Business Main

Foreign reserves find way back to over US $ 3bn

30 Dec 2021

0

0

In accordance with the repeated assurances given by the officials to their ability to increase the country’s foreign currency reserves up to US $ 3.0 billion by the end of the year, the Central Bank yesterday said that the reserves had reached to around US $ 3.1 billion as of December 29 and would remain at that level through the remainder of the year.

Banks ordered to surrender 25% of foreign currency receipts

28 Dec 2021

5

5

The Central Bank yesterday ordered the licensed banks to surrender 25 percent of the foreign currency they receive from a variety of sources on a weekly basis, raising the hitherto prevailed requirement of 10 percent and 20 percent in certain cases.

Budget deficit hits Rs.1.33tn end of 3Q as revenue dries up

27 Dec 2021

0

0

The fiscal deficit continued to expand in the nine months through September 2021 on the back of revenue shortfalls, which were sharper than expected due to the pandemic-induced economic restrictions and sweeping tax cuts in 2019, and the expenses which kept going up, despite some restraint seen over the same period last year.

Export proceeds repatriation rule takes hold as November figures double

24 Dec 2021

0

0

The revised export proceeds repatriation and conversion rule that came into effect end of October appears to be bringing the desired outcomes as Central Bank is seeing the reparations of dollars from exports having doubled during November.

Private sector fires salvo at government

23 Dec 2021

0

0

The authorities were urged yesterday to take immediate remedial actions to rectify the current foreign exchange crunch faced by Sri Lanka, as the country’s private sector appears to be running out of patience with the government’s mishandling of the situation.

Banks instructed to offer extra Rs.10 for hard foreign currency conversions

22 Dec 2021

12

12

Licensed banks have been asked to offer extra Rs.10 for foreign currency notes “held in hand”, as part of a broader incentive package offered to encourage the general public to channel all their foreign currency through the formal banking system.

GRI acquires Protyre in the Baltics

20 Dec 2021

0

0

GRI recently acquired specialty tyre company Protyre in the Baltics. With the acquisition of Protyre in Estonia, and together with its previous acquisition of Nortire, GRI has now strengthened its position to service material handling, agriculture, and OEM customers throughout the Balics region.

Elevated prices to persist through next few months

18 Dec 2021

11

11

Credit rating agency ICRA Lanka said consumer prices, which hit nearly a decade high last month, indicate that the economy might have entered an era of higher prices and the trend could persist in the next few months, proving that it is no longer transitory as repeatedly claimed by the Central Bankers.

November Purchasing Managers’ Index signals rapid economic expansion following easing of restrictions

17 Dec 2021

0

0

The Purchasing Managers’ Index (PMI) for both manufacturing and services activities expanded in November, signalling recovery in economic activities, though risks remain from the evolving pandemic, high external indebtedness and soaring prices.

Vehicle importers call on government to regulate trade

15 Dec 2021

7

7

The government was called on to regulate the importation of motor vehicles by the Vehicle Importers Association of Sri Lanka (VIASL), so that local consumers are safeguarded against “seasonal” importers and malpractices in the trade.

Broad SOE reforms urged for SL to regain confidence of external creditors

13 Dec 2021

0

0

With the government’s current approach appearing to be failing in its ability to meet upcoming external debt servicing commitments, the Colombo-based policy think tank Advocata Institute urged the government to roll out a broad reform package targeting ‘strategically important’ State

Foreign currency salary earners up in arms over conversions by banks

11 Dec 2021

1

1

Sri Lanka’s service exporters, including resident Sri Lankans, who receive their earnings in foreign currencies through the banking channels, have started to protest against the conversions of their foreign currency earnings by banks, under the new export proceeds repatriation rules imposed by the Central Bank (CB).

Basil firm on strict austerity measures

10 Dec 2021

2

2

Finance Minister Basil Rajapaksa yesterday said the government wouldn’t soften the strict austerity measures announced in the Budget 2022, which includes a freeze on new public sector recruitments, and stressed that the government is in no position to loosen up these measures given the narrowing fiscal space.

Foreign reserves plummet to US $ 1.6bn

09 Dec 2021

0

0

The foreign exchange reserves held by the Central Bank has touched a fresh low in November after continuously falling for last three months, on account of foreign currency obligations, which came up for retirement, stoking serious concerns over the ability of the country to ride over the foreign debt crisis without a hard landing of its economy. According to the latest o

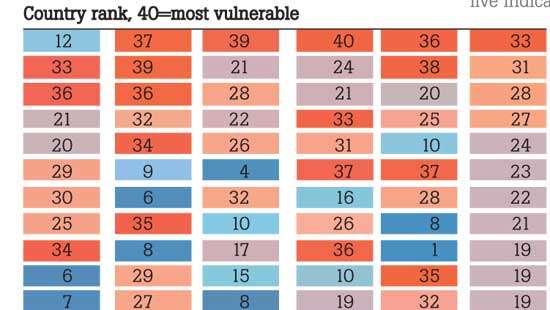

Sri Lanka among most vulnerable to US Fed policy pivot

08 Dec 2021

0

0

The Economist ranked the Sri Lankan economy among the most vulnerable nations to the change in monetary policy by the United States (US) Federal Reserve next year, a move which could tighten liquidity conditions for emerging markets and the broader developing world.

Seeking outside help on bended knees won’t solve SL’s debt woes: Cabraal

07 Dec 2021

15

15

Central Bank Governor Ajith Nivard Cabraal sees a rare silver lining for the country to transform its external sector and the debt profile to a much resilient and sustainable position, with the unique approach taken by the government to emerge out of the current external sector crisis, instead of bending the knees to the International Monetary Fund (IMF).

Mix of strong-arm tactics and charm to restore worker remittance inflows

06 Dec 2021

0

0

The Central Bank (CB) plans to restore official worker remittance inflows by clamping down on unofficial money transmission channels such as ‘Hawala’ and ‘Undiyal’ systems while offering a special incentive package to Sri Lankan expatriates to remit their foreign currency earnings through official channels.

Sri Lanka to capitalise on India’s Neighbourhood First policy to gain assistance

04 Dec 2021

0

0

Capitalising on India’s ‘Neighbourhood First’ policy, Finance Minister Basil Rajapaksa, during his recent visit to New Delhi, firmed up the need for cooperation in four key areas that would help the island ease the hiccups it faces at present.

Blockbuster Sept. earnings season comes to close

03 Dec 2021

0

0

Bringing a blockbuster earnings season to a close, Sri Lanka’s listed companies have delivered robust earnings for the quarter ended in September 2021 indicating that big corporates have largely built resilience and have acclimatised with the new economic order characterised by intermittent restrictions and lockdowns.

CB expects to end 2021 with over US $ 3.5bn foreign reserves

02 Dec 2021

0

0

The Central Bank says it would end the year with over US $ 3.5 billion in foreign exchange reserves, recouping from the recent depths they fell in September and October, as several bilateral funding lines are expected to be realised while the collections from non-debt-creating inflows from remittances and exports have seen a notable increase as of late.

Jan-Aug. deficit hits Rs.1.12tn as revenues undershoot budget

01 Dec 2021

0

0

Sri Lanka’s fiscal deficit expanded to over Rs.1.12 trillion in the first eight months in 2021 compared to about Rs.975 billion in the same period last year, as the pandemic and its prolonged lockdowns deprived the government of its revenues, while its expenditure sored to contain the virus and support the affected.

SL’s worker remittance income predicted to fall to pre-COVID levels this year

30 Nov 2021

0

0

The worker remittance inflows to Sri Lanka is estimated to decline by 6.2 percent year-on-year (YoY) to pre-pandemic levels of US $ 6.7 billion this year while the outlook for 2022 remains largely uncertain, according to the World Bank (WB).

SLT-Mobitel Customer Contact Centre - first in Asia to receive ISO 18295-1:2017 Certification

29 Nov 2021

0

0

Reinforcing customer-centricity in providing excellent services, SLT-Mobitel Mobile has become the first in Asia to receive the international ISO 18295-1:2017 quality standard for its Customer Contact Centre (CCC) operations recently. Additionally, SLT-Mobitel was also awarded ISO 9001:2015 for demonstrated ability to meet customer, statutory and regulatory standards.

Dialog and Covergence.Tech extend verifiable digital education credentials

29 Nov 2021

0

0

In yet another progressive step bringing about a giant leap within the Sri Lankan education domain and marking a first in the country, Dialog Enterprise introduced Convergence Tech Identity (CTI), a revolutionary digital education credentials service, in partnership with Convergence.Tech, the Canadian consulting and technology company working across Digital Transformation, Identity, Credentials, and Traceability.

Cabraal dismisses default talks saying provisions already made to retire 2022 foreign debt in full

29 Nov 2021

0

0

Shrugging off concerns raised by certain parties in recent times over the country’s ability to meet its foreign currency debt obligations falling due next year, the Central Bank Governor Ajith Nivard Cabraal said the provisions had already been made and thus nobody should have any doubts over the country’s ability to service its debt.

Third review approved by IMF, SL to get next US$ 333 million tranche

29 Nov 2021

0

0

Niloufer Esufally-Anverally Makes a Stylish Comeback with the Launch of NLFR

29 Nov 2021

0

0

Global Entrepreneurship Week 2024 kicks off across all 25 districts

29 Nov 2021

0

0

Fonterra to proceed with sale process for Consumer businesses

29 Nov 2021

0

0

BOI signs US$ 12.16mn deal with Celogen Lanka

29 Nov 2021

0

0

15-year-old schoolgirl impregnated, mother’s paramour arrested

29 Nov 2021

0

0

United in art: Children collaborate to celebrate 35 years of CRC

29 Nov 2021

0

0