Business Main

Sale of SOEs presents best option for Sri Lanka to avert potential DDR

14 Feb 2023

0

0

The disposal of the state-owned enterprises (SOEs) presents the best option for Sri Lanka to avert a possible domestic debt restructuring (DDR) scenario, while it could become a catalyst to develop a vibrant capital market to exploit the current market opportunities, where the investors are rallying back to emerging and frontier markets.

Financing assurances obtained by SL thus far inadequate to proceed with EFF: IMF

11 Feb 2023

6

6

With the dawn of the new year, Sri Lanka made significant progress in obtaining financing assurances from its creditors to help unlock the International Monetary Fund (IMF) bailout package; however, according to the multilateral funding agency, what the island nation has managed to bag so far is not enough.

SL still has US$ 3.2bn in external debt to settle this year despite standstill

10 Feb 2023

3

3

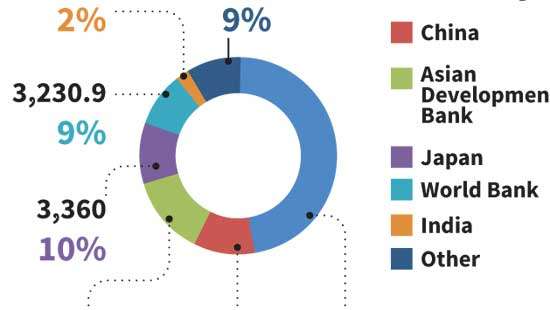

Sri Lanka appears to be still having roughly US$ 3.2 billion worth foreign currency obligations to be settled this year even after announcing a debt standstill on selective debt last year until creditors agree to restructure them.

President lays out economic blueprint for Sri Lanka premised on IMF reform path

09 Feb 2023

0

0

President Ranil Wickremesinghe made his second throne speech in Parliament yesterday to reinforce his blueprint to put the economic back on track and made clear that his government has no role in private businesses except for creating a conducive environment for the private sector to drive the economy.

China confirms attendance at IMF’s first-ever creditor-debtor roundtable in India

07 Feb 2023

1

1

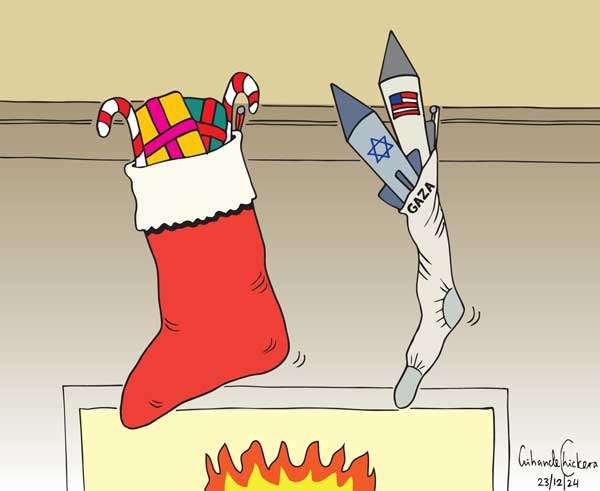

The nations that are in debt with the People’s Republic of China will have the opportunity to negotiate firsthand the debt restructuring agenda, as the world’s second largest economy has confirmed its attendance at the first-ever creditor-debtor roundtable organised by the International Monetary Fund (IMF).

CB begins banks’ asset quality review to identify stresses in the system

06 Feb 2023

3

3

The Central Bank has kicked off an asset quality review of the country’s banking sector to identify possible stresses in different pockets of banks’ balance sheets as they provided enormously on possible bad loans and other financial asset losses in 2022 with the final stretch of moratoria expiring early this year.

Prez. confident in SL rising up and building back a stronger economy

04 Feb 2023

3

3

As Sri Lanka celebrates its 75th year of independence from British rule today, while grappling with the worst economic crisis faced in history, President Ranil Wickremesinghe expresses confidence in the country rising up from the current turmoil and coming back stronger.

Paris Club to “soon” provide financing assurances to help SL unlock IMF funding

03 Feb 2023

0

0

The Paris Club of creditor nations is ready to provide financing assurances to Sri Lanka, a key step needed to unlock a US$2.9 billion bailout by the International Monetary Fund (IMF), Reuters reported yesterday quoting two unnamed sources.

CB insists on staying on reform path regardless of election outcome

31 Jan 2023

3

3

Central Bank Governor Dr. Nandalal Weerasinghe said regardless of the future elections, he wants to see a continuation of the economic reform path the country has embarked on, as it is the only way to come out of the current crisis.

Ceylon Chamber expects economy to fare better this year though consumption expected to contract

28 Jan 2023

1

1

Sri Lanka’s economy will fare better this year than it did in the previous year, where the economy is estimated to have contracted by about 9 percent but consumption is expected to contract till about the second half of the year, the Ceylon Chamber of Commerce (CCC) said in its Sri Lanka Economic Outlook 2023.

CB employees stage protest against govt.’s tax policy

27 Jan 2023

0

0

Central Bank employees yesterday staged a protest supporting the ‘Black Week’ already announced against the increased income tax rates, which came into effect from this month, calling such steeply high tax rates are unbearable and unjust. Last week, Central Bank’s Executive Officers’ Union wrote to the Treasury Secretary saying that the new tax regime is extremely burdensome and done with no proper analysis.

CB stands pat as it sees more room for yields, market rates to ease

26 Jan 2023

0

0

The Central Bank yesterday left its key policy rates at their elevated levels for the fourth consecutive month, as it awaited the recently implemented measures to put further downward pressure on yields and short-term rates, while inflation expectations also remain anchored.

CB chief signals end to debt moratoria

25 Jan 2023

8

8

As businesses across diverse sectors are still hoping for some relief by way of debt moratoria, the Central Bank yesterday indicated that it does not encourage the continuity of such packages as that could take a heavy toll on the banking sector.

Exim Bank letter renews SL’s hope for China’s backing to unlock IMF funding

23 Jan 2023

3

3

Sri Lanka is hopeful of China extending its financing assurances to unlock the bailout package from the International Monetary Fund (IMF), the Ministry of Finance said, as the creditor has taken the first step in affirming its commitment to the island nation’s attempt to restructure its debt.

Rift in PUCSL likely to pave way for proposed electricity tariff increase

21 Jan 2023

5

5

Public Utilities Commission of Sri Lanka (PUCSL) Chairman Janaka Ratnayake yesterday alleged that the country’s political authorities have influenced three commission members to revise the earlier unanimous decision to reject the interim and retrospective electricity tariff hike proposed by the Cabinet of Ministers.

Services liberalisation bogged down by lack of data, stakeholder engagement

20 Jan 2023

0

0

Due to insufficient data and lack of industry engagement, Sri Lanka’s free trade agreement (FTA) negotiators are faced with the daunting task of service sector liberalisation as the country prepares to resume negotiations for proposed comprehensive FTAs with India and China over the next two months.

Opposition to higher taxes comes from within Central Bank

19 Jan 2023

7

7

The Central Bank Executive Officers’ Union expressed its strong objection against the higher personal income taxes, which came into effect from the beginning of this month and condemned the manner in which they were implemented without a proper analysis.

Excise Dept. approves production of new alcoholic beverages locally for export markets

14 Jan 2023

1

1

With the aim to boost foreign exchange earnings from locally produced alcoholic beverages, the Excise Department has granted approval to produce cider and milk punch, with local ingredients, for export markets.

Upbeat CSE prepares for potential SOE listings, to offer new products

13 Jan 2023

2

2

Banking on renewed foreign investor sentiment and expected recovery in the economy in the second half of the year, the Colombo Stock Exchange (CSE) is set to introduce a suite of new products to the market this year, while making its platform available for potential sale of shares of selected state-owned enterprises (SOEs) if the government decided to do so.

StanChart says IMF deal only likely in 2Q amid protracted talks with official creditors

12 Jan 2023

0

0

The Executive Board sign-off for the International Monetary Fund (IMF)-sponsored bailout package for Sri Lanka may not happen until the second quarter of this year, as the country is likely to see delays in obtaining financing assurances from its bilateral creditors to restructure debt, according to Standard Chartered (StanChart) Global Research.

ASPI crosses the 15,000 mark for the first time

12 Jan 2023

0

0

SL exits ’Restricted Default’ rating

12 Jan 2023

0

0

Can funds disbursed through President’s Fund be refunded?

12 Jan 2023

0

0

Main schools in Colombo without principals

12 Jan 2023

0

0

Economic crisis stalls five high-rise buildings

12 Jan 2023

0

0