Reply To:

Name - Reply Comment

Along with the confusion surrounding the method of pricing petrol for the Sri Lankan market, an analysis of the price of petrol over time in comparison to both US petrol prices and global crude oil prices appears to be timely.

Along with the confusion surrounding the method of pricing petrol for the Sri Lankan market, an analysis of the price of petrol over time in comparison to both US petrol prices and global crude oil prices appears to be timely.

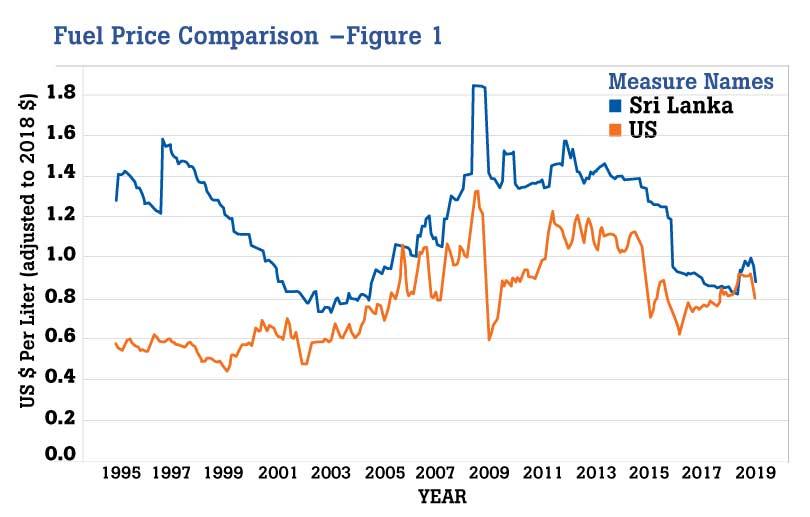

It is not a simple task to compare the prices of commodities between the two countries, especially over time. Factors such as currency conversion and inflation come in to play and thus nominal prices mean very little for such a comparison. Thus, we have obtained the prices of both the Sri Lankan Petrol (Octane 95) and the US Premium Petrol (Octane 92) from December 1994 to December 2018.

The Sri Lankan price was converted to US$ at the spot exchange rates and then both prices were adjusted for inflation by using the Consumer Price Index (CPI) with the base year being 2018. In short, the prices were adjusted for inflation to be shown at 2018 US$.

Petrol, and in ad-hoc all other crude-oil products, is a topic of much discussion of late in Sri Lanka. An ever-increasing price and an increasing need for transport for a globalising community have made all forms of gasoline a vital commodity.

Upon viewing this comparison (in Figure 1), it is apparent that the Sri Lankan price per litre of petrol has always been more than that of the US. However, this is also to be expected since the US has its own refineries and its own oil sources as well, while Sri Lanka does not have the capacity to refine all its oil needs nor have its own oil sources. Thus, a premium is required to compensate for the higher market price needed to be paid for the end product.

Upon viewing this comparison (in Figure 1), it is apparent that the Sri Lankan price per litre of petrol has always been more than that of the US. However, this is also to be expected since the US has its own refineries and its own oil sources as well, while Sri Lanka does not have the capacity to refine all its oil needs nor have its own oil sources. Thus, a premium is required to compensate for the higher market price needed to be paid for the end product.

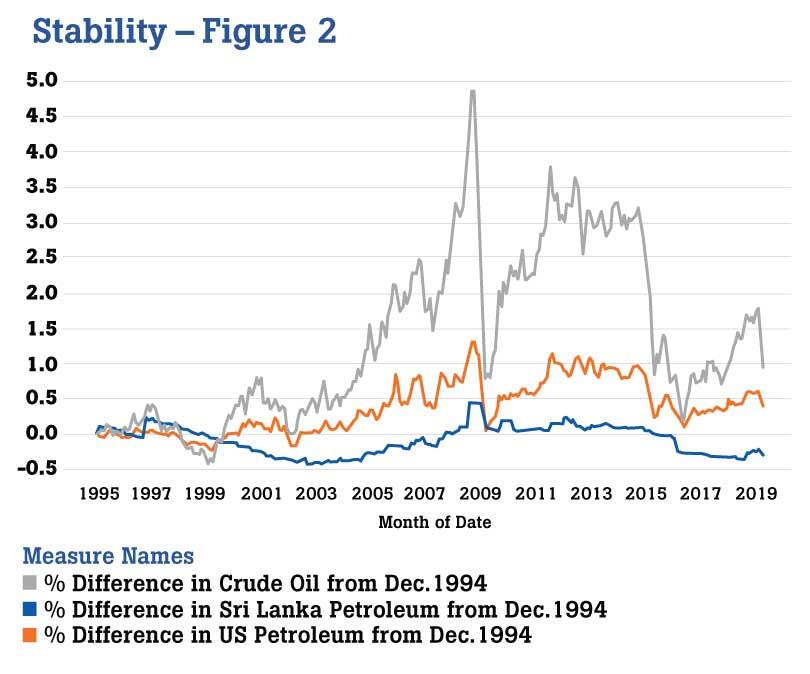

Next, we look at the overall stability of the prices of petrol in comparison to the fluctuations in crude oil prices. Figure 2 shows the percentage change in the price in comparison to the price in December 1994. We can see that neither the US price nor the SL price fluctuates as much as crude oil, but the Sri Lankan price, in particular, appears particularly robust to changes in the crude oil price which may be attributed to the manner in which petrol is provided at a subsidised rate.

Sri Lanka does not have the capacity to refine all its oil needs nor have its own oil sources. Thus, a premium is required to compensate for the higher market price needed to be paid for the end product

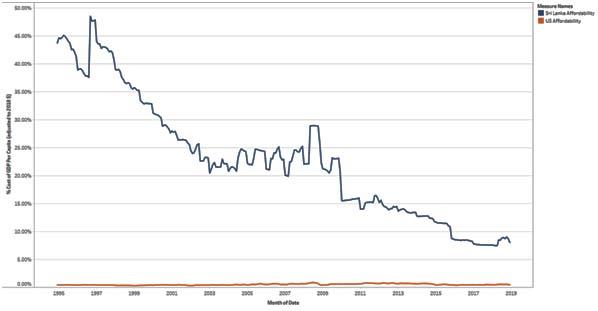

Finally, when looking at affordability in terms of cost of a litre of petrol as a percentage of GDP per capita per day (in Figure 3), we see an overall downward trend in the Sri Lankan series which is reflective primarily of the increase in the GDP of the country. However, the stability of the price as seen before may also be attributed to this seeming increase of the affordability.

Affordability