Reply To:

Name - Reply Comment

When it comes to handling waste, Sri Lanka stands at a primitive level. Or so we think. Waste is not just waste for some. It is big money. This is why waste has converted into a global trade, thereby allowing developed countries to export their waste to developing countries for further treatment, disposal or recycling. Hence, the burden of the toxicity of wastes from Western countries falls predominantly onto developing countries in Africa, Asia and Latin America. With China pulling out of this menace, which may come as a surprise to some, the rest of the countries in South Asia seem to be getting caught in the trap. Recently, Sri Lanka also witnessed an example of a rather smelly transaction that took place as a result of a Gazette notification passed back in 2013.

When it comes to handling waste, Sri Lanka stands at a primitive level. Or so we think. Waste is not just waste for some. It is big money. This is why waste has converted into a global trade, thereby allowing developed countries to export their waste to developing countries for further treatment, disposal or recycling. Hence, the burden of the toxicity of wastes from Western countries falls predominantly onto developing countries in Africa, Asia and Latin America. With China pulling out of this menace, which may come as a surprise to some, the rest of the countries in South Asia seem to be getting caught in the trap. Recently, Sri Lanka also witnessed an example of a rather smelly transaction that took place as a result of a Gazette notification passed back in 2013.

According to the Customs Department, 240 garbage containers have arrived in the country since 2017. 111 of them imported from UK now lie at the Colombo International Container Terminal (CICT), while another 130 are stationed at the Katunayake Free Trade Zone and 57 of them have been re-exported. Area residents claim that with the prevailing rains, the deteriorating waste would soon flow into the nearby canals while concerns have also been raised whether this liquid waste would reach Muthurajawela. If the waste reaches the estuary, it will eventually contaminate the Ocean, posing a threat to marine life. While Muthurajawela is already under threat of a waste dumping purposes, this issue would add to its burden. According to Customs Department Media spokesperson Sunil Jayaratne, the 130 containers containing mattresses were sent in as a dummy operation. “The issue is with the 111 containers lying at the Port. They include various clinical waste including materials disposed from mortuaries, syringes and other material. Some of these materials have been liquidised an deteriorated to the point that we cannot even examine them and this waste is emitting a very bad odour. They have exchanged a lot of money during this transaction and since the Customs has been exempted from clearance as per the special gazette issued in 2013, we don’t have a way to clear such consignments.”

The Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and their Disposal was adopted on 22 March 1989 by the Conference of Plenipotentiaries in Basel, Switzerland, in response to a public outcry following the discovery, in the 1980s, in Africa and other parts of the developing world of deposits of toxic wastes imported from abroad.

The provisions of the Convention centre around the following principal aims; the reduction of hazardous waste generation and the promotion of environmentally sound management of hazardous wastes, wherever the place of disposal; the restriction of transboundary movements of hazardous wastes except where it is perceived to be in accordance with the principles of environmentally sound management; and a regulatory system applying to cases where transboundary movements are permissible.

“But although Sri Lanka signed it, it has not been incorporated in national legislation,” opined Samantha Gunasekara, former Customs Director General. “There have been ad hoc Gazette notifications issued by the Finance Ministry.

Under the Hub Operations Gazette issued in 2013, the Customs Ordinance and Import / Exchange Control laws have been exempted from it. This itself is wrong. It is also an example of

ultra-violence of the law. This means that the Customs is exempted for clearance. Without implementing the Convention into national legislation we don’t have a way to take action. According to the Convention the country that exports the waste should inform the receiving country but no such communication had happened here.”

If the waste reaches the breakwater, it will eventually contaminate the Ocean, posing a threat to marine life. While Muthurajawela is already under threat of a waste dumping purposes, this issue would add to its burden

In his comments, Ajith Weerasundara, Chemicals and Hazardous Waste Management Unit Director at the CEA said that the Authority is taking steps to amend the National Environment Act to ensure that no dumping of waste happens in the country. “Although the containers have been coming in since 2013, we weren’t aware of it. But now we are trying to file legal action and reimport the waste. UK should inform the other country prior to importing as they too are a party to the Basel Convention but were weren’t informed.”

000000000000000000000

However, it was later revealed that the containers were part of a consignment imported by Ceylon Metal Processing Corporation (Pvt) Ltd (CeyMPCo). In a press conference held on Monday, Hayleys Free Zone Ltd., a subsidiary of Hayleys Advantis PLC refuted allegations and further went on to say that the Hayleys Free Zone (HFZ) Ltd. entered into an agreement with freight forwarder ETL Colombo (Pvt) Ltd that was appointed by CeyMPCo for the purpose of processing and re-exporting the mattresses in question. When asked how a free zone operates, Hayleys Advantis Managing Director Ruwan Waidyaratne said that a free zone is an offshore location that doesn’t come under Customs jurisdiction. “So whatever comes in is reworked and reshipped. These items are not for the local market. We are not the owners of the goods. CeyMPCo had a freight forwarder and we asked them to handle cargo at the free zone. We in fact handle multiple cargo where we do price-markings, value additions and re-export the items.”

However, it was later revealed that the containers were part of a consignment imported by Ceylon Metal Processing Corporation (Pvt) Ltd (CeyMPCo). In a press conference held on Monday, Hayleys Free Zone Ltd., a subsidiary of Hayleys Advantis PLC refuted allegations and further went on to say that the Hayleys Free Zone (HFZ) Ltd. entered into an agreement with freight forwarder ETL Colombo (Pvt) Ltd that was appointed by CeyMPCo for the purpose of processing and re-exporting the mattresses in question. When asked how a free zone operates, Hayleys Advantis Managing Director Ruwan Waidyaratne said that a free zone is an offshore location that doesn’t come under Customs jurisdiction. “So whatever comes in is reworked and reshipped. These items are not for the local market. We are not the owners of the goods. CeyMPCo had a freight forwarder and we asked them to handle cargo at the free zone. We in fact handle multiple cargo where we do price-markings, value additions and re-export the items.”

In December 2018, Hayleys had processed and re-exported 29 out of 130 containers as per the last shipment. However, as the importer was facing financial difficulties, there has been a delay in payments by the freight forwarder which has forced the re-working of mattresses in other containers to be postponed. On the other hand, the Board of Investments (BoI) which regulates commercial hub operations had requested Hayleys to avoid taking fresh orders of the same kind. However, in light of the current situation, Hayleys has decided to rework and re-export the mattresses at its own cost.

“We came forward to re-export the containers because the importer is in a financial crisis. But we will use the freight forwarder to export it back. Since these containers come in to the Free Zone we become a consignee as per the Hub Operations Law. We work with 100 other clients and are a consignee to their consignments as well. Since the BOI requested us to move it out, we will try to do it as soon possible”. Waidyaratne further said that the cost of importing the items haven’t been assessed as yet .

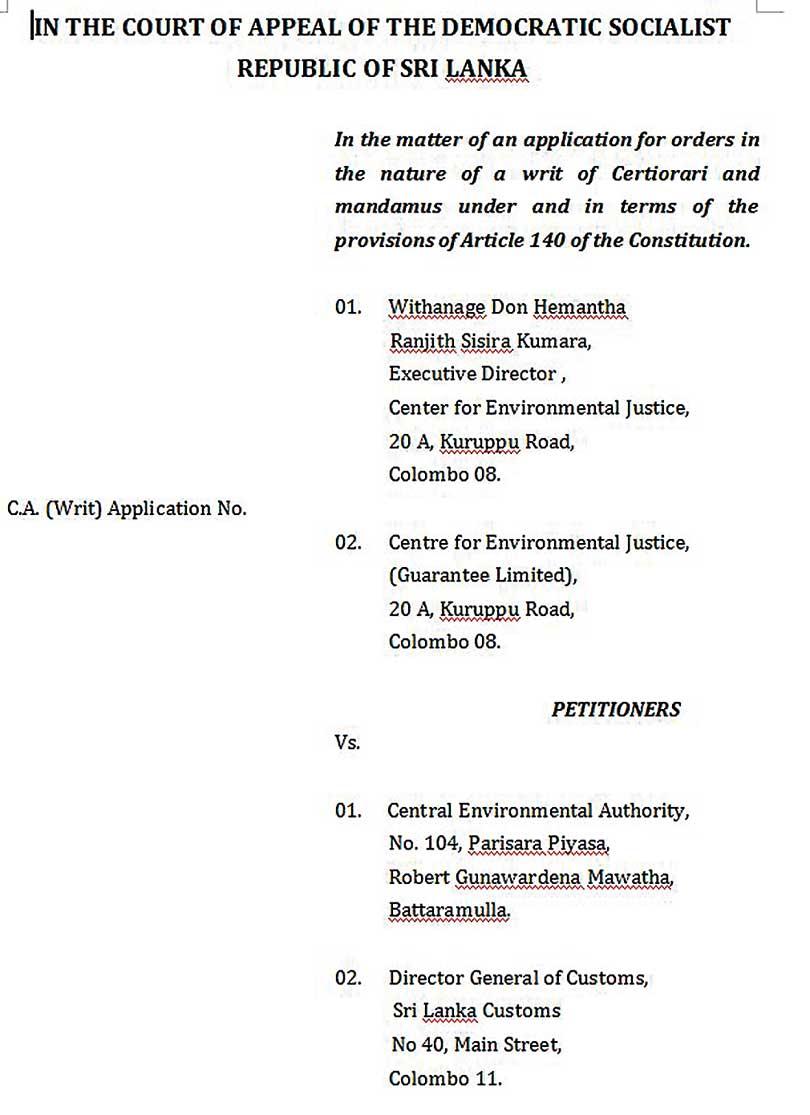

In response to the recent turn of events, the Centre for Environmental Justice (CEJ), a Colombo based public interest environmental organization filed legal actions in the Court of Appeal against the CEA and the Director General of Customs against the omissions and failures to regulate the importation of mixed contaminated waste for a period of time. Speaking to the Daily Mirror, CEJ Chairman, Attorney-at-Law Ravindranath Dabare said that nobody is talking about punishing the offenders. The matter will not be solved only by re-exporting the items. We also have a doubt whether the UK would accept the items back since they were sent in 2017 and also the waste has been deteriorated. Therefore the CEJ thought its better to have court interventions to look into the matter.”

In response to the recent turn of events, the Centre for Environmental Justice (CEJ), a Colombo based public interest environmental organization filed legal actions in the Court of Appeal against the CEA and the Director General of Customs against the omissions and failures to regulate the importation of mixed contaminated waste for a period of time. Speaking to the Daily Mirror, CEJ Chairman, Attorney-at-Law Ravindranath Dabare said that nobody is talking about punishing the offenders. The matter will not be solved only by re-exporting the items. We also have a doubt whether the UK would accept the items back since they were sent in 2017 and also the waste has been deteriorated. Therefore the CEJ thought its better to have court interventions to look into the matter.”

Several attempts to contact CeyMPCo proved futile.

Entrepót trade or the re-export trade involves importing goods from one country and re-exporting to another, with or without any additional processing or repackaging. Goods are exempt from duties at the point of import and re-exports.

Commercial Hub Regulations were initially introduced in Part IV of the Finance Act No. 12 of 2012 of Sri Lanka which was amended by Finance Act No. 12 of 2013, cited as ‘Finance Act – Commercial Hub Regulations’ in the gazette notification No. 1818/30 of July 11, 2013. The introduction of these regulations created a distinction between entrepót traders as follows :

Entrepót Trade under the Commercial Hub Regulations (Foreign Investors falling under the purview of the BOI)

Entrepót Trade under the Customs Ordinance without entitlements to all of the benefits under Commercial Hub Regulations (Local Traders)

Commercial Hub Regulations demarcated six areas in close proximity or within the ports and airports as Free Ports or Bonded Areas (areas which are geographically inside Sri Lanka but are legally considered outside its customs territory and supervised by the Board of Investment of Sri Lanka or the Director General Customs or any other authority under the Commercial Hub Regulations) to facilitate trade. These are the Colombo Port, Hambantota Port, Mattala Airport, Katunayake Export Processing Zone (EPZ), Koggala EPZ and Mirrijjawala EPZ. Though not under the Commercial Hub Regulations, the Colombo Airport Cargo Terminal is also a customs supervised bonded area.

As per the Investment Opportunities, the Notification further reads that ‘any new enterprise which is established or incorporated in Sri Lanka and engaged in any or more of the following business activities, where at least 65% of its total investment has been from foreign sources including and transfers from a Foreign Currency Banking Unit of a licensed Commercial Bank operating in Sri Lanka, and of which the total turnover is from export of goods and/or services, shall be exempted from the applications of the Provisions of the Customs Ordinance (Chapter 235, the Exchange Control Act (Chapter 423), the Imports and Exports (Control) Act No. 1 of 1969 and acts referred to in schedule, referred to in the Principal Act as amended by the Finance Act No. 12 of 2013.