Business Main

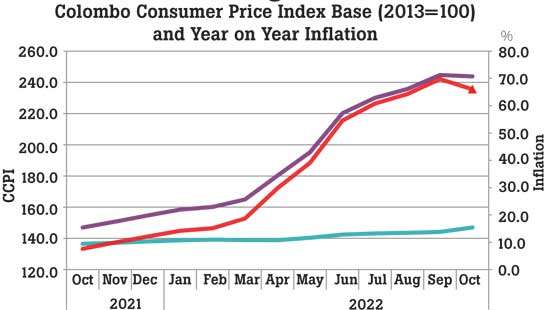

Colombo inflation rate eases to 66% in October

01 Nov 2022

0

0

Inflation in the Colombo district made an about turn in October, bringing an end to the current spell of runaway inflation, which set off more than a year ago when the global commodities prices started rising, caused by the surge in demand amid the supply chain bottlenecks and emergence of foreign currency shortages in the domestic market.

JAAF to strengthen and consolidate relationship with trade unions, apparel workers

29 Oct 2022

0

0

Efforts are underway to bring in measures to firm up and consolidate the relationship between the Joint Apparel Association Forum (JAAF) and trade unions and apparel workers, the apex body of the industry said.

Hoteliers wary of another wave of protests scuttling tourism industry recovery

28 Oct 2022

0

0

Sri Lanka’s hotel sector yesterday asserted it will not tolerate any protests that will eventually result in severe negative implications to the industry, specially at a time when some improvement is seen in international travellers visiting the country.

IMF remains only hope for Sri Lanka to emerge from crisis: CB Governor

25 Oct 2022

16

16

The economic rescue programme with the International Monetary Fund (IMF) remains the only path available for Sri Lanka to emerge from the prevailing economic crisis, as no one else is ready to bail out Sri Lanka, according to Central Bank Governor Dr. Nandalal Weerasinghe.

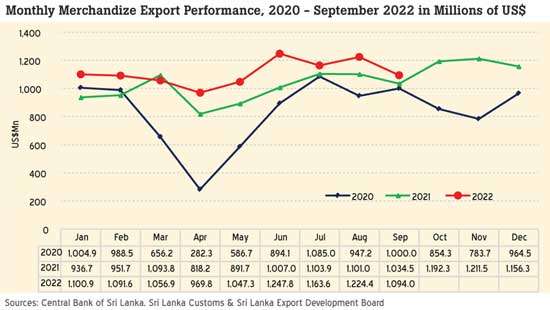

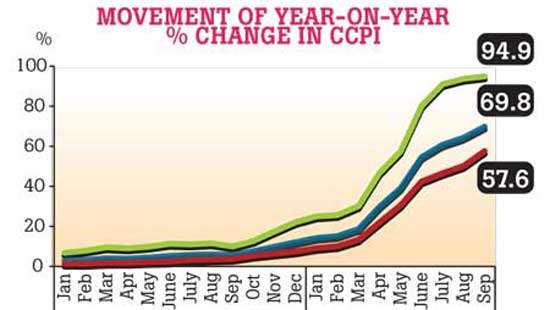

National consumer inflation gallops to 73.7% in potential peak prices in September

22 Oct 2022

3

3

Sri Lanka’s inflation measured by the National Consumer Price Index (NCPI) showed a relentless increase through September, as the prices continued their ascent over and above 70 percent for the second month in a row but the recent monthly price movements have galvanised expectations for the prices to have turned a corner.

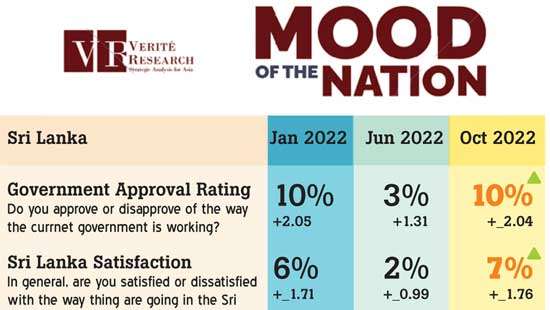

Central Bank estimates further ease in imports as tighter policies take root

21 Oct 2022

3

3

The Central Bank estimated a further decline in imports in September narrowing the trade deficit from the prior month in a clear sign that the policies instituted since April onwards are making the intended adjustments in the country’s external sector which fell into a deep crisis early this year pushing the entire economy off a cliff.

Severe blow to Lankan biz if crisis deepens: Fitch

20 Oct 2022

2

2

The prevailing economic crisis, if deepens or sustained for a prolonged period, could deal a severe blow to many Sri Lankan business sectors, as runaway inflation, elevated interest rates and import restrictions have already pressured their revenues, margins, profits and cash flows, Fitch Ratings said.

Private sector says transparency and accountability should complement tax hike

18 Oct 2022

6

6

While acknowledging the rationale behind the recently proposed higher tax rates, the Ceylon of Chamber of Commerce yesterday urged the government to show greater restraint, accountability and transparency in government spending.

IMF expresses “deep” concern over SL’s current situation

17 Oct 2022

16

16

The International Monetary Fund (IMF) expressed “deep” concern about the current situation prevailing in Sri Lanka and said it hopes it will be able to work fast to end the suffering, specially of the country’s poor and vulnerable.

IMF looking to expand donor coordination for countries such as SL: Georgieva

15 Oct 2022

0

0

As the International Monetary Fund (IMF) is looking to press for a more effective debt resolution mechanism, it is said efforts are underway to also explore avenues that will help expand donor coordination to middle-income countries such as Sri Lanka.

Easing inflationary outlook projected from Oct. onwards

14 Oct 2022

0

0

First Capital Research (FCR) forecasts a possible decline in consumer prices starting from October after inflation was believed to have peaked in September due to muted demand conditions and the likely moderation in the supply side price pressures coming from a looming global economic slowdown.

Sweeping changes to personal and corporate income tax

13 Oct 2022

1

1

Sri Lanka this week gazetted key income tax changes proposed in May, giving effect to a host of personal and corporate income tax hikes while removing concessions and exemptions, with a view to raise government revenues to fix the budget under an International Monetary Fund (IMF)-backed economic rescue programme.

Central Bank pushes back against widespread calls for lower rates

10 Oct 2022

12

12

Pushing back on growing calls by many to cut rates to ease the pain on households and businesses and thereby kick start growth in the economy, the Central Bank last week defended its tight monetary policy as necessary until it s

Sri Lanka still a tourist favourite destination despite challenges

08 Oct 2022

7

7

Sri Lanka faces hardships in the current economic context; however, the island nation has been successful in braving through the challenges and remaining a favourite destination among the travellers across the world.

Central Bank expects sharp deceleration in inflation early next year

07 Oct 2022

0

0

The Central Bank, which kept its key interest rates unchanged yesterday to continue with its bone-crushingly tight monetary policy, said a significant deceleration in inflation is expected in the early part of next year, particularly with higher base effects kicking in.

Lanka poised to become winter escape for European tourists

06 Oct 2022

11

11

With an increasing number of Europeans looking to avoid an expensive winter, due to the skyrocketing energy prices, Sri Lanka’s tourism industry is positioned to grow exponentially in the upcoming winter season, supported by the devalued rupee and recent relaxation of travel advisories, according to the latest report by First Capital Research (FCR).

CB expected to hold rates amid signs of easing price pressures

04 Oct 2022

0

0

The Central Bank is widely expected to hold its key rates steady this week, when the monetary board meets tomorrow (Wednesday) to review its monetary policy for the seventh time of the year, after delivering a cumulative 950-basis-point hike through July, in a bid to tame roaring inflation, which hit almost 70 percent in September.

Colombo inflation flirts with 70% in Sept. as prices surge

01 Oct 2022

6

6

Inflation in capital Colombo, as measured by the year-on-year (YoY) change in the Colombo Consumer Price Index (CCPI), rose to 69.8 percent in September, from 64.3 percent in August, as the crisis-struck nation continues to battle with exorbitant prices.

President says Sri Lanka’s debt restructuring attempt watched by many

30 Sep 2022

0

0

President Ranil Wickremesinghe yesterday said the world is keenly watching how Sri Lanka will recover from the “self-inflicted” economic crisis, the worst in its post-independent history, by negotiating with its creditors for financing assurances to unlock a bailout package from the International Monetary Fund (IMF).

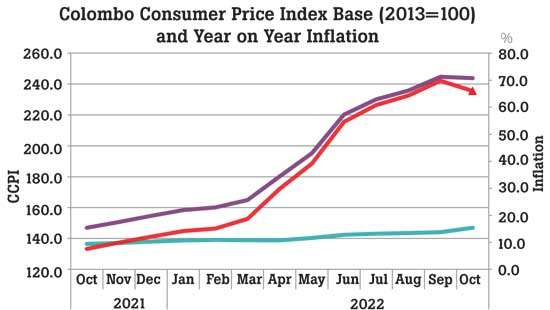

Economic crisis plunges pandemic’s ‘new poor’ below poverty line

29 Sep 2022

4

4

While the pandemic in the last two years created a segment of people identified as ‘new poor’, who were on the brink of poverty, the economic crisis, which soon followed, tipped them down below the poverty line, sending the country’s official poverty levels at least multiple levels higher than what was prior to the pandemic.

Moody’s raises Sri Lanka’s rating

29 Sep 2022

4

4

ASPI crosses the 15,000 mark for the first time

29 Sep 2022

4

4

SL exits ’Restricted Default’ rating

29 Sep 2022

4

4

Moody’s raises Sri Lanka’s rating

29 Sep 2022

4

4

Probe underway as child dies after surgery at J’Pura hospital

29 Sep 2022

4

4

Over 370 jumbos perish in 2024

29 Sep 2022

4

4