Reply To:

Name - Reply Comment

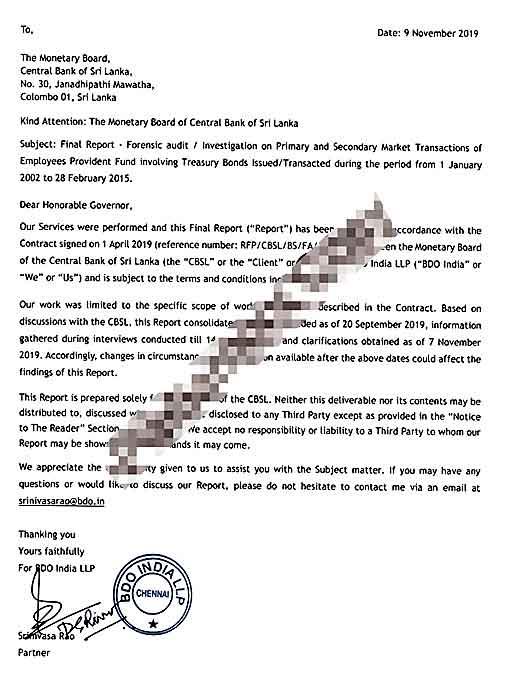

The forensic audits were conducted by two private sector audit firms contracted by the Central Bank of Sri Lanka

| Despite its sizeable collection, the EPF is now facing a severe crisis due to poor investment decisions made by its management |

| A forensic audit has confirmed that these poor decisions have resulted in significant financial losses associated with the fund |

| The forensic audit didn’t disclose how the EPF money was invested during the bond scam |

| The EPF is regarded as the largest pension scheme in Sri Lanka |

| By 2023, the EPF had received contributions from 2.7 million members |

| The practice of investing EPF funds in both the stock market and bond market continues, even in the face of losses |

The Employees’ Provident Fund Act No. 15 of 1958 established the Employees’ Provident Fund (EPF) as a mandatory retirement contribution scheme for employees in the private and semi-public sectors who are not entitled to a pension. By the end of 2022, the EPF’s assets stood at 3.4 trillion rupees, increasing to 3.9 trillion rupees by 2023. The EPF is regarded as the largest pension scheme in Sri Lanka. Contributions to the fund consist of 8% of an employee’s salary and 12% from the employer, amounting to a total of 20% added to the fund monthly. By 2023, the EPF had received contributions from 2.7 million members.

The Employees’ Provident Fund Act No. 15 of 1958 established the Employees’ Provident Fund (EPF) as a mandatory retirement contribution scheme for employees in the private and semi-public sectors who are not entitled to a pension. By the end of 2022, the EPF’s assets stood at 3.4 trillion rupees, increasing to 3.9 trillion rupees by 2023. The EPF is regarded as the largest pension scheme in Sri Lanka. Contributions to the fund consist of 8% of an employee’s salary and 12% from the employer, amounting to a total of 20% added to the fund monthly. By 2023, the EPF had received contributions from 2.7 million members.

The EPF is currently the largest member-contribution-based security fund in Sri Lanka. Even if a tenth of its contributions are misappropriated, the financial loss would be substantial. Despite its sizeable collection, the EPF is now facing a severe crisis due to the poor investment decisions made by its management. A forensic audit has confirmed that these poor decisions have resulted in significant financial losses for the fund.

| “Labour rights would be reviewed and confirmed in the future” |

| When the issue was raised with the Secretary of the Ministry of Justice, Home Affairs, Public Administration, Local Government, and Labor, S. Alokabandara, he said, “Labour rights would be reviewed and confirmed in the future”. He further stated that a new Secretary for the Ministry of Labour is expected to be appointed soon, after which a comprehensive study will be conducted on these issues. |

It is widely known that the country incurred massive losses due to the Central Bank ‘bond scam’, and a considerable amount of EPF funds was lost in the process. Investigations have revealed that the losses incurred by the EPF exceed even those of the bond scam itself. This was due to improper bond investments made by the EPF.

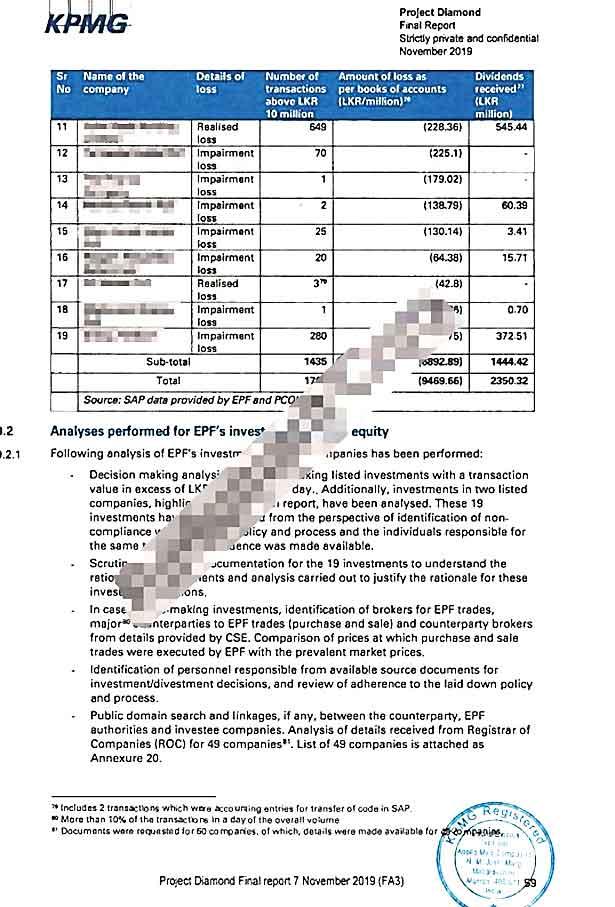

A forensic audit conducted on funds invested on purchasing company shares indicates a loss

The Central Bank bond scam was investigated by both the COPE and a special presidential commission, with two reports released following these investigations. However, neither report provided a comprehensive assessment of the exact monetary loss to the Employees’ Provident Fund (EPF) due to its bond investments or the extent of fraud involved. While the Special Presidential Commission acknowledged irregularities in the EPF, it recommended conducting a forensic audit to investigate the irregularities.

The forensic audit report, requested based on this recommendation, was released in 2019. The audit provided details into how the EPF funds were invested. The findings were presented in five separate reports, two of which addressed the EPF’s investments in the stock market and bonds.

The forensic audit report shows EPF monies being used for investment purposes

The investments made using EPF money in the stock market during the period from 2002 to 2018 were investigated. However, the review of investments and transactions in the bond market was limited to the period from 2002 up to February 2015, concluding just before the large-scale bond scam that occurred on February 27, 2015. The information on bond market transactions after February 2015 was not audited, possibly because Central Bank officials may have decided to withhold these details. This matter needs to be examined by higher authorities.

The forensic audits were conducted by two private sector audit firms contracted by the Central Bank of Sri Lanka (CBSL). The Monetary Department of the CBSL decided to limit the scope of the forensic audit to the period from 2002 to February 2015 and provided specific guidelines to the audit firms. As a result, the bond scam that occurred after February 2015 was excluded from the audit as the bond scam occurred within the bond market itself. It remains unclear whether the time limits were imposed by the CBSL to prevent details of the scam from being disclosed.

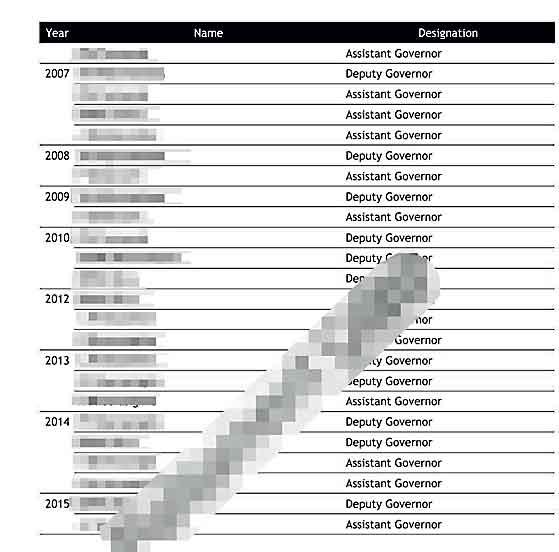

Details of Central Bank officials who contributed to loss making through investments in Bond Scam and stock market

The report of the Special Presidential Commission highlighted irregularities in bond transactions during the period from February 2015 to March 2016. However, the 2019 forensic audit didn’t include an investigation into these transactions. EPF money was also invested in the bonds mentioned here. While the value of the EPF money may have increased, no investigation has been conducted to determine the extent of the losses, if any, or to identify irregularities.

The forensic audit didn’t disclose how the EPF money was invested during the bond scam. However, the audit report revealed that over the years investigated, transactions in the stock and bond markets resulted in a combined loss of approximately 20 billion rupees for the EPF.

According to the forensic audit, from 2002 to 2015, irregular bond market transactions alone caused a loss of 9,826 million rupees to the EPF. The loss to the EPF due to irregular transactions in the stock market was 9,826 million rupees. The loss from both listed stocks, worth 9,470 million rupees, and unlisted stocks between 1998 and 2017 totaled 389 million rupees. This brings the total loss from irregular transactions in both markets to nearly 20 billion rupees. This figure doesn’t include the financial impact of the central bank bond scam, which remains uncalculated.

The loss of nearly 20 billion rupees in the EPF was attributed to investments made based on poor decisions, as highlighted in the forensic audit report. Following the conclusion of the war in 2009, the Colombo Stock Market emerged as one of the best-performing stock markets globally, with the All Share Price Index (ASPI) growing by over 125% in 2009 and an additional 96% in 2010.

Perplexing losses despite stock market success

Despite this remarkable growth in the stock market, the EPF’s investments yielded only a 3% return in 2009 and 4% in 2010. In 2010 alone, the EPF suffered a loss of 40 billion rupees due to improper investment strategies in the stock market. The forensic audit confirmed that these losses resulted from the improper and incorrect investment in the stock market.

The funds of the EPF have been invested in the shares of various institutions, resulting in significant financial losses, as highlighted in the forensic audit report. Shares of 17 private and public institutions were purchased, and further EPF funds were invested in these entities. According to the forensic audit, these investments were influenced by the interests of certain high-ranking officials within the Central Bank, whose names and positions were disclosed in the report. A separate audit was conducted to analyze the investments made in each of these institutions using EPF funds. According to the report, a company’s share price, which stood at 17 rupees in April, had risen sharply to 209 rupees by July. Instead of purchasing the shares when they were priced at 17 rupees, the EPF invested when the shares had already escalated to 209 rupees. The forensic audit identified this as a poor decision by the Central Bank’s senior management. The report further emphasised that the funds were invested without a proper management stratergy, leading to a significant loss for the EPF.

Regarding all these details, Verité Research (Pvt) Ltd sought detailed information on bond transactions between February 2015 and March 2016 through the Right to Information Act. However, there has been no satisfactory response from the Central Bank of Sri Lanka. As a result, the institution underscores that there are significant concerns regarding every transaction made so far. The institution emphasises that the 3.9 trillion rupees held by the fund is at risk due to investments made with the EPF’s monies in the stock and bond markets sans transparency.

This 3.9 trillion rupees is not the property of the Central Bank of Sri Lanka. It represents the hard-earned savings of employees working in private and semi-government institutions across the country. The Central Bank has a responsibility to safeguard and properly manage these funds. To address the potential losses incurred in 2015–2016 from bond investments using EPF funds, a separate forensic audit should be conducted. Recommendations were made to the Central Bank through the Special Presidential Commission to conduct a forensic audit to investigate the 2015 bond scam and uncover the fraud related to the Employees’ Provident Fund. However, these recommendations were not implemented.

The COPE investigation into the bond scam primarily highlighted the benefits gained by Perpetual TreasuriesLimited as a result of these transactions. However, neither the COPE reports nor the findings of the Presidential Commission of Inquiry quantified the exact losses incurred by the EPF due to these transactions. Despite the Central Bank scam and the losses from previous stock market investments, it appears that no substantial lessons have been learned by the authorities. The practice of investing EPF funds in both the stock market and bond market continues, even in the face of losses.

A problematic situation has emerged regarding the transparency of investments made by the EPF in the bond and stock markets. This issue stems from the Central Bank of Sri Lanka’s refusal to disclose details of how EPF funds are invested. Verité Research (Pvt) Ltd, under the Right to Information Act, sought comprehensive information on these transactions. However, the Central Bank declined to provide the requested data, citing concerns over sharing sensitive market-related information with third parties. In response, the then Deputy Governor of the Central Bank of Sri Lanka, and now the present Governor, Dr. P. N. Weerasinghe, informed Verité Research (Pvt) Ltd on 06-06-2017, under letter number 0020/17, that the information could not be disclosed. Dissatisfied with this response, Verité Research lodged a complaint with the Right to Information Commission in 2017, reiterating their request.

In 2018, the Rightto Information Commission directed the Central Bank of Sri Lanka to release the requested information to Verité Research. Furthermore, the Commission instructed the Central Bank to include all details of the relevant transactions in its annual accounts. These instructions were also published on the Commission’s website.

In 2023, Minister S. Sumanthiran questioned Central Bank representatives during a COPF session regarding their failure to release this information. MP M.A. Sumanthiran later stated in Parliament on 07-01-2023 that the Central Bank of Sri Lanka had still not provided a response. Even though this is the situation in Sri Lanka, in other countries, details of transactions involving social security funds are made publicly accessible. The absence of such disclosure in Sri Lanka highlights a significant issue.

An extract from an audit report related to the Central Bank Bond Scam

This raises the question whether transparency issues persist in Sri Lanka regarding these transactions. The Annual Accounts Report on Investments in Employees’ Provident Fund transactions is required to be submitted within three months of the end of each year. However, the annual account report for 2023 hasn’t been submitted yet. Former governments in Sri Lanka have also imposed taxes on EPF investments, beginning with a 10% tax introduced in 1989. Since 2018, this tax rate has increased to 14%. Individuals earning less than 100,000 rupees are not required to pay taxes. The majority of EPF contributors are individuals earning less than 100,000 rupees per month. For these workers, whose contributions represent their lifetime employment savings, imposing a 14% tax on EPF investments is regarded as unfair.

Domestic debt restructuring in Sri Lanka, conducted under an IMF proposal, targeted only the EPF for restructuring. While 14 countries have restructured domestic debts since 1998, these nations typically include employee funds only as a last resort when other debts cannot be addressed. Sri Lanka, however, stands out as the only country to restructure its debt targeting the EPF. This approach has inflicted severe damage on the fund.

At that time, the existing government stated that the EPF voluntarily contributed to the debt restructuring. However, this money belongs to the working people of the country. If that is the case, the Central Bank of Sri Lanka is merely the custodian of that money, not the owner. It raises the question: how can the Central Bank, as the custodian and not the owner, voluntarily make the EPF contribute to the restructuring of local debt under such circumstances?

Efforts to seek clarification from the Governor of the Central Bank of Sri Lanka, Nandalal Weerasinghe, proved unsuccessful. Attempts to contact the Central Bank via 0112 477 648, 0112 477 132, 0112 477 214, 0112 477 669, and 0112 346 304 were met without a response.