Reply To:

Name - Reply Comment

Protest staged by Ceylon Electricity Board Joint Trade Union Alliance (CEBJTUA) in front of CEB headquarters (File photos)

Though the editorial of December 14 of the Daily Mirror is captioned as “Debt-Ridden ceb and the need for restructuring”, the rationale is not clear on many counts as to why we need to restructure a monolithic single Government entity which had functioned for more than five decades under the CEB Act of 1969 yet failed to understand what is meant by Cost reflective pricing, when all of us are reeling under a 75% increase in electricity tariff imposed almost overnight since August of this year.

restructure a monolithic single Government entity which had functioned for more than five decades under the CEB Act of 1969 yet failed to understand what is meant by Cost reflective pricing, when all of us are reeling under a 75% increase in electricity tariff imposed almost overnight since August of this year.

The Daily Mirror readers’ poll published on December 17 on the question whether the hike in electricity tariff could have been avoided if the CEB had been better managed? is an overwhelming 68.5% / almost 70 % “YES”. This begs the question whether the solution to the energy issue has been thoroughly investigated (or not)?

Let me start with the footnote of the Report on page 18 of 30 of the Cabinet-appointed Committee on Power Sector Reform (October 20, 2022) which pointedly says “It should be understood that cost reflective tariff does not mean passing the costs, with inherent inefficiencies, bad planning and poor financial management to the electricity consumer”.

process (breaking the CEB into 14 Companies.)

In the same breath, the Government is attempting to sell national assets/farms of loss-making entities without recourse to reversing its losses.

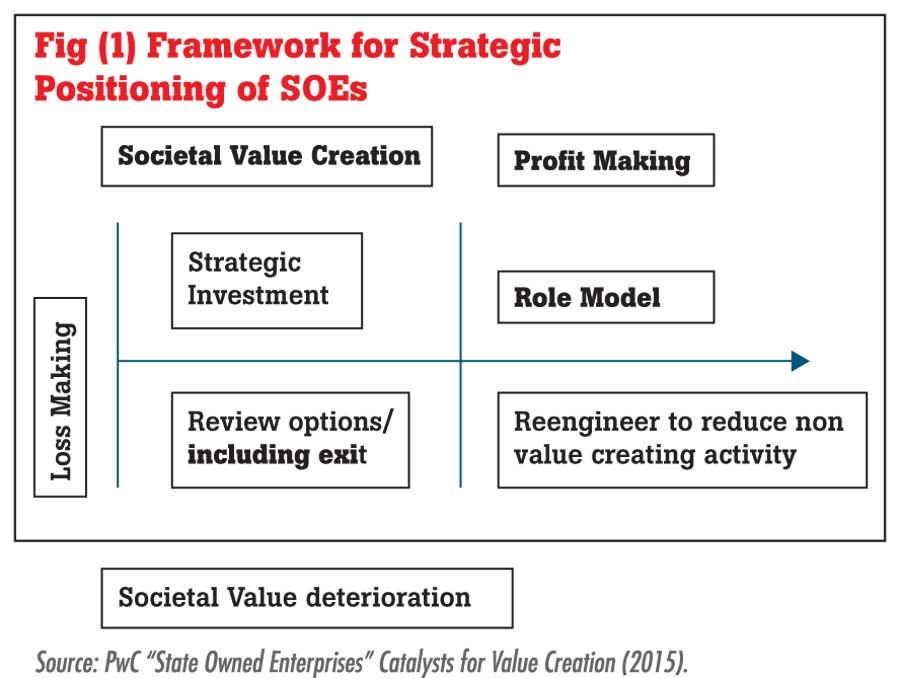

It’s amusing to recall that in another sister journal the writer refers to this situation / he claims that “The entire citizenry is aware that the key reasons for losses in SOEs are political manipulation, mismanagement and wastage” sometime in the same month (Aug 2022) be as it may, the main issue why CEB has been put to the Grind Stone is the dilemma to assess the Needs Vs Profitability criteria. Utilities such as the CEB has to fall within one of the 4 grids (See Fig below)

CEB falls into quadrant One (Top LHS) where strategic capital infusion needs to be engineered.

What went wrong with CEB

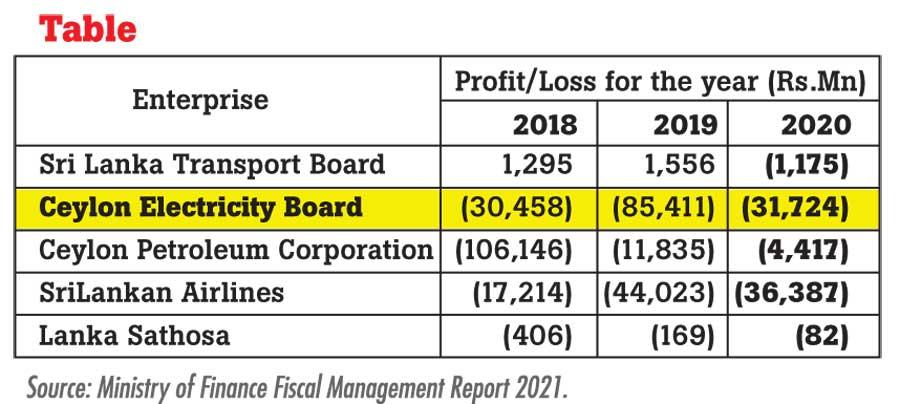

Then why is an entity whose societal value creation is high, rendering its service inefficiently? The table below shows the history of CEB’s losses since 2018, which according to a weekly columnist in a Sunday Paper has accumulated to Rs.1,500 Bln over the last ten years, for the top 5 SOEs (including CEB.)

Unfortunately, though the above Fiscal Management Report shows a decline in losses in 2020, the current trend is that in the first quarter 2022, CEB’s loss has extended to Rs. 66 Bln/pointing to a runaway tilt in its operating efficiency.

The Anatomy of its Loss

The CEB currently owns Six licenses (from the Electricity Act of 1969) & inherits

This vertical hierarchy, though under a regulatory agency such as PUCSL, has only led to undermining the regulator’s role. CEBEU (CEB Engineers Union) continues to wield its informal power even that of the PUCSL but de facto remains the arbiter of the board’s development programme and its implementation. Nor has the board been able to foster market development of the power sector. Above all, it did not support tariffs based on prudent cost expenditure and efficiency. The CEB Tariff there for is not based on the cost of service and return on capital as is to be expected.

The Faux Pas

The Daily Mirror in an exposé in early August 2022 published a COPE report which compared the board’s total loss for the previous year as equal to the total Tax Collection of the GOSL. while the ever-powerful CEBEU managed to leverage itself to favour the Engineers cadre with an additional Salary level in its grades in the salary structure as “E” (in addition to the existing K,L,M,N) , which anomaly was squashed by legal action filed by a workers union.

The Long-Term Low-Cost Generation Expansion Plan (LTLCGEP) is another casualty of this all-powerful union. The Government’s goal of generating 70% of the energy requirement by 2030, through renewable sources was the victim: Though the CEB EU is keen to renew PPA from Independent vendors it had stymied the following planned power projects: Valaichchenai Solar (10MW)/Polonnaruwa Welikanda Solar (10MW)/Siyambalanduwa Solar (100MW)/Pooneryn Solar (100MW) Pooneryn Wind Power (100MW)/Heavy Fuel oil barge in Galle (100MW) which load was to be fed to the National Grid by 2020 had gone forever.

The most blatant act of this coterie (calling themselves Managers) was the power blackout in June of this year. This unscheduled power outage subverted the CEB’s capacity to generate hydropower and instead led to emergency power purchase from thermal power plants of retired IPPs (WestCoast and Sojitz) generating a loss of Rs.600Mln.

Unbundling and Commercialization

Therefore it’s not privatizing public assets but saving them to serve the public more efficiently. How the CEB is unbundled has significant implications on the viability and Financial sustainability of the unbundled components.

The rationale then is

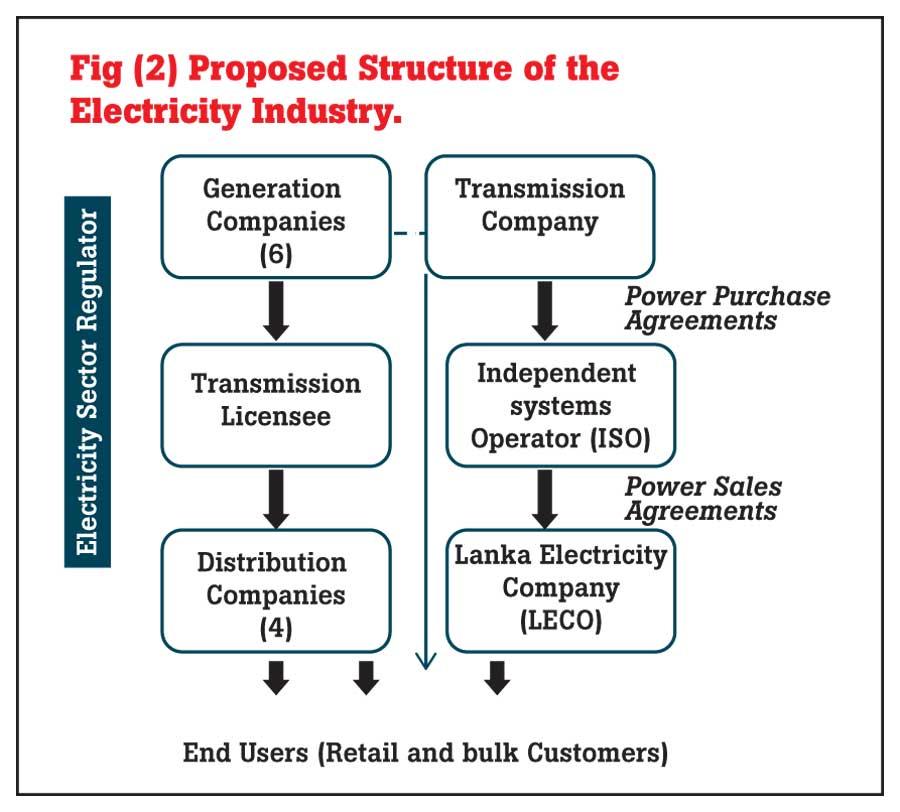

Assets to be transferred to the successor companies deploying the GOBU provisions of the Companies Act 23 of 1987. 100% of the shares to be eventually transferred to the Treasury .it is also to be observed that the Transmission Company (tending to be a monopoly which favours investor interest) to remain commercially responsive in a regulated sector. (see diagram below)

Cost Reflective Tariff

While cost reflective tariff is ensured under the law, the issue had been the failure of the sector institutions (CEB and its subsidiaries) to respond to power requirements commercially. Therefore tariff setting founded on the principles and assumption of cost recovery and financial viability of all independent entities will be a pre-requisite for attracting investment into the power sector. Such tariffs based on proper methodology will provide an incentive to improve performance, be prudent in expenditure and be transparent and fair.

(The writer is a retired Senior

Consultant ex IDA, World Bank

An Institutional Specialist in many Multilateral donor funded projects including the ADB,

JICA and UNDP)

He can be reached at [email protected]