Business Main

Possible recession in eurozone likely to worsen SL’s forex woes

16 Jul 2022

0

0

Fitch Ratings this week warned that Sri Lanka’s export and tourism sectors are likely to take a hit from the possible recession in the eurozone and it could further exacerbate the country’s actuate foreign exchange shortage.

Prospects of SL securing IMF bailout remain bright despite political unrest

14 Jul 2022

3

3

Despite the current leadership vacuum in the country, a reputed economist remains optimistic of the prospects of Sri Lanka securing a rescue package from the International Monetary Fund (IMF) by September-October and following a staff-level agreement expected in about three weeks.

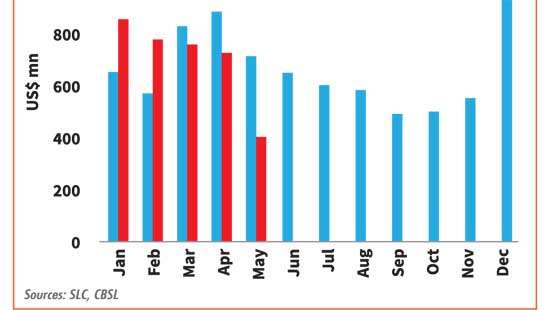

SriLankan Airlines January-April losses at thumping Rs.248bn

13 Jul 2022

6

6

The losses at SriLankan Airlines for the first four months to April topped Rs.248.4 billion in 2022, including one-time exchange loss of Rs.145 billion that came in March due to the collapse of the rupee against the dollar,

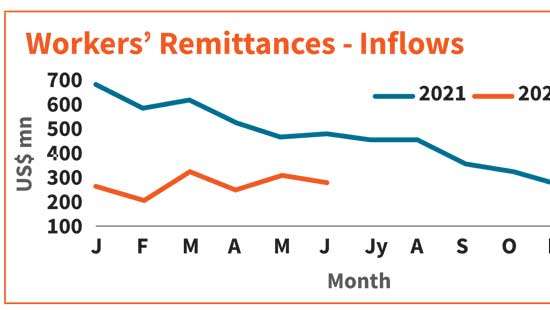

June remittance income wipes out slight gain made in May

11 Jul 2022

0

0

The remittances in June undid even the slightest gains made in May, as the key foreign income earner to the country is continued to be beset by the informal channels, which appear to be still functioning regardless of the actions taken to clamp down on them.

CB keeps doors open for further rate hikes should inflation stays stubborn

09 Jul 2022

0

0

After delivering a much-anticipated rate hike, yet short of the size some expected, the Central Bank said it is ready to take further steps to rein in inflation and bring it to its desired 4 to 6 percent range, which is at least 12 to 18 months away at the best-case scenario and also contingent on global commodities prices.

T-bill yields jump over 400bps signalling another jumbo rate hike today

07 Jul 2022

0

0

In line with the expectations, the Treasury bill yields jumped the most since April, signalling another bumper rate hike announcement today, as the Central Bank allowed the bill and bond yields to go up since last week amid the worsening economic crisis.

PM tells parliament any IMF deal could happen only in Aug.

06 Jul 2022

0

0

Prime Minister Ranil Wickremesinghe yesterday told parliament that any deal with the International Monetary Fund (IMF) could only be struck if and when Sri Lanka shows its plans to restore debt sustainability, which he said could happen by August.

India could bail out SL as IMF rescue package appears to take time- economist

05 Jul 2022

12

12

As China is in dilemma while the rest of the world has qualms over helping Sri Lanka, India could deepen its role in bailing out its debt-strangled neighbour by giving the leadership for the proposed donor consortium,

BOI launches five-year residence visa to entice foreign investors

02 Jul 2022

17

17

In an effort to step up the nation’s game in luring in foreign direct investments (FDI), Sri Lanka’s investment promotion agency, the Board of Investment (BOI), launched yesterday the five-year residence visa programme dedicated to investors.

PUCSL to complete unbundling of CEB’s distribution operations soon

30 Jun 2022

2

2

Undertaking the first major reform in Sri Lanka’s electricity sector since 2002, the Public Utilities Commission of Sri Lanka (PUCSL) this week announced plans to complete the stalled unbundling of the Ceylon Electricity Board’s (CEB) distribution operations into four independent units over the next couple of weeks, with an aim to enhance efficiency and transparency of the country’s electricity sector.

PUCSL asks exporters to settle electricity bills in dollars

28 Jun 2022

0

0

As a partial solution to find the required foreign currency to maintain power generation at the Norochcholai coal power plant, the Public Utilities Commission of Sri Lanka (PUCSL) is asking all exporters, including services exporters, to settle their monthly electricity bills in US dollars.

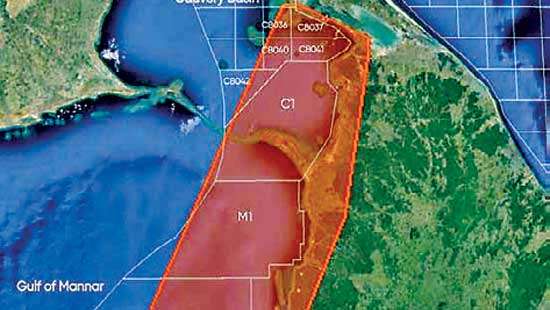

First aerial mapping of SL petroleum resources to be presented at SEAPEX confab

25 Jun 2022

12

12

Bell Geospace, the world leaders in gravity gradiometry, is gearing up to present the insights gathered from the first aerial mapping of petroleum resources in Sri Lanka at the prestigious South East Asia Petroleum Exploration Society (SEAPEX) Asia Pacific Conference in London.

Pressure mounts on Treasury yields again as economic woes run deeper

24 Jun 2022

0

0

Bucking the weeks-long trend, upwards pressure was seen again on Treasury yields this week as primary dealers and bond investors bid higher amid the worsening economic crisis, which has engulfed the entire country, bringing it to its knees.

Soaring interest rates seen forcing banks to delay or cancel bond issuances

23 Jun 2022

0

0

The soaring interest rates triggered by the jumbo key rate hike on April 8 have prompted the banks to either delay or cancel their corporate bond issuances as part of their Tier II capital enhancement journey, according to the banking industry sources.

Dollar crunch unravels SL’s decades-long transport crisis

22 Jun 2022

4

4

Sri Lankans are in a catch-22 situation as they neither can use their private vehicles nor take public transport after decades of neglect and underinvestment in the latter, which was allowed to decay to its current dilapidated state, according to a transport sector expert.

Early fiscal data points to another year of blowout budget deficit in 2022

21 Jun 2022

0

0

The early data available on the government’s fiscal performance in the first two months of 2022 indicated signs of yet another year of blowout budget deficit in 2022, after three back-to-back years of gaping budget holes, which was partially responsible for the current seismic economic crisis.

Sri Lanka comes to grinding halt as fuel runs out

20 Jun 2022

0

0

Sri Lankan economy comes to a complete standstill from today as the country has run out of fuel, bringing all economic activities to an abrupt halt as the government declared holiday for most State sector services, suspended schools and universities and asked the private sector to work-from-home.

May PMI subdued as economic crisis batters manufacturing and services activities

17 Jun 2022

0

0

The economic crisis, which precipitated into an all out civil unrest, took massive toll on the country’s manufacturing and services activities in May with factories scaling down operations and people losing jobs in what appears to be a forerunner for a deeper contraction in the Sri Lankan economy in the scale that it has never seen before.

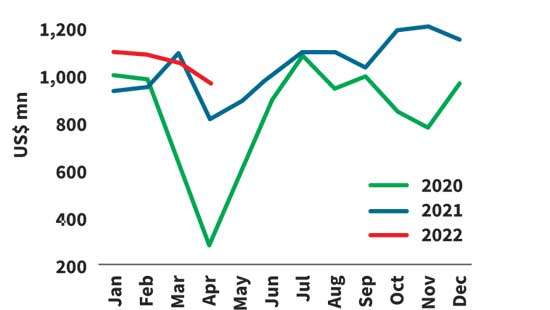

SL’s BOP hole deepens as foreign inflows run dry

16 Jun 2022

0

0

Sri Lanka more than doubled its deficit in the balance of payment (BOP) in the first four months compared to the same period in 2021, as imports raced, remittances sank, direct investments fizzled out and the expected borrowings didn’t come through.

April imports show stubbornly high food bill sparking SL’s food security concerns

15 Jun 2022

0

0

April external sector aptly demonstrated Sri Lanka’s over-reliance on imports for basic needs such as food, power and energy, and transport as expenditure on such categories stood out stubbornly high, making a strong case for the country to change its track if it is to emerge out of the current economic crisis, the worst in its post-independence history.

Remittance income up in May from April signalling positive trend

13 Jun 2022

2

2

Worker remittances to Sri Lanka recovered from April levels, but still stand significantly below what the country received a year ago, reflecting the lingering challenges facing the authorities in restoring confidence in getting expatriates to use the official banking channels more when repatriating their moneys, which will directly help to import food, fuel, cooking gas and medicines.

Dhammika Perera exits boardroom to enter Parliament

11 Jun 2022

0

0

Ending weeks of speculation, business tycoon Dhammika Perera yesterday resigned from the director boards of a number of listed companies he controls, where he served in the capacity of Chairman or Co-Chairman, to make way for his entry into politics.

PUCSL says will not allow unfavourable PPAs with private sector developers

10 Jun 2022

0

0

Sri Lanka’s power sector regulator, the Public Utilities Commission of Sri Lanka (PUCSL) stressed that it would not allow the Ceylon Electricity Board (CEB) to enter into power purchase agreements (PPAs) with the private sector developers, including India’s Adani Group, violating the least cost principle.

Auction yields slump for third consecutive week

10 Jun 2022

0

0

Moody’s raises Sri Lanka’s rating

10 Jun 2022

0

0

ASPI crosses the 15,000 mark for the first time

10 Jun 2022

0

0

Moody’s raises Sri Lanka’s rating

10 Jun 2022

0

0

Wayside bandits haunt people travelling Malabe-Ambathale road in Colombo

10 Jun 2022

0

0

Probe underway as child dies after surgery at J’Pura hospital

10 Jun 2022

0

0

Over 370 jumbos perish in 2024

10 Jun 2022

0

0