Business Main

Social market economy need of the hour for Sri Lanka: President

06 Aug 2022

25

25

Sri Lanka as a nation must step up efforts in establishing a social market economy, so that going forward the people can move forward with the assurance of sustainable growth and development, President Ranil Wickremesinghe said.

Govt. told to use household electricity consumption to determine welfare eligibility

04 Aug 2022

14

14

The leading economists of the Verite Research Sri Lanka Economic Policy Group (SLEPG) called on the relevant authorities to steer away from using Samurdhi as a determinant of eligibility for welfare benefits and instead, consider electricity consumption for targeting vulnerable groups, as it is a superior method.

Immediate government assistance sought to avoid paralysis of tea exports

03 Aug 2022

0

0

The Sri Lanka Tea Board (SLTB) along with industry stakeholders seeks a well-coordinated and synergised mechanism from the government to resolve the fuel and agrochemical shortages threatening Sri Lanka’s tea production and industry sustainability.

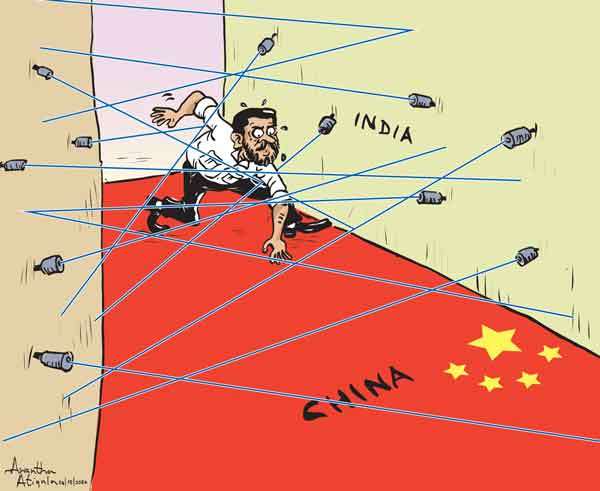

China remains key sticking point in debt restructuring: Fitch

29 Jul 2022

0

0

China continuously pops up as one of the key sticking points for Sri Lanka to reach the much needed debt sustainability as Fitch Rating this week too weighed in on the matter saying that the world’s second biggest economy could complicate the island nation’s debt talks with its creditors.

JKH defies economic crisis to pull off strong June quarter

28 Jul 2022

0

0

John Keells Holdings PLC (JKH) reported some robust top and bottom-line performance in the three months to June (1Q23), despite the multiple vagaries coming from the economic crisis, as the business activity reached its pre-pandemic levels across all segments compared to a year ago when virus-related restrictions dampened the performance.

SL has been on champagne diet with kasippu income, top economist quips

27 Jul 2022

13

13

The status of Sri Lanka’s fast-crumbling economy has been attributed to many factors, but the key reason for the downfall of the island nation is that it has been on a ‘champagne diet with a kassipu income’ for a bit too long, according to a top economist in the country.

Exporters set to face higher freight charges amid acute jet fuel shortage

26 Jul 2022

4

4

Sri Lankan exporters are set to experience increased air freight rates amid capacity constraints stemming from reduced frequencies and limits on payloads, caused by the acute jet fuel shortage in the country.

Sri Lanka faces risk of airlines pulling out as jet fuel issue worsens

25 Jul 2022

2

2

With no credible solution in sight to resolve the jet fuel shortage and the fund repatriation issues faced by the country’s aviation industry, several airlines are contemplating on suspending their operations to Sri Lanka threatening tourism industry’s recovery, which depends on air connectivity.

CCC submits proposal to PUCSL for effective electricity tariff revision

23 Jul 2022

0

0

In order to ensure the implementation of an effective tariff revision, which sustainably addresses Sri Lanka’s energy requirements, the Ceylon Chamber of Commerce (CCC) submitted suggestions and recommendations on the proposed electricity tariffs to the Public Utilities Commission of Sri Lanka (PUCSL) this week.

Crisis-struck SL need not wait for IMF agreement to get fiscal act straight

22 Jul 2022

0

0

Crisis-struck Sri Lanka need not wait for support from the International Monetary Fund (IMF) to get its act straight, and must get about rolling out fiscal reforms at the earliest to help ease the ongoing pressures stemming from economic mismanagement, a former Central Bank official said.

Economic hardships could persist as bridge financing remains a long shot

21 Jul 2022

1

1

The current economic conditions could grind on till Sri Lanka strikes an agreement with the International Monetary Fund (IMF), which will unlock other sources of funding, as bridge financing, which the authorities were hoping for in the interim, remains hard to come by, according to Central Bank Governor Dr. Nandalal Weerasinghe.

CB explains why no blanket debt moratorium this time

20 Jul 2022

0

0

Explaining the reasons why a blanket moratorium could not be deployed to assist the crisis-hit borrowers this time, the Central Bank said its responsibility is to protect the interests of both lenders and depositors and overdoing to protect one’s interests could bring in some unintended consequences to the other and would create imbalances in the banking sector and thereby the overall economy.

IMF directly reaches out to SL’s creditors to find quick resolution

19 Jul 2022

0

0

The International Monetary Fund (IMF) yesterday said it is in the creditors’ interest for them to come on board with efforts to restructure Sri Lanka’s debt faster, as it would ensure they recover their money at a future date when they help to fast-track the country’s re-emergence from the current economic malaise.

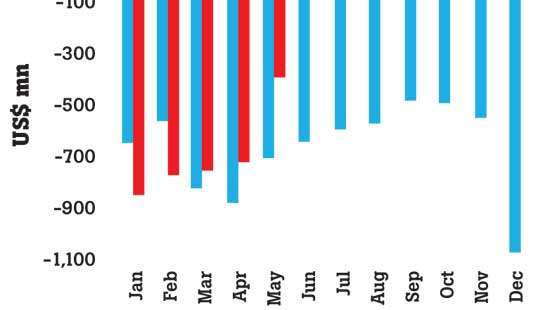

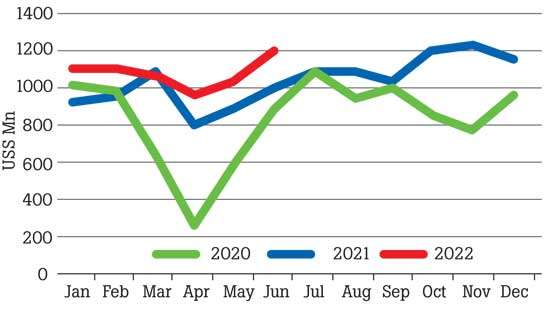

India eclipses China to become top lender to debt-laden Sri Lanka

18 Jul 2022

12

12

India has surpassed China to become the top lender to Sri Lanka, as the former came to the rescue when Sri Lanka started experiencing some acute shortage of foreign currency from the beginning of the year which reached a breaking point in March causing a complete collapse of the country’s economy.

Auction yields slump for third consecutive week

18 Jul 2022

12

12

Moody’s raises Sri Lanka’s rating

18 Jul 2022

12

12

ASPI crosses the 15,000 mark for the first time

18 Jul 2022

12

12

Moody’s raises Sri Lanka’s rating

18 Jul 2022

12

12

Wayside bandits haunt people travelling Malabe-Ambathale road in Colombo

18 Jul 2022

12

12

Probe underway as child dies after surgery at J’Pura hospital

18 Jul 2022

12

12

Over 370 jumbos perish in 2024

18 Jul 2022

12

12