year 2014, compared to Rs.585.2 million in 2013, statistics released by Sri Lanka Ports Authority showed (SLPA).

Maithri and Ranil assure level-playing field for Biz

24 Dec 2014

1

1

Private businesses will be able to operate without any political influence under a new government formed by t he Common Opposition, according to Common Opposition Presidential Candidate Maithreepala Sirisena and Opposition Leader Ranil Wickremasinghe, who were speaking at ‘Unite,’ the opposition’s forum held at Cinnamon Lakeside for the private sector yesterday.

3Q Earnings Up 51% To Rs. 51bn; Banking Sector Leads The Pack

23 Dec 2014

0

0

The Colombo Stock Exchange (CSE) listed entities upped their total earnings for the quarter ended September 30, 2014 by as much as 51.3 percent to Rs.51.1 billion from the same quarter in 2013, according to a 3Q earnings update released by an independent research firm.This is an acceleration from a 21.7 percent year-on-year (YoY) earnings increase in the second quarter of 2014, Capital Alliance Securities (Private) Limited’s research uni

Real-Estate Financing Market To be Democratized

22 Dec 2014

0

0

Sri Lanka’s small investors will soon be able to invest in large scale real-estate such as office space, shopping malls and apartment complexes through the stock exchange, as the capital market regulator, is currently working with the Colombo Stock Exchange (CSE) to introduce a realestate-based securities product next year.

Achieving Results is Good Governance: MR

18 Dec 2014

0

0

Political continuity, good governance, stability and end of corruption were the key messages conveyed by President Mahinda Rajapaksa when top businessmen rallied towards his cause yesterday at a business forum titled ‘Momentum’ - Asia’s Largest Synchronized Forum hosted by ‘Professionals for a Stable Sri Lanka’.

HNB Gets Us $ 50mn Loan From Korea Exim Bank

17 Dec 2014

0

0

Hatton National Bank PLC (HNB) has entered into an agreement with Korea’s Export-Import Bank (KEXIM) to establish a revolving credit line of US $50 million to finance trade between Sri Lanka and Korea, becoming the first bank in Sri Lanka to do so.The master interbank credit agreement was signed in Colombo by HNB Chairperson Dr.Ranee Jayamaha, and MD/CEO Jonathan Alles on behalf of HNB and KEXIM Senior Executive Director Young-whanSul on

CB Keeps Policy Rates Unchanged

13 Dec 2014

0

0

Sri Lanka’s Central Bank yesterday left its key policy rates unchanged for the eleventh consecutive month in December on account of strong economic growth, pick up in credit growth and the benign inflation, but did not rule out the possibility of another round of easing towards the next year.As a result, the monetary board left the key policy rates—the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR)

Malaysian Expertise To Upgrade Colombo’s Transportation Infrastructure

11 Dec 2014

0

0

Malaysia’s Maju group signed an agreement to transfer technology, experience and expertise related t o public transport infrastructure probono to the Sri Lankan Transport Ministry to create an integrated transportation hub in Colombo.

First Vietnam Trade Delegation In Town To Bolster Trade Relations

09 Dec 2014

0

0

The first Vietnamese trade delegation to the country is currently holding talks with its Sri Lankan counterparts at the Ceylon Chamber of Commerce to further strengthen bilateral trade and investment between the two countries.“The bilateral trade volume has been growing at a remarkable 30 percent annually. This is the highest growth of bilateral trade in South Asia,” Vietnam Ambassador for Sri Lanka Phan Kieu Thu said.

November Tourist Arrivals Up 9.4%

04 Dec 2014

0

0

Tourist arrivals to Sri Lanka during the month of November rose 9.4 percent year-on-year (YoY) to 119,727 visitors while total arrivals for the first 11 months of the year stood at 1.34 million, up 20.3 percent YoY, the official tourism data showed. Sri Lanka targets 1.5 million tourists at the end of this year and 2.5 million by 2016. To achieve this year’s target Sri Lanka needs 151,519 tourists visiting the country in December. The hi

Cse Launches Rs. 150mn State of the art Cds

03 Dec 2014

0

0

Colombo Stock Exchange (CSE) yesterday launched its Rs.150 million state-ofthe-art, new generation Central Depository System (CDS) supplied and maintained by Millenium IT, with an upgrade to the Automated Trading System (ATS).“With t he launch of t he new CDS and ATS, we have become world-class,” CSE Chairman Vajira Kulatilaka said.CSE launched its first CDS, funded by USAID, in 1991 and was the first in Asia and eighth in the worl

Jkh Set To Draw Record Syndicated Loan

01 Dec 2014

0

0

John Keells Holdings PLC (JKH) will be going for a 7-year syndicated loan to the tune US$445 million, the largest ever in the country, to partly finance its US$ 820 million Waterfront Project, according to foreign media reports.“Standard Chartered will be handling the process, and it will be at a LIBOR plus rate. We will get a fine rate,” JKH Deputy Chairman Ajit Gunawardene responding to an inquiry by Mirror Business said.

Experts Urge Lankan Businesses To Restructure For Trade Benefits

28 Nov 2014

0

0

The country will not get any trade benefits from the China-Sri Lanka Free Trade Agreement (FTA) if the local industries continue their current modus operandi, was the consensus reached at a recently held forum titled “Doing Business with China: FTA and Beyond Forum,” organized by the Sri Lanka ExportersAssociation and Verité Research.

Cabraal Spells Out 8-point Agenda For Banks

27 Nov 2014

0

0

Central Bank Governor Ajith Nivard Cabraal yesterday spelled out an eight-point agenda for the Lankan banking sector to get themselves aligned with the government’s ‘Vision 2020’.The government hopes to achieve the US $ 150 billion economy and gross domestic product (GDP) per capita of US $ 7000+ by 2020. According to Cabraal, the banking sector, which represents 60 percent of the financial system, has a pivotal role to play

CBSL’s single policy interest rate mechanism comes into effect today

27 Nov 2014

0

0

Sri Lanka Economic Summit in January 2025

27 Nov 2014

0

0

Industries Ministry public day re-launched after four years

27 Nov 2014

0

0

Third review approved by IMF, SL to get next US$ 333 million tranche

27 Nov 2014

0

0

Niloufer Esufally-Anverally Makes a Stylish Comeback with the Launch of NLFR

27 Nov 2014

0

0

Newly elected Jaffna MP pays tribute to Prabhakaran

27 Nov 2014

0

0

Another court case against Arjuna Aloysius

27 Nov 2014

0

0

Seeks police security

27 Nov 2014

0

0

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)