Business Main

IMF backs Sri Lanka’s financial sector stability in potential DDR scenario

05 May 2023

6

6

The International Monetary Fund (IMF) plans to support the government to come up with a strategyto safeguard financial sector stability in a potential domestic debt restructuring (DDR) scenario, a top official of the Fund said.

CEB to be broken into 14 entities; new regulator in the offing

04 May 2023

7

7

Public Utilities Commission of Sri Lanka (PUCSL) Chairman Janaka Ratnayake this week charged that the government is attempting to privatise the Ceylon Electricity Board (CEB) by breaking it into 14 entities, through the proposed Electricity Reforms Bill, putting the country’s energy security and national security in grave danger.

Colombo inflation falls sharply in April as base effect kicks in

29 Apr 2023

6

6

The Colombo district inflation fell sharply in April, as the higher base effects from last year kicked in while the commodities prices are cooling, on the back of easing supply conditions and the relative strength in the rupee, which reduced the prices of imported goods.

CBSL presents Annual Report 2022 to President

28 Apr 2023

0

0

In terms of Section 35 of the Monetary Law Act No. 58 of 1949, the seventy third Annual Report of the Monetary Board of the Central Bank of Sri Lanka was presented yesterday to President Ranil Wickremesinghe, who is also the Minister of Finance, Economic Stabilisation and National Policies, by Dr. P Nandalal Weerasinghe, the Governor of Central Bank of Sri Lanka.

Debt talks with Paris Club and India on one platform; China separately

27 Apr 2023

0

0

Sri Lanka plans to continue bilateral debt restructuring negotiations with the Paris Club creditors and India on a common platform and with China separately, without any prior conditions, in order to reach debt sustainability by restructuring the country’s unsustainable debt to manageable levels.

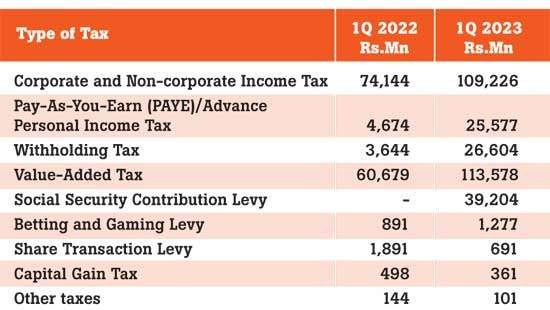

Tax revenue doubles to Rs.316bn in first quarter

25 Apr 2023

0

0

The tax collections by the Inland Revenue Department (IRD) rose by a record 216 percent year-on-year (YoY) to Rs.316.62 billion in the first quarter of this year, driven by the changes in the tax policy and gradual recovery of economic activities, according to Inland Revenue Department Commissioner General D.R.S. Hapuarachchi.

Sri Lanka to build South Asia’s largest logistics complex in Port of Colombo

22 Apr 2023

8

8

Sri Lanka’s aspiration to become a major logistics hub in the region took a giant leap forward yesterday, with the launch of a project to build the largest commercial and logistics complex in South Asia in the Port of Colombo, with an investment of US $ 392 million.

Tea exports down 22% in March, 15% in first quarter

21 Apr 2023

0

0

Sri Lanka’s tea exports dipped 22 percent year-on-year (YoY) to 17.97 MnKgs in March continuing the declining trend seen in both tea production and exports in recent times, the data released by Forbes & Walker Tea Brokers showed.

Employees go before Supreme Court against proposed sale of SLT

20 Apr 2023

0

0

The Sri Lanka All Telecommunication Employees Union yesterday filed a fundamental rights (FR) petition in the Supreme Court, seeking an order restraining the Treasury Secretary from taking any steps to divest the shares held by him in Sri Lanka Telecom PLC (SLT).

Asiri Group plans US $ 100mn hospital in Port City Colombo

18 Apr 2023

0

0

Sri Lanka’s largest private sector healthcare provider Asiri Hospital Holdings PLC, a unit of Softlogic Group, in a landmark announcement yesterday disclosed its plans to set up a state-of-the-art hospital within China-backed Port City Colombo (PCC).

Foreign interest in G-Secs increases on hopes of economy’s swift recovery

17 Apr 2023

0

0

Foreign interest in Treasury bills and bonds was seen growing steadily in the recent few weeks reflecting their readiness to bet on the future trajectory of the Sri Lanka’s economy. As per the data available....

Int’l Monetary Fund issues growth warning as it lowers 2023 forecast

13 Apr 2023

1

1

The International Monetary Fund (IMF) slightly lowered its outlook for the global economy on Tuesday, while predicting that most countries will avoid a recession this year despite economic worries and geopolitical strains.

CB confident of sealing debt deal before IMF first review

06 Apr 2023

2

2

The Central Bank officials expressed confidence in wrapping up the negotiations with both its bilateral and commercial creditors well prior to the first review of the International Monetary Fund (IMF)-assisted programme, which would come up in six months.

Policy rates on hold as financial conditions ease

05 Apr 2023

0

0

The Monetary Board of the Central Bank left the key policy rates unchanged at the current levels as financial conditions continue to ease since the government clinched the US$ 3 billion Extended Fund Facility (EFF) with the International Monetary Fund two weeks ago.

Sri Lanka hopes to finalise debt relief deal in six months

31 Mar 2023

4

4

Sri Lanka expects to conclude the discussions with its creditors-both official and private-and reach a debt relief deal by the first review of the International Monetary Fund (IMF) programme that received Executive Board approval early last week.

Auto industry requests quota system from govt. to resume vehicle imports

30 Mar 2023

9

9

Sri Lanka’s automobile industry is requesting the government to consider a quota system for vehicle imports for its survival and the livelihoods of over 100,000 people, who are directly or indirectly employed by it.

ASPI crosses the 15,000 mark for the first time

29 Mar 2023

0

0

SL exits ’Restricted Default’ rating

29 Mar 2023

0

0

Can funds disbursed through President’s Fund be refunded?

29 Mar 2023

0

0

Main schools in Colombo without principals

29 Mar 2023

0

0

Economic crisis stalls five high-rise buildings

29 Mar 2023

0

0