Business Main

Analysts expect CB to slash rates further to spur growth

11 Jul 2023

3

3

Analysts expect a further reduction of 100-200 basis points in policy interest rates by the Central Bank in the coming months, aiming to provide additional support for economic recovery, as inflation is projected to stabilise at the desired mid-single-digit levels, surpassing the initial expectations.

Economist calls for calming fears over bank deposits during DDO

06 Jul 2023

9

9

Amid the growing concerns among bank deposit holders regarding the potential negative consequences during the progress of the Domestic Debt Optimisation (DDO) initiative, senior economist and Verité Research Executive Director Dr. Nishan de Mel said such fears appear to be unwarranted.

Budget deficit expands despite higher taxes and expenditure cuts

05 Jul 2023

5

5

Barely into a year since the present administration opted for an International Monetary Fund (IMF)-assisted fiscal reset by raising taxes and rationalised spending, the budget is still running a higher deficit than....

Anticipation grows for possible policy rate cut on Thursday

04 Jul 2023

0

0

There is a widespread expectation of an upcoming policy rate cut announcement by the Central Bank on Thursday (6th) to further relax the financing conditions in the market to support the economic recovery, as inflation expectations remain well-anchored at their desired levels.

Real prices contradict sharp deceleration in inflation rate

03 Jul 2023

0

0

The food prices measured on a monthly basis rose for the second month in a row in June, albeit at a slow pace from a month ago, reflecting that the inflationary impulses still remain abound in the economy and the bulk of the heavy lifting in bringing down the annual headline inflation is done by the massively high base effects of last year.

Ex-Central Banker casts doubts on adequacy of proposed DDO strategy

30 Jun 2023

8

8

Given the anticipated shortfall in state revenue from the targeted levels, a former Central Banker casted doubts on the narrow scope in the proposed Domestic Debt Optimisation (DDO) strategy providing sufficient leeway for the government to get the fragile budgetary situation under control, while raising concerns on the disproportionate impact on the low-income earners.

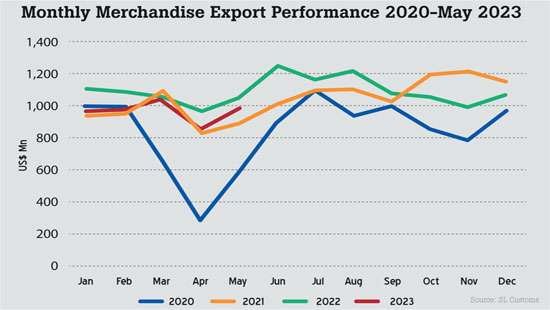

Sluggish exports continue for fifth straight month in May

29 Jun 2023

0

0

The sluggish performance of Sri Lanka’s merchandise exports continued for the fifth straight month in May, as Sri Lanka’s main industrial export, apparel and textile products, dipped amid the slowdown in demand from the key markets.

Banks seen slashing deposit rates while lending rates lag big time

28 Jun 2023

25

25

Sri Lankan banks which took little interest towards deposits when interest rates were going up appear to have suddenly woken up to aggressively cut rates on such deposits when the rates are on their way down, leaving the hapless savers devastated from still red-hot prices in the economy.

Stock market positive as assurances on DDO boost investor confidence

27 Jun 2023

0

0

The Colombo Stock Exchange (CSE) investors took the impending Domestic Debt Optimisation (DDO) announcement positively, as both indices closed in green, with investors particularly showing interest in banking stocks, a sector many feared would be impacted negatively by the DDO

JAAF dismayed by zero revisions made to industrial electricity tariff

24 Jun 2023

1

1

Sri Lanka’s apparel sector, the largest foreign exchange earner and a key contributor to the debt-ridden economy, yesterday said it is “dismayed” by the zero revisions made to industrial electricity tariff rates by the Ceylon Electricity Board (CEB), despite having the allowance.

WB urges SL to develop social protection system that serves its poor

22 Jun 2023

0

0

Given that half of the population living in poverty in Sri Lanka is not covered by social protection schemes, the World Bank stressed it is essential to have increased transparency, inclusion, adaptability and accountability mechanisms to ensure the establishment of an improved welfare system. “As Sri Lanka works to recover and reset from its worst economic crisis in decades, now is the time to turn crisis into an opportunity to build a resilient

Banks call for urgent development of insolvency regime as loan defaults soar

20 Jun 2023

6

6

Sri Lanka Banks Association (SLBA) representing all commercial banks in the country yesterday stressed the urgent need for the development of an effective insolvency regime in response to the sharp rise in loan defaults in the country.

Sri Lanka told to use global economic slowdown to rethink growth strategy

17 Jun 2023

1

1

Sri Lanka needs to make efforts to use the ongoing global economic slowdown as an opportunity to rethink its growth strategy, as its economy is highly vulnerable and remains at a disadvantage compared to many of its competitors and peers, asserted an international economist.

Economy contracts 11.5% in first quarter

16 Jun 2023

0

0

Sri Lanka’s Gross Domestic Product (GDP) is estimated to have contracted 11.5 percent in the first quarter of 2023 from a year ago amid high interest rates, increased input prices, import restrictions and lower earnings from apparel exports, the Department of Census and Statistics (DCS)

SOE restructuring focuses on market failures, not profits and losses: Shah

15 Jun 2023

0

0

The state-owned enterprises (SOEs) should be unchained from government control, regardless of whether they are profit or loss-making, if the benefits arising from their performance are to flow into the national economy, said Suresh Shah, the head of the SOE Restructuring Unit.

Sri Lanka will record positive economic growth in 4Q: Siyambalapitiya`

13 Jun 2023

0

0

Despite various negative projections by multilateral agencies and even by the country’s Central Bank, Sri Lanka would record positive economic growth in the final quarter of this year, Finance State Minister Ranjith Siyambalapiriya said.

Tea exporters concerned over government’s move to abolish SVAT scheme

09 Jun 2023

4

4

Sri Lanka’s tea exporters yesterday expressed “deep concerns” over the government’s decision to abolish the Simplified Value-Added Tax (SVAT) system as they fear the move will create cash flow difficulties for them among several other issues.

SL exits ’Restricted Default’ rating

09 Jun 2023

4

4

SriLankan airlines hosts agents’ tour to Gan island

09 Jun 2023

4

4

First Capital crowned as Brand of the Year at SLIM Brand Excellence 2024

09 Jun 2023

4

4

Bitcoin surges past $100k for first time

09 Jun 2023

4

4

Can funds disbursed through President’s Fund be refunded?

09 Jun 2023

4

4

Main schools in Colombo without principals

09 Jun 2023

4

4

Economic crisis stalls five high-rise buildings

09 Jun 2023

4

4