Reply To:

Name - Reply Comment

The much awaited proposed Budget 2019 presented by Finance Minister Mangala Samaraweera is being highly criticised claiming that it is a dream budget. On the other hand Budget 2019 is being showered with praise by several others.

However, what is important is observe what influence the budget has made on the livelihood of the people. When considering the revision of taxes on imported vehicles, what can be observed is a hike in the prices of almost all vehicles consequent to the proposed Budget. Besides, it is not good news for middleclass people.

The article touches on all types of vehicles and how their prices will be subject to change while discussing as to why the Finance Ministry has taken steps to revise taxes.

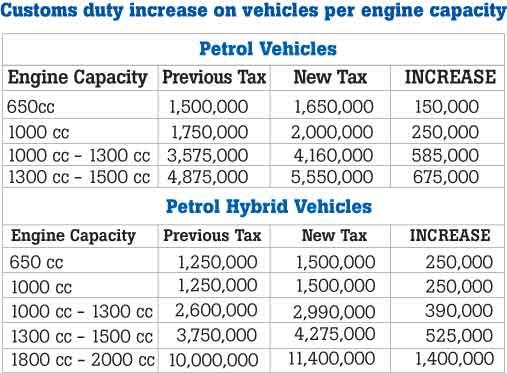

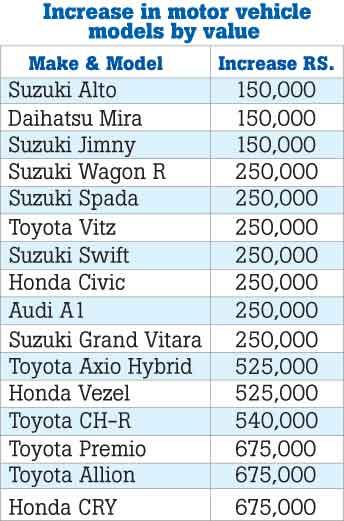

Due to the revision of Excise Duty on motor vehicles and implementation of the luxury tax on the recent Budget proposal, local vehicle prices would be increased by a minimum of Rs.150,000.

After imposing taxes, imported vehicle prices have been increased between Rs.150,000 and Rs.600,000.

The Vehicle Importers Association of Sri Lanka (VIASL) said that for the first time in the vehicle import history, a new luxury tax has been imposed apart from the Customs duty, if the manufacturing cost of a vehicle exceeds Rs.3.5 million.

Speaking to the media recently, VIASL Chairman Ranjan Peiris said that this new procedure has been introduced along with the new Budget proposal which was presented in parliament.

“All the vehicles will fall under the luxury tax after converting the manufacturing cost of a vehicle into Sri Lankan currency and if the value exceeds Rs.3.5 million. Vehicles such as Toyota  Premier, Toyota Axio, Honda Vezel, Toyota CHR and Honda Grace, used by ordinary people, fall under the luxury tax category,” he said.

Premier, Toyota Axio, Honda Vezel, Toyota CHR and Honda Grace, used by ordinary people, fall under the luxury tax category,” he said.

“As a vehicle importer, I do not see these as luxury vehicles. Luxury vehicles which have an engine capacity of more than 1800cc, contain more options and are higher in value. This new luxury tax may have been imposed accidentally or as a result of a mistake by the Finance Minister. He has to look at this issue from the perspective of the people,” he said.

“We think that the Minister would take steps to release the vehicles used by the ordinary people from this new luxury tax. As an association, we are not against imposing a luxury tax on actual luxury vehicles.

"Accordingly, the Government imposed a luxury tax-free threshold for diesel and petrol vehicles at Rs 3.5 million to be subjected to 120 percent and 100 percent luxury taxes respectively"

But this is not fair. According to the new luxury tax, Rs.1,240,000 would have to be paid as a luxury tax for a vehicle with an engine capacity of 1,000cc in addition to the manufacturing cost. Even the permit holder has to pay the luxury tax keeping with the vehicle they order,” Pieris said.

Due to the new taxes, vehicle imports have decreased by 65 to 70% and simultaneously, the vehicle sales also have declined sharply. While imposing new taxes, the Government may have been trying to limit vehicle imports. According to the new mechanism, the new luxury tax is imposed on electric cars too.

The newer electric cars that can travel 300 km are very expensive and a Rs.2 million luxury tax was also imposed on them. Therefore the new tax system needs to be streamlined. The tax revision of the imported vehicles would affect the second-hand vehicle market in the future.

However, the import tax on electric motor vehicles of 70 kw have been brought down by Rs. 175,000.

(VIASL Chairman Ranjan Peiris said they that did not import electric vehicles as they were not selling rapidly.

“Reducing taxes on vehicles which are not fast-selling is useless. Before reducing the taxes the Government should provide infrastructure and accessory facilities,” Pieris said.

Meanwhile, following the Budget proposal, the Excise Duty on vehicles imported as ‘chassis fitted with engines’ will be reduced.

Accordingly, the Excise Duty on hearses, single cabs will be revised.

The Excise Duty on hybrid and electric vans will be revised to reflect the energy efficiency benefits. The Duty on Buddy Trucks with cargo carrying capacity less than 2000 kg will be reduced under the Budget proposal.

The 200% cash deposit on Letter of Credit (LC) had been removed by the Ministry, but a ‘luxury tax’ would be calculated if the LC exceeds

Rs.3.6 million.

There would be no need to calculate a luxury tax for vehicles when importing because that tax is already being collected when registering at Department of Motor Traffic (DMT).

VIASL Chairman Ranjan Peiris said that the overall tax proposal was a mess and there was no benefit to the people. The Budget has let down vehicle importers. If the Government had a discussion with the vehicle association before preparing the Budget, this could have been profitable.

Finance Minister Mangala Samaraweera told a news briefing that the taxes on the import of motor vehicles proposed by the 2019 Budget were applicable only for those on letters of credit (LCs) opened on or after March 06, 2019.

There is speculation that the taxes would also be imposed on LCs opened before this date.

He said it came into effect from midnight on the date on which the Budget was presented to the Parliament and that it would not affect any LCs opened before that date.

The new tax is applicable from March 6. The Government expects to regenerate a total of Rs.48 billion from the revision of excise duty and the luxury tax, with this amount being quite significant considering the size of other revenues sources.

The proposed luxury tax on vehicles will hinder the Government’s ambitious target of collecting Rs.48 billion in revenue through duties, as the proposed tax would lead to a drastic decline in vehicle imports.

“The Government is expecting the previous number of vehicle imports to continue despite the luxury tax. However, it won’t probably happen. The Government has to consider realistic numbers when they impose a tax. With the proposed tax structure, people won’t import vehicles,” VIASL Secretary Arosha Rodrigo said.

The Government imposed a luxury tax on motor vehicles on the Cost, Insurance and Freight (CIF) value of the vehicle or the manufacturer’s price in excess of the luxury tax-free threshold determined by the Government, based on the type of vehicle.

Accordingly, the Government imposed a luxury tax-free threshold for diesel and petrol vehicles at Rs 3.5 million to be subjected to 120 percent and 100 percent luxury taxes respectively.

The Government also imposed a 60 percent luxury tax on electric vehicles which have a tax-free threshold of Rs.6 million.

In conclusion, it is fitting to note that the proposed Budget 2019 has shown no mercy on the middleclass people. It is apparent that it is the prices of the vehicles, often bought by the middle class people, that rise subsequent to a tax revision. At the same time, it is questionable as to why prices of luxury vehicles have not been revised.