Business Main

CB to suspend forex payments outside banking system

30 Apr 2022

11

11

The Central Bank yesterday announced a slew of measures in a bid to ride the current economic emergency, caused by the severe dearth in foreign currency in the domestic market, until any deal could be struck with the International Monetary Fund (IMF) for a rescue package.

UNDP proposes ‘debt-for-nature swaps’ to tackle SL’s debt problem

29 Apr 2022

0

0

Adding to the ways and means, which Sri Lanka could explore to restructure its foreign currency debt, the country has been presented with the option to forgo part of its debt in return for its aggressive commitment towards environmental conservation and investments in climate-related projects.

IMF assures support; but immediate funding assistance unlikely

25 Apr 2022

0

0

The International Monetary Fund (IMF) releasing a statement during the weekend after the first round of technical level talks with Sri Lankan authorities in Washington, expressed its willingness to engage with Sri Lanka for a medium term economic stabilisation package, but fell short of providing specifics of the timelines and the size of a potential programme support.

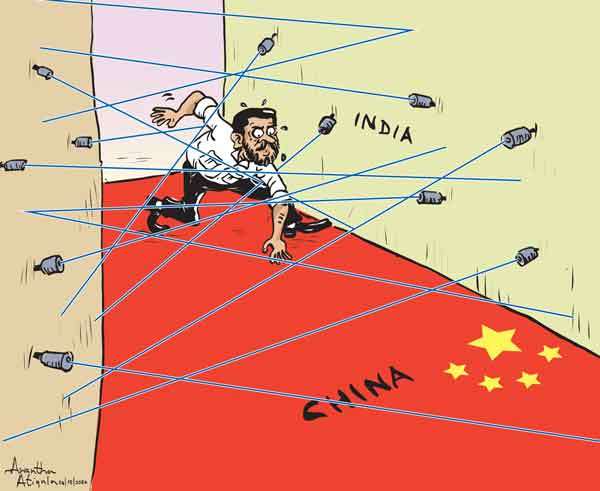

India extends duration of US $ 400mn currency swap

23 Apr 2022

0

0

Sri Lanka yesterday received the much-required breathing space in managing its foreign reserves with neighbouring giant India continuing to lend a helping hand to help brave through the worst economic crisis faced since independence.

Economist highlights 3 key prerequisites to resolve economic crisis

22 Apr 2022

0

0

Authorities need to expedite the process of finding solutions to the country’s economic issues if the hardships faced by people currently are to be eased at the earliest, according to Verité Research chief Dr. Nishan de Mel.

IMF says any loan to Sri Lanka requires debt sustainability

21 Apr 2022

0

0

The International Monetary Fund (IMF) said discussions with Sri Lanka on a potential IMF loan programme are at an early stage and any deal would require “adequate assurances” that the island country’s debts can be put on a sustainable path.

Private sector calls for repealing of 20A to end political deadlock

20 Apr 2022

0

0

In a letter addressed to President Gotabaya Rajapaksa, Sri Lanka’s private sector represented by the joint chambers yesterday urged the President to immediately initiate legislative action to repeal the 20th Amendment to the Constitution, to end the current political deadlock.

Broker, margin credit rules to be relaxed to mitigate pressure on forced selling

19 Apr 2022

0

0

With a view to mitigate the pressure on forced selling, following Sri Lanka’s decision to opt for a pre-emptive default on its external debt, the Colombo Stock Exchange (CSE) and Securities and Exchange Commission (SEC) are in the process of relaxing the rules on broker credit and margin credit limits temporarily when the market opens next week, top officials said.

Temporary stock market closure sparks debate

18 Apr 2022

1

1

A debate has been sparked by the stock market watchdog Securities and Exchange Commission’s (SEC) decision to close the market for five days starting from today at the request of the board of directors of the Colombo Stock Exchange (CSE) and some stockbrokers.

Sudden float of rupee was a bad idea: new CB Governor

12 Apr 2022

10

10

Weighing in on the recent rupee float, which has caused severe hardships to people, as prices rose by many multiples within a matter of weeks, the newly-appointed Central Bank Governor Dr. Nandalal Weerasinghe said how it was done raises questions at so many levels.

Sri Lanka’s inflation to peak at 28% in coming months before subsiding

11 Apr 2022

0

0

Sri Lanka’s headline inflation could peak at 28 percent in the next couple of months from the 18.7 percent in March, as the full effects of the rupee float and the festive demand amid higher global commodities prices could set off a lengthy stretch of hotter prices.

CB sends shockwaves with 700bps policy rate hike to arrest inflation

09 Apr 2022

22

22

The Monetary Board of the Central Bank under the newly-appointed Governor Dr. Nanadalal Weerasinghe yesterday delivered a whopping 700 basis point policy rate hike, though many expected a milder hike in the range of 200 to 300 basis points.

Biz chambers, associations call for interim government to avoid economic collapse

08 Apr 2022

0

0

A letter has been sent to Speaker of Parliament by 38 private sector business chambers and associations that represent vital sectors of the economy calling for an interim government to end the ongoing social, political and economic instability.

Political uncertainty exacerbates SL’s external crisis: Moody’s

07 Apr 2022

0

0

Moody’s Investors Service yesterday warned that prolonged political uncertainty and the resignation of key officials could hinder Sri Lanka’s ability to obtain external financing to repay its sizeable foreign debt, thereby exacerbating the risk of a debt default for the country.

Power crunch runs deeper than dollar shortage- energy expert

06 Apr 2022

0

0

Sri Lanka’s power sector crisis cannot be resolved in the immediate future nor in the short-term while no amount of dollars would end the daily power cuts that are currently in force, according to a leading power and energy sector expert.

SL’s hope for economic stability under IMF hangs in balance

04 Apr 2022

0

0

With the government resorting to anti-democratic measures to curb the wave of protests emerging across the country against the mishandling of the economy, Sri Lanka’s hopes for economic stability under an International Monetary Fund (IMF) programme hang in the balance.

Govt. assures uninterrupted power and fuel supplies to BOI firms in EPZs

02 Apr 2022

0

0

Aviation and Export Zones Development State Minister D.V. Chanaka assured the power disruptions and fuel shortages faced by the companies in the BOI Export Processing Zones would come to an end shortly. He shared that the shortages are likely to come to end by next week.

Expedite debt restructuring to address forex shortage: Ceylon Chamber

01 Apr 2022

0

0

The Ceylon Chamber of Commerce yesterday reiterated the need for the government to address the foreign exchange shortage urgently by expediting the debt restructuring process as it will halt any future principal and interest payments of debt and allow the reserves available to meet immediate needs of the people.

Apparel sector offers to pay in dollars to procure diesel for generators

31 Mar 2022

0

0

As industries are on the brink of cracking under the pressure of having to deal with the ongoing fuel shortages and power cuts, Sri Lanka’s apparel sector has extended a proposal to the authorities to procure diesel paying on US dollar.

Worker remittances income sinks to fresh low in February

28 Mar 2022

0

0

Worker remittances income sank to a fresh low in February, continuing its poor performance for the ninth consecutive month, but the flexibility introduced to the exchange rate on March 7 gave is expected to reverse this trend at least to some extent from March onwards.

SL’s private businesses lag in adopting modern technology: UN report

26 Mar 2022

0

0

Despite having grappled with the new working patterns that companies were pushed to take up due to the COVID-19 pandemic, Sri Lanka’s formal private businesses appear to lag in the adoption of modern technology in business operations.

Sri Lanka advised not to restructure domestic debt

25 Mar 2022

0

0

As Sri Lanka is gearing up for a major exercise with the International Monetary Fund (IMF) to restructure its debt, the government must be firm in its negotiations with the multilateral lender to avoid any proposals to restructure its domestic debt, a top economist opined.

SL on right track; but things will get worse before becoming any better: economists

24 Mar 2022

0

0

Sri Lanka’s willingness to accept expert assistance to come out of the worst economic crisis since its independence puts the country on the right track but any positive outcome will not be reaped before a tough and painful journey, opine two leading economists.

SL to hire int’l law firm to assist debt restructuring

23 Mar 2022

0

0

In line with the policy decision taken to seek International Monetary Fund’s (IMF) assistance, the government is moving to hire an international law firm on long-term basis to obtain technical assistance to restructure the country’s external debt with IMF backing.

Sri Lanka risks stagflation as prices continue to soar

22 Mar 2022

0

0

Sri Lanka appears to be entering into an era of extremely high inflation and low growth, stoking serious concerns of stagflation, as the policymakers seem to have lost their grips on the economy, which is now going haywire with endless shortages of commodities and long lines of queues for daily essentials, which now have proved to be deadly for some unfortunate senior citizens.

Auction yields slump for third consecutive week

22 Mar 2022

0

0

Moody’s raises Sri Lanka’s rating

22 Mar 2022

0

0

ASPI crosses the 15,000 mark for the first time

22 Mar 2022

0

0

Moody’s raises Sri Lanka’s rating

22 Mar 2022

0

0

Wayside bandits haunt people travelling Malabe-Ambathale road in Colombo

22 Mar 2022

0

0

Probe underway as child dies after surgery at J’Pura hospital

22 Mar 2022

0

0

Over 370 jumbos perish in 2024

22 Mar 2022

0

0