Reply To:

Name - Reply Comment

Rolls of stickers where each piece is sold for Rs 100

It has been alleged that security tax stamps or stickers pasted on liquor bottles are currently being sold illegally. The Excise Department of Sri Lanka is responsible for providing these stickers to liquor manufacturers. However, it has been reported that some distillers have purchased these sticker rolls in bulk from the Excise Department. The report from the ‘Committee on Ways and Means of Parliament’ also confirmed that some alcohol producers have been using these stickers to increase their profits by producing substandard alcohol.

It has been alleged that security tax stamps or stickers pasted on liquor bottles are currently being sold illegally. The Excise Department of Sri Lanka is responsible for providing these stickers to liquor manufacturers. However, it has been reported that some distillers have purchased these sticker rolls in bulk from the Excise Department. The report from the ‘Committee on Ways and Means of Parliament’ also confirmed that some alcohol producers have been using these stickers to increase their profits by producing substandard alcohol.

Liquor manufacturers receive 10,000 stickers per roll when purchasing in bulk. Each sticker is sold for one hundred rupees which makes one roll worth one million rupees. It has been reported that these stickers purchased in bulk are being used to produce counterfeit liquor bottles, labeled as ‘No. 2.’ There were also reports of counterfeit stickers being printed and used to produce substandard alcohol. These stickers are printed by an Indian company and include a barcode. But when these stickers are scanned, no information can be retrieved.

After purchasing stickers in bulk through the Excise Department of Sri Lanka, regulation procedures carried out by institutions to put the system in place seem to be insufficient. This has allowed fraudulent activities to continue. There are public allegations that the Excise Department of Sri Lanka is delaying investigations.

|

A report issued by the Committee of Ways and Means

Ranjith Siyambalapitiya

Liquor bottles bearing the illegal stickers

|

Some companies sell illegal alcohol using fake stickers to avoid paying taxes on their production. As a result, the government has lost significant tax revenue. Instead of paying taxes, these companies spend large sums on purchasing fake stickers. To combat this, it was decided to use official stickers to control the sale of illegal liquor. These stickers also made it easier for the government to collect taxes from the legitimate products produced by companies. These original stickers have also helped to curb the sale of counterfeit liquor bottles labelled as ‘number two.’

State minister confirms existence of fake stickers

State Minister of Finance Ranjith Siyambalapitiya confirmed on 09.02.2023 that around 100,000 bottles of alcohol with fake stickers were seized in one week. He underscored that excise duty revenue has significantly fallen below expectations due to this issue involving bogus stickers. The Minister Siyabalapitiya noted that over 100,000 bottles of alcohol with suspicious stickers were seized during raids. These raids were conducted with the aim of uncovering strategic attempts to bypass the new sticker system.

Further, following an order from the Committee on Ways and Means of Parliament, it was revealed in a meeting chaired by Member of Parliament Patali Champika Ranawaka that nearly 6,000 bottles of liquor with fake stickers were seized by excise officers during raids conducted nationwide on August 21, 2023.

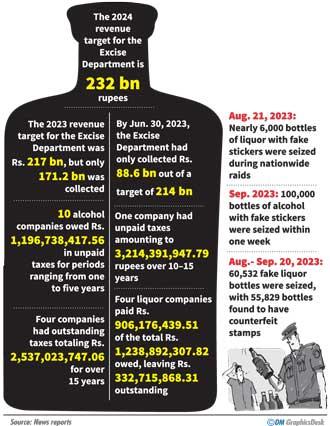

According to the Committee’s report, the government has lost a significant amount in the form of excise duty. In both the first and second reports, MP Ranawaka emphasised the loss of taxes to the Excise Department of Sri Lanka. The revenue target set for the Sri Lanka Excise Department in 2023 was 217 billion rupees, with a target of 232 billion rupees for 2024. Despite two excise duty revisions as of December 31, 2023, the excise department only generated 171.2 billion rupees in revenue. In 2022, following the tax revision, the Excise Department of Sri Lanka expected to collect 169.4 billion rupees in revenue.

Excise Department fails to meet revenue targets

The Excise Department was expected to collect approximately 6235.9 billion rupees in taxes by June 30, 2023. The revenue target for the six months from January to June 2023 was 214 billion rupees, but only 88.6 billion rupees was collected. Additionally, the target for tobacco revenue was set at 3 billion rupees; yet only 363 million rupees was collected. As a result, the Excise Department failed to meet its revenue targets for January through June 2023.

The Committee on Ways and Means identified the increase in counterfeit alcohol production and tax evasion by alcohol manufacturing companies as key factors contributing to the shortfall in excise revenue. In response, a Cabinet Memorandum titled ‘Implementation of Stickers and Sticker Management Systems’ was issued under number 21/0335/304/031 on February 22, 2021, to prevent the production of fake alcohol using official stickers. The Distilleries Company of Sri Lanka implemented the use of these stickers within six months. These security tax stickers have three features: overt, covert and forensic. The overt feature allows for the verification of authenticity of the security tax stamp by the naked eye. The covert feature requires special devices to confirm the authenticity of the security tax stamp. The forensic feature uses scientific methods to detect counterfeit stamps. The cost of printing each sticker is 1.80 rupees.

However, when the barcode on these stickers is scanned, there is no provision to gather any information through the diagnostic feature. Despite this, the Ways and Means Committee report states that security features were added to the tax stamp; allowing its validity period and the authenticity to be verified using a mobile phone. India’s Madras Security Printers Company provided the Sri Lanka Excise Department with 200 scanning devices and 40 UV lights to help identify the authenticity of these security tax stamps. Nevertheless, the report from the Committee on Ways and Means revealed that the Excise Department of Sri Lanka has not been using these devices.

As a result, the department has been unable to take legal action against shops selling alcohol bottles with fake security tax stamps or against the manufacturers producing them.

Recently, the Committee on Ways and Means of Parliament reported on these fraudulent activities, issuing three reports that included recommendations for a separate review of the Excise Department of Sri Lanka. According to the report, the Treasury set a revenue target of 217 billion rupees for the Excise Department in 2023, with a target of 232 billion rupees for 2024. By December 31, 2023, two excise duty revisions had taken place. But the Excise Department of Sri Lanka maintained that despite the amendments the revenue generated was only 171.2 billion rupees. In 2022, the excise department had generated 169.4 billion rupees in revenue.

Among the 23 distilleries registered with the Excise Department of Sri Lanka, Distilleries Company of Sri Lanka PLC and Lion Brewery Ceylon PLC account for 73 percent of the revenue collected by the treasury. The Parliamentary Committee on Ways and Means has also pointed out that some distilleries registered with the Excise Department of Sri Lanka are not following proper procedures.

As of 2023, 10 (ten) alcohol manufacturing companies hadn’t paid taxes totaling 1,196,738,417.56 rupees for periods ranging from one to five years. Over 10-15 years, one company had unpaid taxes amounting to 3,214,391,947.79 rupees, and for more than 15 years, four companies had outstanding taxes totaling 2,537,023,747.06 rupees. According to the Committee on Ways and Means, four out of these 10 companies had also failed to complete their tax and late fee payments for 2023. Four liquor companies have paid 906,176,439.51 rupees of the total 1,238,892,307.82 rupees owed, leaving an additional 332,715,868.31 rupees still to be collected.

It is noteworthy that the Committee on Ways and Means, on August 10, 2023, ordered the Commissioner General of Excise to seize alcohol bottles with fake security stamps or stickers, but no action had been taken until then. This fact is mentioned in a report issued by the Committee on Ways and Means. The committee’s report also highlights that neither the Ministry of Finance nor the Excise Department had taken appropriate action.

However, on the contrary, between August and September 20, 2023, 60,532 fake liquor bottles were seized, with 55,829 of them found to have counterfeit security stamps. It is concerning that, despite the opportunity to curb this smuggling activity, the government hasn’t given this issue the necessary attention. Currently, the production of ‘number two’ bottles has been temporarily halted due to a shortage of stickers. However, during the investigation, it was reported that some liquor manufacturers are mixing counterfeit ‘number two’ bottles with legitimate liquor bottles. A significant amount of information has been uncovered by this newspaper regarding the fraudulent activities of these companies. This information will be made public via another series of articles.

“We revoked the licence of a company that failed to pay excise duty”-Ranawaka

This is what Patali Champika Ranawaka, Chairman of the Committee on Ways and Means, had to say regarding the recovery of overdue excise duty: “We revoked the licence of a company that failed to pay excise duty. However, the Commissioner General of Excise has not yet taken action to recover the taxes. When we questioned him, he claimed that an order from the Ministry of Finance was needed to stop issuing these licences. This implies that the Director General of Excise is suggesting that, since the Finance Minister is also the President, it is the President who protects tax evaders.”

This is what Patali Champika Ranawaka, Chairman of the Committee on Ways and Means, had to say regarding the recovery of overdue excise duty: “We revoked the licence of a company that failed to pay excise duty. However, the Commissioner General of Excise has not yet taken action to recover the taxes. When we questioned him, he claimed that an order from the Ministry of Finance was needed to stop issuing these licences. This implies that the Director General of Excise is suggesting that, since the Finance Minister is also the President, it is the President who protects tax evaders.”

Patali Champika Ranawaka further stated that the President is shielding this company.

Excise Department officials unavailable for comment

Several attempts were made to contact the Director General of the Excise Department of Sri Lanka, M.J. Gunasiri, but there was no response. A spokesperson later informed that the Commissioner General had stepped out of the office. Attempts made to reach Deputy Commissioner General M. Jayantha de Silva for comments were also unsuccessful.

Although the Commissioner General and Deputy Director General of the Excise Department were not available for comment, they still have the opportunity to provide their viewpoints.