Business Main

Exports down for second month in Nov. as global economic slowdown bites

10 Jan 2023

0

0

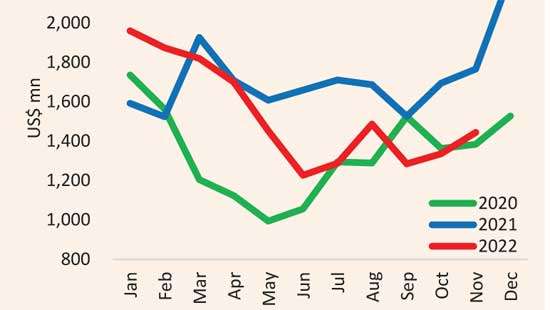

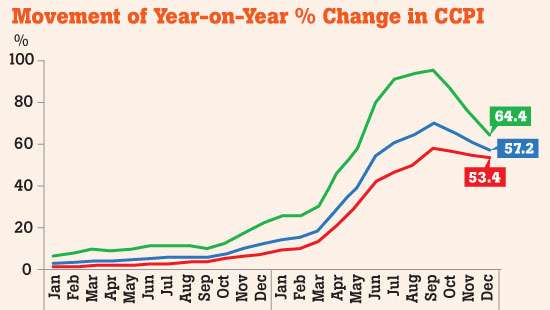

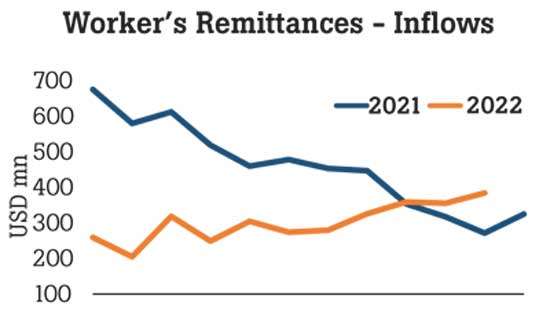

Sri Lanka’s earnings from exports declined for the second consecutive month in November while the trade deficit widened from the previous month, as the global economy slows down amid decades-high inflation and rise in interest rates to tackle the surging prices.

Digitalisation of financial services, a game changer for Sri Lanka: CB chief

09 Jan 2023

3

3

As South Asian economies have been focusing on digitalisation efforts to uplift the overall government and financial sector infrastructure, the Central Bank of Sri Lanka asserted that improving focus in this arena....

CB lays out policies to restore price stability, macroeconomic strength

05 Jan 2023

4

4

The Central Bank yesterday laid out its short to medium-term policy path and a slew of other measures that it intends to roll out primarily to restore price stability and to maintain the financial system’s health, as Sr Lanka struggles to emerge from the worst economic crisis since its independence.

Central Bank announces measures to reactivate inter-bank market

04 Jan 2023

1

1

The Central Bank this week announced changes to open market operations to start the year by limiting licensed commercial banks’ access to its Standing Deposit and Lending Facility windows, which together determines the overnight liquidity level in the money market.

Tourism ends 2022 on high note with December recording third highest monthly tourist arrivals

03 Jan 2023

5

5

Sri Lanka tourism ended the year 2022 on a positive note, as the arrivals of international visitors to the country for the final month of the year crossed the 90,000 mark, while the total arrivals for the year topped 700,000.

Banking sector profitability plunges as crisis takes toll on credit costs, growth

30 Dec 2022

0

0

Sri Lanka’s banking sector, which is usually resilient and generates consistent profits across economic cycles took a heavy beating this year, causing the sector to fall out of favour with the investor community.

Govt. told to opt for least cost power generation mix to prevent shock tariff hikes

29 Dec 2022

7

7

At a time when the entire country is up in arms against the proposed monster power tariff hike in less than five months into the first one in August, Sri Lanka’s national management accounting body,

Jan-Sept govt. revenue gets boost from red-hot prices, higher taxes

27 Dec 2022

3

3

Sri Lanka’s nine-month government revenue this year rose compared to last year’s levels, as the economy inflated amid the runaway prices and tax revenue started flowing, as a result of the hike in the indirect taxes such as the Value Added Tax (VAT), under the first round of tax increases came into effect from June.

SL told to revisit dividend tax policy to rectify double taxation

22 Dec 2022

3

3

As Sri Lanka’s dividend tax policy is inhibiting risk-taking, entrepreneurship and timely restructuring activities in the corporate sector, a top investment professional called upon the government to take corrective actions to rectify the unfair double taxation on profits when distributing dividends to investors.

Tea exporters set record straight on export proceeds repatriation and conversion

20 Dec 2022

5

5

Sri Lanka’s tea exporters joined the bandwagon in clarifying its stance on the issue revolving around repatriation and conversion of export proceeds, pointing out they have been abiding by the relevant rules and regulations.

Nov. PMI points to contraction in activities albeit some improvement from last month

17 Dec 2022

0

0

The Purchasing Managers’ Index (PMI) continued to remain in the contractionary territory in November, albeit some improvement in activity from the previous month, as the subdued demand conditions, both locally and internationally, weighed on the Sri Lankan economy, which is on course for its worst decline in its history this year.

Sri Lanka further sinks into recession as economy contracts 11.8% in 3Q

16 Dec 2022

6

6

The Sri Lankan economy further sank into recession after its Gross Domestic Product (GDP) for the third quarter gave up as much as 11.8 percent of its output, bringing the nine-month contraction in the economy to 7.1 percent.

Strengthening fiscal rules next key reform for economic stability: CB

15 Dec 2022

11

11

The proposed strengthening of the Fiscal Management Responsibility Act (FMRA), which would require strict compliance with the fiscal targets, will be the next key reform for economic stability, leading to a sustainable economy in the long term, according to Central Bank Governor Dr. Nandalal Weerasinghe.

Weaker rupee to lead swift tourism industry recovery

13 Dec 2022

13

13

Driven by the country’s growing appeal as a low-cost tourist destination, following the steep depreciation of the rupee, Sri Lanka’s tourism industry is expected to make a swift and steady recovery in this winter season, with tourist arrivals surpassing pre-crisis levels in 2024.

President says no plans for reforms; stresses need for new economic model

06 Dec 2022

33

33

Sri Lanka has no plans whatsoever for reforms going forward, President Ranil Wickremesinghe told a room full of the country’s top private sector business leaders yesterday but instead would be thinking bigger and bolder in terms of its growth agenda.

Private credit continues to slump; October logs Rs.47bn contraction

05 Dec 2022

0

0

Net credit to the private sector fell for the fifth consecutive month in October reflecting the depth and the breath of the economic contraction, which is impacting businesses and individuals alike after the economy....

ASPI crosses the 15,000 mark for the first time

05 Dec 2022

0

0

SL exits ’Restricted Default’ rating

05 Dec 2022

0

0

SriLankan airlines hosts agents’ tour to Gan island

05 Dec 2022

0

0

Can funds disbursed through President’s Fund be refunded?

05 Dec 2022

0

0

Main schools in Colombo without principals

05 Dec 2022

0

0

Economic crisis stalls five high-rise buildings

05 Dec 2022

0

0