Reply To:

Name - Reply Comment

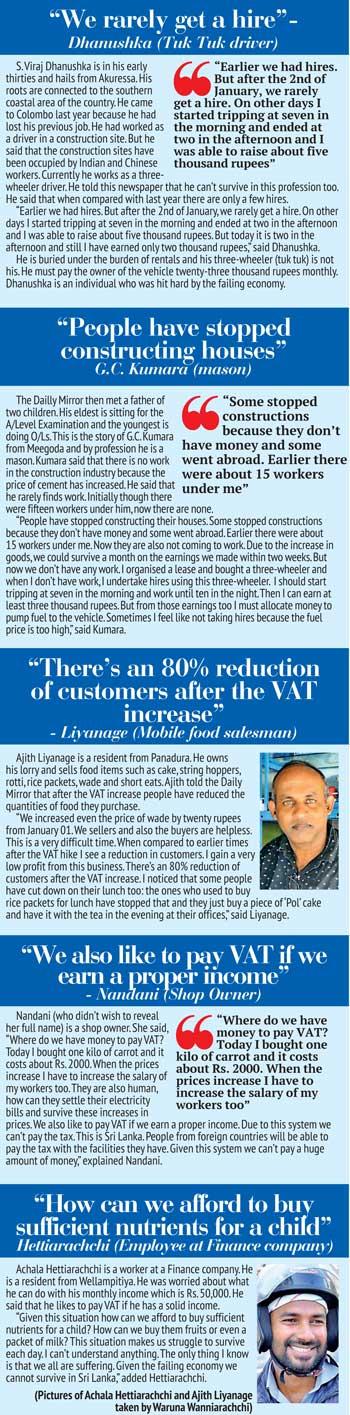

As a result of the VAT increase which was effective from January 01, 2024 mobile food providers are complaining that there is an 80% drop in customers

For Sri Lankans the New Year didn’t bring any hope. Due to the prior announcements made by the government the country’s people stepped into 2024 with a fear of taxation and VAT implementation. They stepped into 2024 with a bothered mindset about their economy.

For Sri Lankans the New Year didn’t bring any hope. Due to the prior announcements made by the government the country’s people stepped into 2024 with a fear of taxation and VAT implementation. They stepped into 2024 with a bothered mindset about their economy.

In the 2024 budget speech, President Ranil Wickremesinghe proposed a tax increase starting January 1. He underscored the need to boost state revenue to meet international debt and interest payments. The urgency was emphasised by the International Monetary Fund (IMF), which warned of a possible default on a $3 billion loan’s second installment due to insufficient revenues. The cabinet approved the tax hike in October. The Ministry of Finance predicts that the VAT increase will raise the government’s income by 56%; going from LKR 2.851 billion in 2023 to LKR 4.127 billion in 2024, according to their calculations.

On December 11, the parliament gave the green light to a proposal raising the Value Added Tax (VAT) from 15 percent to 18 percent. Additionally, the regime has decided to include 97 essential items to be subject to VAT; which was previously exempted.

To probe the depths of this VAT increment the Daily Mirror spoke to a few academics in Economics to obtain their opinions regarding the VAT increment. The purpose was to see whether this new vat scheme will boost the country’s economy. In general the introduced VAT would burden the vulnerable people of this country.

Wayamba University of Sri Lanka Department of Accountancy Head Professor Aminda Methsila Perera shared a balanced opinion on this VAT issue. Dr. Perera explained about the two types of taxes which are direct and indirect tax.

“The Government increased Direct taxes up to 36%. And now they are talking about the indirect taxes; mainly the VAT. Whoever is running the government must think of how they can increase the taxes or the income. When talking about the effects on the economy the government wanted to increase direct taxes. The government has not considered the way it is going to collect it. For example, currently there are approximately six hundred thousand tax files. But if you look at the workforce it is almost eight point five million. So that implies that many people do not pay the taxes. What the government should do is not to charge taxes from the people who are paying taxes now, so they must expand the tax base. If they can expand the tax base, they can raise more revenue from direct tax. Usually, we recommend that the state maintains at least 40% in the form of direct taxes and 60% from indirect taxes. This is because indirect taxes will impact the entire economy; even having a bearing on less affluent people. But direct tax is not that. The people who earn should pay tax. Therefore, if the government can enhance the tax base and increase it up to 40% (currently we are having 35%) it they can reduce the impact of VAT and all these indirect taxes,” explained Dr. Perera.

“The Government increased Direct taxes up to 36%. And now they are talking about the indirect taxes; mainly the VAT. Whoever is running the government must think of how they can increase the taxes or the income. When talking about the effects on the economy the government wanted to increase direct taxes. The government has not considered the way it is going to collect it. For example, currently there are approximately six hundred thousand tax files. But if you look at the workforce it is almost eight point five million. So that implies that many people do not pay the taxes. What the government should do is not to charge taxes from the people who are paying taxes now, so they must expand the tax base. If they can expand the tax base, they can raise more revenue from direct tax. Usually, we recommend that the state maintains at least 40% in the form of direct taxes and 60% from indirect taxes. This is because indirect taxes will impact the entire economy; even having a bearing on less affluent people. But direct tax is not that. The people who earn should pay tax. Therefore, if the government can enhance the tax base and increase it up to 40% (currently we are having 35%) it they can reduce the impact of VAT and all these indirect taxes,” explained Dr. Perera.

He said that this sudden VAT increase will impact the citizens of the country. He stressed that in such a situation the government should be concerned about very crucial needs of the people such as fuel and electricity. He believes that by taking these kinds of decisions the government will be able to recover its economy that crashed. He added that at the same time the regime is putting too much pressure on the people. Dr. Perera stressed that these kinds of sudden VAT increases are unbearable from a people’s perspective. Also, he warned that if the burden of living is unbearable on the people and negatively impacts businesses individuals will leave the country.

“We collapsed in 2019 and even the World Bank is saying that they are surprised to see how Sri Lanka is recovering. Our recovery rate may be a little faster and that is unbearable for business as well as the citizens. So, the government should very carefully monitor this issue,” added Dr. Perera.

Dr. Perera suggested that it is healthy for the government to consult experts’ opinions and conduct case studies before taking sudden decisions.

“Therefore, when the government makes any change, I feel that it should be based on different outcomes rather than on a politically driven decision. So, they must analyse the situation well and get expert opinion and do some case studies and adopt the good practices like in the other parts of the world,” suggested Dr. Perera.

University of Colombo Department of Economics Professor of Economics Dr. Priyanga Dunusinghe throws his weight behind the people who are consumers. He disagrees with the VAT increment introduced by the government. He repeatedly underscored that when charging tax there is a proper way of doing it. He didn’t agree with the present VAT increment. He said that he believed that it should be carried out in three levels. Also, he warned that this will massively impact the wellbeing of people. Dr. Dunusinghe believes that this VAT increase will highly impact the education and healthcare sectors.

“Overall, this will have a negative impact. This could even have a negative impact on the overall competitiveness and the productivity in the economy as well. This is because the cost of production has increased,” warned Dr. Dunusinghe.

Dr. Dunusinghe also shared with this newspaper a solution which the government could implement.

“One possible solution that the government can implement is rather charging an 18% VAT maybe they can apply it in three levels: Maybe 5% for essentials, 15% for normal goods and 25% for luxury goods. If you look at the countries in South Asia and other developing countries, they apply different rates rather than charging a single rate. So, I think the government needs to think about that.

“When you have a high VAT rate and there is uncertainty surrounding the fiscal policy, particularly the tax policies, foreign investors will be discouraged. But I don’t think that VAT is the main reason that foreign investors must consider. They may worry about the ongoing debt restructuring and the sustainability of economic reforms, political stability and the availability of the skilled labour.

“There is a sizeable uncertainty in the global economy. These uncertainties will have a damaging effect on Sri Lankan economy. That is why the government must be very careful,” explained Dr. Dunusinghe.

Daily Mirror spoke to the Senior Lecturer in Economics Dr. Indrajit Aponso to get his insights on this new VAT charge. He doesn’t see any positivity coming out of this VAT increase.

“Who’s paying these taxes? The guys who are really producing and engaged in generating income are the ones who are getting really affected. Overall the economy in Sri Lanka must ensure its growth, get its exports going, get its production capacity going. ” said Dr. Aponso.

Being experts and Professors in Economics, they are also not very much content regarding the VAT increment. Though Dr. Perera said that there is a rapid economic recovery, he also stressed that it is hard for people to bear.