Business Main

President hopeful of new financial culture following IMF deal

23 Mar 2023

0

0

President Ranil Wickremesinghe yesterday expressed confidence in creating a new financial culture and environment that had not prevailed in Sri Lanka before, through the Extended Fund Facility (EFF) programme that was approved by the International Monetary Fund (IMF) Executive Board this week.

Local marketers confident in fixing Sri Lanka’s falling brand

18 Mar 2023

3

3

Sri Lanka is in dire need to correct its image in the eyes of the international community, given the negative sentiments that are still largely prevalent, as stepping up efforts in this regard is the marketing fraternity of the country.

Proposed CB law will pave way for unpopular but essential decisions

17 Mar 2023

5

5

The new Monetary Law Act, which aims to grant independence to the Central Bank with enhanced accountability, will empower the monetary authority to make unpopular but essential decisions in prioritising price stability in the country under a flexible inflation target framework, a top official said.

Shipping industry seeks presidential intervention on regulation changes

14 Mar 2023

0

0

While seeking presidential intervention, the Sri Lanka Shippers’ Council (SLSC) warned that the recent decision by Ports, Shipping and Aviation Minister Nimal Siripala De Silva to remove the regulations on freight charges is likely to hurt the competitiveness of Sri Lanka’s exports and result in higher import costs, fuelling inflation.

New anti-corruption law in Parliament soon as IMF considers Sri Lanka’s loan

09 Mar 2023

12

12

The government will bring in an anti-corruption bill to Parliament shortly, as agreed with the International Monetary Fund (IMF) when entering a staff-level agreement last September, Cabinet Spokesperson Minister Bandula Gunawardana said.

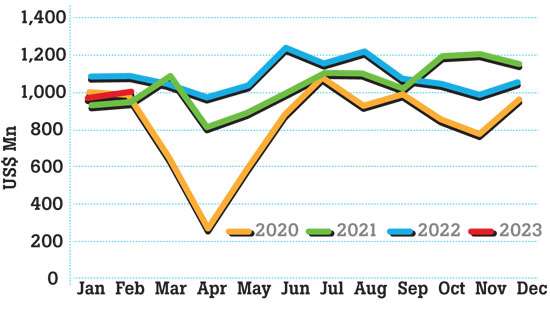

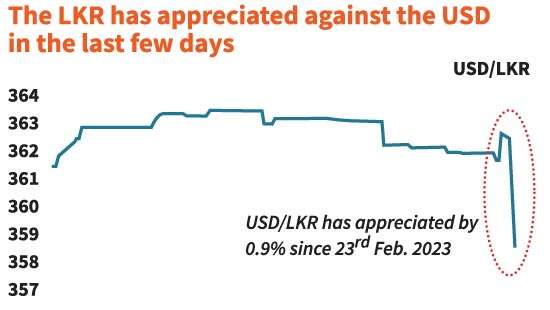

Faster decline in inflation likely due to rupee appreciation

07 Mar 2023

0

0

The Central Bank last Friday projected a faster decline in the rate of inflation in the coming months, as businesses and households will benefit from the relative strength in the rupee in recent times, which gets translated into lower imported goods prices.

CB delivers 100bps surprise rate hike on IMF insistence

04 Mar 2023

0

0

Taking everyone by surprise, the Monetary Board of the Central Bank yesterday raised the policy interest rates by 100 basis points, though many predicted the monetary authority to either maintain the status quo or signal a dovish tilt by cutting rates.

Bets divided equally between a rate cut and maintaining tight policy

02 Mar 2023

0

0

The analysts at First Capital Research (FCR) assigned equal weightage between a rate cut and an unchanged policy stance at the upcoming monetary policy announcement tomorrow afternoon but they doubled down on their bets on a dovish tilt by the members of the rate setting committee at the next review, with a sizable rate cut in the second quarter.

Rupee appreciates after almost a year into free float

01 Mar 2023

9

9

Sri Lankan rupee appreciated yesterday on improved sentiments over the current and future foreign exchange conditions in the domestic market after the announcement that International Finance Corporation (IFC) is willing to provide US$ 400 million worth of swap facility for three commercial banks to support essential imports.

World Bank’s IFC extends US $ 400mn financing to three Sri Lankan banks

28 Feb 2023

2

2

To support Sri Lanka amid an ongoing economic crisis, the International Finance Corporation (IFC), the investment arm of the World Bank, is providing a cross-currency swap facility to three of Sri Lanka’s leading national banks that deal with over 30 percent of Sri Lanka’s remittances and exports.

Govt. settles Rs.191bn worth of arrears to various contractors and suppliers

25 Feb 2023

5

5

The government has settled the majority of the arrears to the tune of Rs.191 billion to contractors and suppliers, after assuming power on August 31, last year, despite an 8 percent contraction in the economy during the year, Finance State Minister Ranjith Siyambalapitiya said.

Ranil tells economy his top priority; says there’s no election to postpone

24 Feb 2023

0

0

President Ranil Wickremesinghe yesterday told parliament that his top priority is building a strong economy and not politics, though the Opposition political parties directly accused him of trying to postpone an election that has already been announced.

No immediate plans to sell ECT: Ports Minister

16 Feb 2023

8

8

Contradicting with the earlier plans to handover the East Container Terminal (ECT) to Japan, Ports, Shipping and Aviation Minister Nimal Siripala de Silva hinted that the government plans to retain the control of the ECT of the Port of Colombo while inviting the private sector to invest in the proposed Colombo North Port development project.

ASPI crosses the 15,000 mark for the first time

16 Feb 2023

8

8

SL exits ’Restricted Default’ rating

16 Feb 2023

8

8

Can funds disbursed through President’s Fund be refunded?

16 Feb 2023

8

8

Main schools in Colombo without principals

16 Feb 2023

8

8

Economic crisis stalls five high-rise buildings

16 Feb 2023

8

8