Business Main

CB expects no major change to current tax policy from budget

18 Oct 2021

0

0

Although the government faces an uphill task in managing public finances amid significant decline in the tax revenues caused by pandemic-induced restrictions, it is unlikely to introduce major changes to its current tax policy, which has remained low and consistent for two years, according to the Central Bank.

Govt. urged to improve social security for employees and employers

16 Oct 2021

0

0

As the COVID-19 pandemic delivered a massive hit on the local labour market, the government going forward should urgently look at improving and expanding access to social security for employees and employers, the Institute of Policy Studies (IPS) said.

CB keeps policy rates steady to support economic recovery

15 Oct 2021

2

2

The Central Bank yesterday left its key policy rates unchanged indicating that the Monetary Board considers the current monetary policy stance is appropriate to both fend off any demand side inflationary pressures, while supporting the recovery of the economy gradually coming off the month-long virus-related restrictions.

IMF lowers Sri Lanka’s outlook on persistent pandemic pressures

14 Oct 2021

0

0

The International Monetary Fund (IMF) lowered its growth outlook for Sri Lanka, alongside the rest of the world’s, on the risks stemming from the prolonged virus that gave rise to supply chain disruptions and higher price pressures, which made the global recovery a difficult and an uneven affair.

CB expected to hold rates tomorrow after surprise hike in Aug.

13 Oct 2021

0

0

There is a greater likelihood for the Central Bank to maintain the current monetary policy stance at today’s monetary policy meeting—which will be announced tomorrow, given the damage caused to the economy in the third quarter by the prolonged lockdowns and the need to support the government through liquidity when other financing sources have nearly run dry, according to First Capital Research (FCR).

SL has no need of crisis budget, says ex-IMF official

12 Oct 2021

0

0

As Sri Lanka is roughly a month away from presenting its budget for 2022, a former International Monetary Fund (IMF) official said it doesn’t have to be a crisis programme, instead it should focus on growth, with a medium-term path towards fiscal deficit reduction and debt sustainability, with provisions for taking care of the vulnerable sections of society.

SL’s homegrown debt repayment plan may keep investors away: HSBC, Citi

11 Oct 2021

0

0

As the Sri Lankan government continues to resort to short-term ad hoc arrangements to service the country’s external debt obligations, two leading international investment banks warn that the lack of clarity on the debt sustainability front could keep both foreign and domestic investors at bay further worsening the country’s already weak external position.

Public debt surges by Rs.1.6tn in first seven months as pandemic batters state revenues

09 Oct 2021

0

0

The outstanding debt of the Central government rose sharply in the first seven months of 2021, with the domestic financing increasing the most, as the budget deficit expanded to large proportions when the pandemic knocked the state revenues off course since April this year, when the restrictions returned.

NCE slams CB for placing all exporters in one basket

08 Oct 2021

0

0

Sri Lankan exporters yesterday slammed the Central Bank for unjustly placing all exporters in one basket when the latter charged that exporters are not fully repatriating and converting their proceeds within a reasonable timeframe.

Organic farming could help fetch premium prices

06 Oct 2021

0

0

While underscoring the need to help farmers make a gradual shift towards organic fertilizer usage from chemical fertilizers to overcome the short-term difficulties confronted during the transition, the Export Development Board (EDB) Chairman Suresh de Mel recently defended the government’s organic fertilizer policy as such could help Lankan agri exporters to make inroads into premium markets.

CB issues impairment guidelines for banks

05 Oct 2021

0

0

The Central Bank has issued guidelines on how the banks should approach when dealing with loan impairments, effective from next year, when they come out of the latest round of moratoria, as there could still be a section of borrowers whose cash flows would be under pressure, even after the removal of economic restrictions.

CB unveils six -month plan to stabilise economy

02 Oct 2021

0

0

Amid a foreign exchange and a looming external debt crisis, Central Bank Governor Ajith Nivard Cabraal yesterday unveiled the much-awaited ‘The Six-Month Road Map for Ensuring Macroeconomic and Financial System Stability’, with an aim to usher in greater stability to the economy, backed by stable prices and sound macroeconomic fundamentals.

Govt. urged to come to senses on fertilizer ban

01 Oct 2021

0

0

The government will have to come to its senses with regard the ban on chemical fertilizers as the current decision is more detrimental to the economy than the supposed negative implications arising from the usage of such fertilizers, Sri Lanka’s planters said.

Life insurance drives overall industry growth in first half

30 Sep 2021

0

0

Sri Lanka’s insurance industry did well through the first six months in 2021 (1H21), led by the life insurance sector, continuing the momentum it gained in 2020, when the pandemic and its resulting health and monetary policy conditions augured favourably with the industry.

Govt. indicates safe re-opening of country remains priority

29 Sep 2021

0

0

Safe re-opening of the economy from lockdowns is imperative for Sri Lanka to push through its recovery after the country was emerging out of the pandemic induced recession in 2020 which left large slacks in many areas and sectors, awaiting to be regained and recovered to their full capacities, according to new Central Bank Governor Ajith Nivard Cabraal.

Inflation could breach CB’s upper limit, warns ICRA Lanka

25 Sep 2021

0

0

The current trajectory of the consumer inflation is likely to go past the medium-term inflation target of the Central Bank, forcing it to lean towards its hawkish stance, which it set off in August to stem any more likely pressures on prices, according to ICRA Lanka Limited.

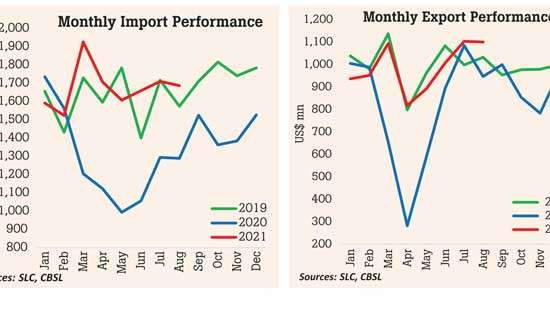

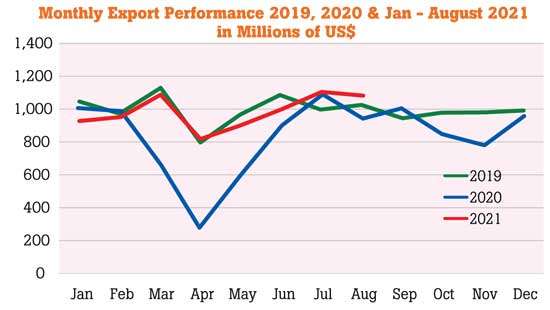

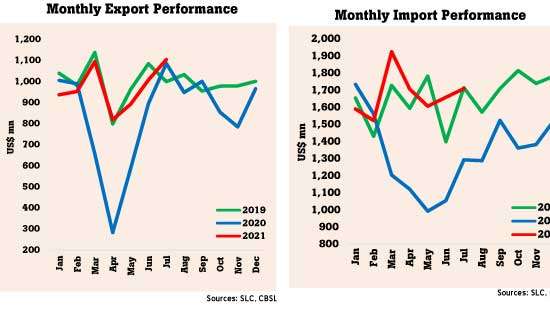

Export earnings top billion dollars for third consecutive month in August

23 Sep 2021

0

0

Sri Lanka’s merchandise export earnings topped a billion dollars for the third consecutive month in August, with almost all the major export categories performing well despite the pandemic-induced restrictions, the Export Development Board (EDB) said in a statement.

Worker remittances fall for third consecutive month in August

22 Sep 2021

0

0

Remittance income from Sri Lankan migrant workers slumped for the third consecutive month in August, extending the year-on-year decline set off in June this year, a trend which is partly associated with the levelling off of the pace of growth continued for little over a year, and the re-emergence of grey market operations.

Pandemic provides room for bold economic reforms

21 Sep 2021

0

0

Reminding the famous saying that one must never waste a good crisis, a leading economist in the country opined that there has never been a better time for Sri Lanka to make the pressing and long overdue reforms in its economy through tough revenue and expenditure reforms.

Cabraal to soon unveil new economic stability road map

18 Sep 2021

0

0

The newly-appointed Central Bank (CB) Governor Ajith Nivard Cabraal this week announced plans to unveil a fresh economic stability road map shortly, prioritising stability, including plans to pull back on money printing, with a view to rebuild confidence on the economy among the key stakeholders and market participants.

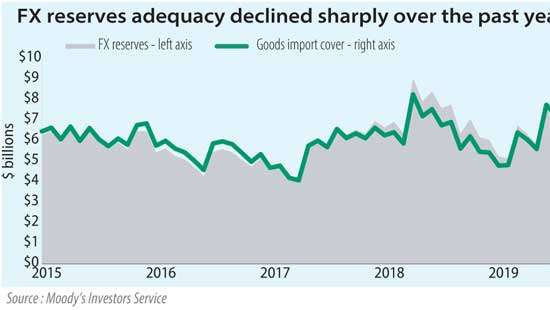

Recovery in August reserves fails to impress Moody’s

17 Sep 2021

0

0

Moody’s Investors Service yesterday said Sri Lanka’s external reserves remain still low even after taking receipts of inflows of around a billion dollars in the last couple of weeks, which helped the country to recoup part of the lost assets caused by the settlement of a billion dollar sovereign bond and other liabilities through August.

Weak sovereign rating, pandemic continue to pressure Lankan banks

16 Sep 2021

0

0

Sri Lanka’s banks’ credit ratings are continued to be pressured by the challenging operating environment stemming from the weak sovereign credit profile and the lingering effects of the pandemic and its toll on the broader economy, according to Fitch Ratings.

Economists call for extensive review of tax system to improve revenue mobilisation

15 Sep 2021

0

0

An improvement in Sri Lanka’s revenue mobilisation effort requires an urgent and extensive review of the tax system, to ensure the government can meet its expenditure commitments, while the country is in the midst of one of the worst macroeconomic crises in its history, economists said.

Sri Lanka’s tourist arrivals surpass 2 million in 2024

14 Sep 2021

0

0

Auction yields slump for third consecutive week

14 Sep 2021

0

0

Moody’s raises Sri Lanka’s rating

14 Sep 2021

0

0

ASPI crosses the 15,000 mark for the first time

14 Sep 2021

0

0

‘Cardinal’ only used to polish the floor: Pastor Jerome

14 Sep 2021

0

0

Govt. has not yet decided when to assign official vehicles to MPs

14 Sep 2021

0

0

Sharp increase in financial frauds during festive season: SLCERT

14 Sep 2021

0

0