Business Main

SL only at the beginning of very arduous and painful journey: Dr. Coomaraswamy

02 Dec 2022

0

0

As Sri Lanka awaits with bated breath to experience some sense of relief from the ongoing crisis that has been brought about by severe economic mismanagement, the country is only at the beginning of a very arduous and painful journey, an ex-Central Bank Governor cautioned.

Listen to people, not just to technocrats to resolve issues in economy

01 Dec 2022

7

7

Sri Lanka needs to listen more to what its people are saying, instead of paying heed to only technocrats, said senior economist Prof. Shantha Devarajan. By not paying attention to the call of citizens, the real problems of the national economy will not be solved, he cautioned.

CB chief tells foreign investors why they should invest in Sri Lanka now

29 Nov 2022

16

16

Central Bank Governor Dr. Nandalal Weerasinghe yesterday made an open call to the foreign investor community to take investment positions pertaining to Sri Lanka, as the country is about to enter the recovery path, leaving behind the worst of the ongoing economic turmoil.

New Central Bank law could finally see the light of day prior to IMF deal

28 Nov 2022

5

5

The new Central Bank Act will soon see passage through the Cabinet and Parliament as the final draft remains ready as part of a broader package of things to be met as prior actions required to unlock the International Monetary Fund (IMF) deal to pull the country out of its current economic mess.

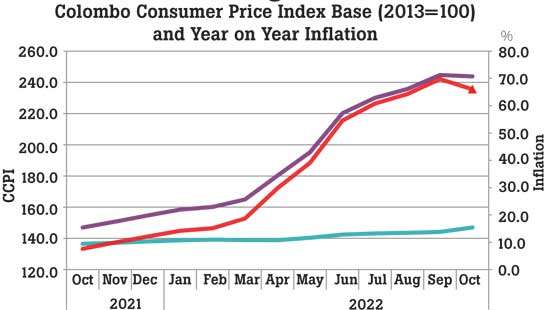

Curtailing inflation critical to avert Zimbabwe-like scenario

26 Nov 2022

21

21

Although the prevailing high interest rate regime may discourage investments, Central Bank (CB) Governor Dr. Nandalal Weerasinghe asserted that curtailing inflation is more critical for the survival of businesses over low interest rates and to avert a Zimbabwe-like scenario.

Central Bank threatens with administrative controls to bring market rates down

25 Nov 2022

2

2

The Central Bank forewarned that it would be compelled to bring in administrative controls such as deposits and lending rate caps unless the markets adjust their interest rates to reflect the easing inflation and improvement in money market liquidity.

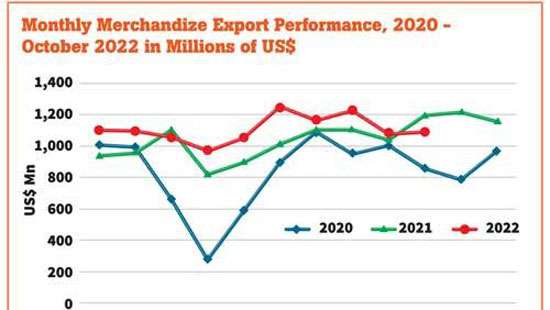

Nandalal cracks the whip on exporters

24 Nov 2022

15

15

Amid growing public pressure, the Central Bank (CB) this week said it stands ready to name and shame the exporters who fail to provide adequate reasons within next two weeks for falling behind to convert their export earnings to rupees within the mandated time periods.

Budget 2023 aims for stability while laying platform for rebooting growth: Treasury Secy

22 Nov 2022

7

7

Outlining the main policy thrust underlying Budget 2023 that was unveiled last week, Finance Ministry Secretary Mahinda Siriwardana said it was designed with the intention of contributing to the economic stabilisation path, which the country had already embarked on, while laying the platform for rebooting growth.

Estate sector needs more income-generating avenues to keep children in school: IPS

19 Nov 2022

16

16

In an effort to prevent the children of the estate sector from falling deeper into the socio-economic crisis faced, the relevant authorities must look at introducing new programmes that expand the earning capacity of adults, so that the school-going age group is kept away from seeking employment, the Institute of Policy Studies (IPS) said.

Minister Semasinghe says no domestic debt restructuring, but markets not convinced

18 Nov 2022

0

0

State Finance Minister Shehan Semasinghe yesterday said the government up to now has not taken any decision to restructure the domestic debt, though speculation is rife that ultimately Sri Lanka will be compelled to restructure domestic debt.

CB believes interest rates at peak levels after inflation turned a corner

17 Nov 2022

2

2

The Central Bank believes that interest rates may have reached their highest levels after inflation peaked in September and showed a slight deceleration in October amid the ultra-tight monetary policy and higher taxes brought in to reduce demand in the economy.

CB offers strongest defence against calls for lower tax rate on forex earnings

16 Nov 2022

7

7

Staging strong defence against those who sought preferential tax treatment on foreign exchange earning companies, Central Bank Governor, Dr. Nandalal Weerasinghe yesterday questioned whether the decades-long practice of taxing the exporters and others who earn in foreign currency lower had delivered the country the desired objectives.

Budget 2023 sticks to reform path with IMF nod pending

15 Nov 2022

0

0

With an International Monetary Fund (IMF) deal yet to be sealed, Budget 2023 presented to Parliament yesterday stuck with the reform path Sri Lanka had embarked upon after the economy crashed in April, as a result of bad economic policies followed for decades.

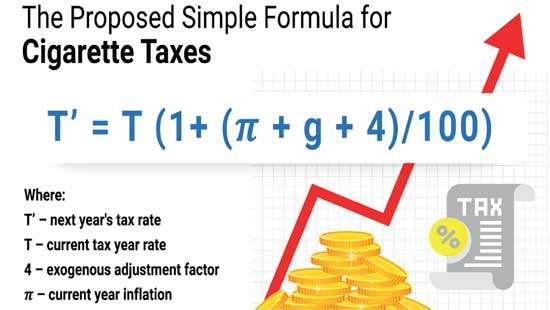

Think-tank builds case for increased tobacco taxation in 2023 Budget

11 Nov 2022

8

8

The upcoming 2023 national Budget must entail policies, which automatically links tobacco taxation rises with the size of the economy and inflation, the Colombo-based think tank, Institute of Policy Studies (IPS) said.

IFS affirms commitment to Sri Lanka; says not deterred by ongoing economic crisis

08 Nov 2022

2

2

At a time when many Sri Lankans are focused on migrating and local businesses relocating their operations to other geographies, having lost their faith in the country beset by the worst economic crisis since its independence, global enterprise software company IFS is determined to stick by Sri Lanka and continue its growth plans in the island nation undeterred.

IFS affirms commitment to Sri Lanka; says not deterred by ongoing economic crisis

08 Nov 2022

0

0

At a time when many Sri Lankans are focused on migrating and local businesses relocating their operations to other geographies, having lost their faith in the country beset by the worst economic crisis since its independence, global enterprise software company IFS is determined to stick by Sri Lanka and continue its growth plans in the island nation undeterred.

ASPI crosses the 15,000 mark for the first time

01 Nov 2022

0

0

SL exits ’Restricted Default’ rating

01 Nov 2022

0

0

SriLankan airlines hosts agents’ tour to Gan island

01 Nov 2022

0

0

Can funds disbursed through President’s Fund be refunded?

01 Nov 2022

0

0

Main schools in Colombo without principals

01 Nov 2022

0

0

Economic crisis stalls five high-rise buildings

01 Nov 2022

0

0