Business Main

PM requests IMF to expedite rescue package as Sri Lanka runs out of cash

09 Jun 2022

0

0

Prime Minister Ranil Wickremesinghe in his capacity as the Finance Minister has requested International Monetary Fund (IMF) Managing Director Kristalina Georgieva Tuesday evening to expedite the process of staff-level agreement, which would then pave the way for the rescue package at least by September.

PM presents comprehensive reform package to emerge from worst crisis

08 Jun 2022

0

0

Presenting what appears to be a comprehensive reform package, Prime Minister Ranil Wickremesinghe yesterday charted a three-phased path for the country to emerge from the current economic abyss caused by the pandemic, which was then compounded by extremely poor economic management.

Daily guidance on dollar/rupee rate has brought in greater stability to forex market: CB

07 Jun 2022

0

0

The Central Bank yesterday said the daily guidance rate released on the exchange rate between the United States dollar and Sri Lankan rupee is delivering the intended results by way of bringing in greater stability to the domestic foreign exchange market, which otherwise would have delivered disastrous implications, due to the rupee’s free fall.

Printing money similar to giving high dose of sugar to diabetic

06 Jun 2022

5

5

Taking a swipe at Prime Minister Ranil Wickremesinghe’s repeated comments to the effect of the government having to rely on printed money to pay for essential government bills such as payment of salaries and pensions in the ensuing months, the former Central Bank Deputy Governor, Dr. W.A. Wijewardena likened it to giving sugar to a diabetes patient, to reflect the severity of the move in aggravating the current problems in the economy.

CB says open account suspension won’t cause huge shortages

31 May 2022

0

0

Shrugging off concerns raised by various parties that the restrictions imposed on Open Account Payment Terms would lead to a large-scale shortage of essential food items, the Central Bank yesterday assured the public that it would ensure availability of foreign exchange through the banking system for the importation of essential goods, including food items.

Tourism sector presents ‘Revival for Survival’ plan for quick recovery

28 May 2022

11

11

The hard-hit tourism sector has formulated a strategy document, the ‘Revival for Survival’ plan, to help support the industry through the ongoing economic crisis and move towards a positive work trajectory at the earliest.

IMF seeks assurance of debt sustainability prior to any lending

27 May 2022

0

0

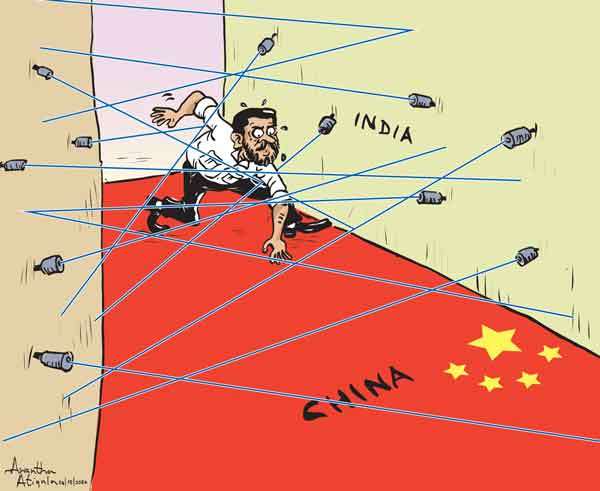

Following the conclusion of the IMF Staff virtual mission to Sri Lanka, the multilateral lender yesterday said Sri Lanka needs to restore debt sustainability prior to any kind of lending to the crisis-stricken island nation.

Premier says he will slash expenditure in new budget

26 May 2022

0

0

Sri Lanka’s new Prime Minister Ranil Wickremesinghe, who was also appointed as the country’s Finance Minister yesterday, said he would present an interim budget within six weeks, slashing infrastructure projects to reroute the funds into a two-year relief programme for the crisis-hit island nation.

Sri Lanka returns to fuel pricing formula partially ending subsidy regime

25 May 2022

4

4

With State-owned Ceylon Petroleum Corporation (CPC) struggling to finance fuel imports amid steep losses, Sri Lanka has returned to a cost-reflective fuel pricing formula partially ending an uneven subsidy regime after over two years, resulting in a record increase in fuel prices

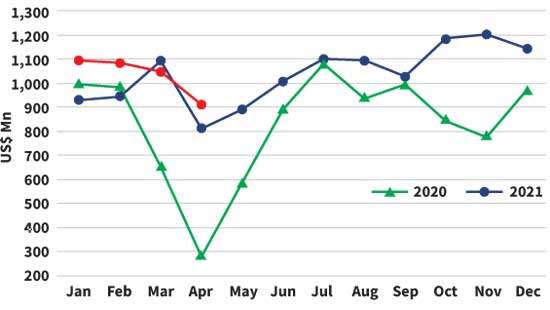

Merchandise exports set new April record despite setbacks

24 May 2022

0

0

Despite the multiple challenges from fuel and power shortages to social unrest, Sri Lanka’s merchandise exports set a new record in April, recording the highest ever export value for the month supported by the floating of rupee exchange rate in the previous month.

Planters fear Ceylon Tea suffering fate of SL tourism

19 May 2022

0

0

The Planters Association of Ceylon yesterday expressed fear in the fate of Ceylon Tea being similar to that of the tourism sector, as the relevant authorities continue to fail to acknowledge, let alone manage the hardships faced.

Stocks up on hopes of political stability with new PM appointment

14 May 2022

0

0

The Colombo bourse bounced back yesterday strongly on the back of renewed optimism amid prospects for political stability in the country with the appointment of United National Party Leader Ranil Wickremesinghe as the new Prime Minister.

Grey market crackdown alone could bring some sanity to forex market: CB

13 May 2022

0

0

Re-channeling foreign exchange flows into the formal banking sources alone could solve the bulk of the problems in the domestic foreign exchange market liquidity as over 25 percent of foreign currency transactions take place outside the banking system, according to the Central Bank Governor.

CB says time running out; calls for political stability

12 May 2022

0

0

The Central Bank yesterday made a fervent appeal from all elected representatives, including Executive President Gotabaya Rajapaksa, to make way to establish political stability, rule of law and civic order immediately, to ensure that people’s economic sufferings wouldn’t worsen anymore.

SL to run blowout budget deficit for third straight year

10 May 2022

0

0

After two years of massive budget deficits, Sri Lanka is on its way to record another blowout budget deficit in the current year, with the deficit estimated for 2022 at 10.2 percent of gross domestic product (GDP), the estimates by the Central Bank showed.

Tourism Min. gives stern warning to SLTDA, SLAITO heads

07 May 2022

5

5

As matters are becoming increasingly ugly between the Sri Lanka Tourism leadership and private sector stakeholder, the Tourism Ministry has sternly requested the two parties to immediately put a stop to the public mudslinging.

Sabry paints gloomy economic outlook for next two months

05 May 2022

0

0

Presenting what could be the most honest account by a ruling party member of the depth of the economic crisis faced by Sri Lanka at present, Finance Minister Ali Sabry yesterday proposed a slew of policy reforms capable of correcting the course of the economy, including a new budget to be presented in Parliament, containing higher taxes.

SL likely to restore pre-2020 tax regime as govt. to put economy back on track

04 May 2022

0

0

As Sri Lanka is now compelled to make some tough choices to put its economy back on track, both the Finance Ministry and Central Bank officials are calling for higher taxes as part of a crucial fiscal reforms package, while the talks with the International Monetary Fund (IMF) continue for a rescue package.

CB may relax forced Fx conversion rule as evidence shows opposite results

02 May 2022

0

0

In a bid to restore normalcy in the domestic foreign exchange market and thereby enhance its liquidity, the Central Bank could relax the mandatory conversion requirement on foreign currency in place for merchandise exports and services.

Auction yields slump for third consecutive week

02 May 2022

0

0

Moody’s raises Sri Lanka’s rating

02 May 2022

0

0

ASPI crosses the 15,000 mark for the first time

02 May 2022

0

0

Moody’s raises Sri Lanka’s rating

02 May 2022

0

0

Wayside bandits haunt people travelling Malabe-Ambathale road in Colombo

02 May 2022

0

0

Probe underway as child dies after surgery at J’Pura hospital

02 May 2022

0

0

Over 370 jumbos perish in 2024

02 May 2022

0

0