Business Main

Central Bank sold nearly US$ 600mn in forex to defend rupee before letting it go

21 Mar 2022

12

12

In the two months to February, the Central Bank had sold nearly US$ 600 million in foreign currency to maintain the currency peg with the United States dollar at 198/203 levels before letting it go from March 7, as maintaining peg at that level became untenable.

BoP deficit hits all-time high of US$ 4bn in 2021

18 Mar 2022

0

0

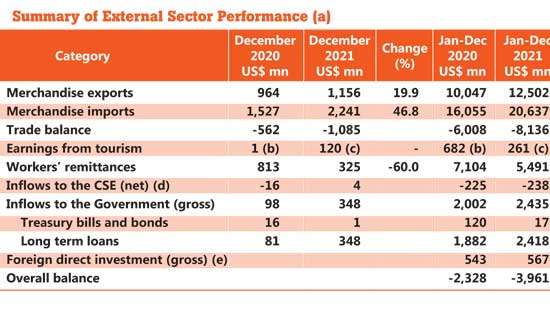

Sri Lanka has reported a record balance of payment (BOP) of US$ 3, 961 million for 2021, nearly doubling from US$ 2, 328 million in 2020, as the country’s merchandise import bill surged to a three-year high while it lost key tourism and remittance income due to the pandemic.

President announces decision to work with IMF

17 Mar 2022

0

0

Addressing the nation, President Gotabaya Rajapaksa yesterday announced his decision to work with the International Monetary Fund (IMF) to explore a sustainable solution for the country to repay its foreign debt and build back its foreign reserves.

Sri Lanka ends single-digit interest rate era as average lending rate jumps above 10%

15 Mar 2022

0

0

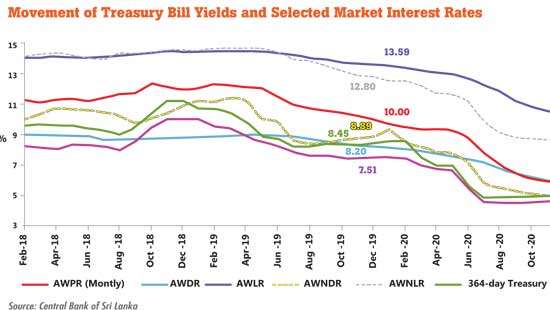

The average lending rate of commercial banks jumped above 10 percent in the final week of January, well ahead of the March policy rate hike, indicating that the era of single-digit interest rates is effectively over for Sri Lanka after a short-lived cycle.

Russia-Ukraine conflict seen as biggest short-term impediment for SL tourism

12 Mar 2022

0

0

The local tourism should brace itself to face a major impediment in relation to outbound travel and prolonged absence of tourists, especially from Russia and Ukraine, due to the ongoing conflict between the two countries.

COVID moratoria to be unwound from April 1

10 Mar 2022

0

0

The payment holidays on loans of the pandemic-affected borrowers and other relief afforded to them during the pandemic, which were extended a few times, will expire effective from April 1 and specific instructions to banks in this regard will be issued shortly.

CB continues to resist IMF-led debt restructuring to end foreign exchange crisis

07 Mar 2022

7

7

The Central Bank is still disinclined to recommend to the government to seek International Monetary Fund (IMF) support for a rescue package and foreign currency debt restructuring even amid the country in a deeper foreign exchange crisis, which has resulted in unending fuel shortages and power cuts.

Central Bank delivers 100bps rate hike to fight forex crisis

05 Mar 2022

0

0

The Central Bank of Sri Lanka (CBSL) raised its key policy rates by 100 basis points, delivering its highest rate hike in more than a dozen years and raised selected administrative rates by 200 basis points effective immediately.

IMF spells out reforms required for SL to overcome current economic crisis

04 Mar 2022

0

0

The International Monetary Fund (IMF) said Sri Lanka must raise interest rates and taxes, gradually float the exchange rate, market price utilities and reform unproductive State enterprises to reduce debt burden, rebuild reserves to come out of the prevailing economic mess that it has dug itself into.

SL risks running out of life-saving medicines, warn pharma importers

03 Mar 2022

5

5

With the pharmaceutical stocks rapidly diminishing, the Sri Lanka Chamber of Pharmaceutical Industry (SLCPI) yesterday warned of a looming shortage of critical life-saving medicines in the market within the next two to six weeks, due to the worsening foreign exchange crisis and in the absence of a fair pricing formula for pharmaceutical products.

Tea exports to Russia and Ukraine come to grinding halt

02 Mar 2022

1

1

Amid the on-going conflict between Russia and Ukraine where Western nations have imposed sanctions on Russian banks, Ceylon Tea exports to Russia and Ukraine, which account for 10 percent of the country’s tea exports, have come to a grinding halt.

Tourism sector to face another setback with Ukraine crisis

01 Mar 2022

0

0

Sri Lanka’s reviving tourism industry is likely to hit another stumbling block, due to the ongoing invasion of Ukraine by Russia. The conflict will have direct implications on the number of tourist arrivals into the island nation.

Worker remittance bleeding continues despite incentives

28 Feb 2022

0

0

The worker remittance income plummeted in January, continuing the months-long bleeding in the largest foreign income earner to the country, reflecting that the incentives offered by the authorities haven’t been effective in wooing migrants to use the official banking channels.

Market-driven price formula urged to pull SL out of darkness

26 Feb 2022

0

0

Pulling Sri Lanka out from the darkness it has plunged into requires a market-driven price formula. The mechanism is necessary for the nation to effectively steer away from an energy crisis, an independent economic think tank said.

National inflation surges to 16.8% in January

23 Feb 2022

0

0

In line with Colombo prices, the national consumer prices too climbed in January reaching its highest levels since officials began compiling data for the index in October 2015 as food prices climbed and the non-food prices continued to gain pace.

Tourist hotels oppose blackouts on large-scale electricity users

18 Feb 2022

9

9

Sri Lanka’s hotel sector yesterday asserted that the proposed blackouts for large-scale electricity consumers will be detrimental for the tourism industry, given that it is only beginning to slowly recover from the massive hit experienced in the last two years.

Government to negotiate with China, Japan and ME for imports, export inputs

17 Feb 2022

0

0

Amid the ongoing foreign exchange crisis, President Gotabaya Rajapaksa has appointed three Cabinet Sub-Committees chaired by Foreign Relations Affairs Minster Prof. G.L. Peiris to lead negotiations with China, Japan and the Middle East, to secure imports of essential food items and export inputs.

Sri Lanka’s 2021 remittance record worst in South Asia

14 Feb 2022

0

0

A comparison of remittance inflows to selected South Asian nations between 2020 and 2021 showed Sri Lanka has had the worst record with negative growth in inflows last year, reflecting diverging fortunes between nations based on their foreign exchange policy.

Record trade deficit in Dec. as imports top US $ 2bn

12 Feb 2022

0

0

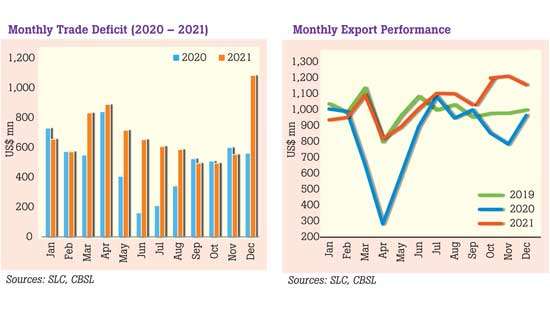

Sri Lanka recorded its highest monthly trade deficit in December 2021, as imports surged to their highest ever monthly value amid significantly increased expenditure on oil imports, the trade data released by the Central Bank showed.

DCS survey shows grave impact lockdowns had on employment

11 Feb 2022

0

0

The lockdowns and the subsequent restrictions on economic activities had an enormous impact on the employed population in all sectors with at least 7 percent of the paid workers having either lost or quit their employment during the first cycle of lockdowns alone, a survey showed.

Auction yields slump for third consecutive week

10 Feb 2022

9

9

Moody’s raises Sri Lanka’s rating

10 Feb 2022

9

9

ASPI crosses the 15,000 mark for the first time

10 Feb 2022

9

9

Moody’s raises Sri Lanka’s rating

10 Feb 2022

9

9

Wayside bandits haunt people travelling Malabe-Ambathale road in Colombo

10 Feb 2022

9

9

Probe underway as child dies after surgery at J’Pura hospital

10 Feb 2022

9

9

Over 370 jumbos perish in 2024

10 Feb 2022

9

9